Last updated: July 27, 2025

Introduction

Quetiapine fumarate, a second-generation atypical antipsychotic, is primarily prescribed for schizophrenia, bipolar disorder, and major depressive disorder. Its versatile therapeutic profile has cemented its position within psychiatric pharmaceuticals, driving robust global demand. As the industry navigates patent expirations, generic entries, regulatory changes, and evolving market dynamics, comprehensive market analysis and price projections become critical for stakeholders—including manufacturers, investors, healthcare providers, and policymakers.

Global Market Overview

Market Size and Growth Trends

The global market for quetiapine fumarate has exhibited steady expansion, driven by increasing prevalence of psychiatric disorders and greater mental health awareness. According to IQVIA data, the global antipsychotic drugs market was valued at approximately USD 15 billion in 2021, with quetiapine representing a significant share, estimated at over USD 4 billion.

Between 2021 and 2026, the market CAGR is projected to be around 4.5%. Key growth factors include:

- Rising prevalence of schizophrenia and bipolar disorder globally.

- Expanding application of quetiapine for adjunctive depression.

- Increasing adoption in emerging markets due to improving healthcare infrastructure.

- Growing awareness campaigns reducing stigma surrounding mental health treatment.

Regional Dynamics

-

North America: Dominates the market owing to high healthcare expenditure, advanced healthcare infrastructure, and widespread insurance coverage. The U.S. holds the largest share, with extensive off-label use for various psychiatric conditions.

-

Europe: Shows steady growth, benefitting from regulatory approvals and early adoption. Italy, Germany, and France are prominent markets.

-

Asia-Pacific: Emerging as a significant growth hub due to rising mental health awareness, urbanization, and increasing pharmaceutical manufacturing capacity. Countries like China and India are pivotal.

-

Latin America and Middle East & Africa: Exhibit slower growth but present substantial opportunities owing to expanding healthcare access.

Competitive Landscape

The market landscape comprises patented formulations, with key players such as Pfizer (original patent holder), followed by numerous generics and biosimilars post-patent expiry. The patent expiration of Seroquel (brand name for quetiapine) in many territories from 2017 onward initiated a surge in generic manufacturing, drastically reducing drug prices.

Major companies involved include:

- Sandoz (Novartis): Leading generic manufacturer.

- Mylan (now part of Viatris): Large supplier of generics.

- Alvogen and Teva: Significant players in generic antipsychotics.

- Pfizer: Original patent holder, now focusing on branded formulations and biosimilars.

The generic proliferation has precipitated price erosion and intensified competition, impacting profit margins but expanding market access.

Regulatory Environment and Patent Landscape

Patent expirations have reshaped the competitive landscape. Pfizer's Seroquel patent expired in 2017 in the U.S., elevating generics' market share and decreasing drug prices.

Regulatory approvals facilitate rapid entry of generics but may be complicated by patent litigations and biosimilar regulations, especially in pivotal markets like the U.S., EU, and Japan. Market access barriers, pricing regulations, and reimbursement policies influence sales volumes and pricing strategies.

Pricing Dynamics and Trends

Pre-Patent Expiry Phase

Initially, branded quetiapine fumarate commanded premium pricing, supported by patent protections, direct-to-consumer advertising, and physician branding. Prices ranged from USD 8 to USD 15 per pill, depending on dosage and region.

Post-Patent Expiry and Generic Entry

Following patent expiry, global prices plummeted. In the U.S., generic versions reduced the cost by approximately 60-80%, with current retail prices around USD 2-4 per pill, reflecting intense price competition.

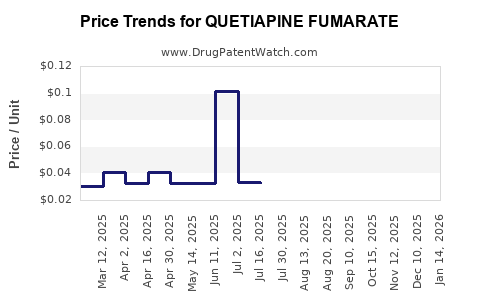

Current Pricing Trends

| Region |

Brand Price (USD/pill) |

Generic Price (USD/pill) |

Notable Factors |

| North America |

USD 12-15 |

USD 2-4 |

Significant generic penetration; insurance impact |

| Europe |

EUR 8-12 |

EUR 1-3 |

Price regulation; reimbursement policies |

| Asia-Pacific |

USD 4-8 |

USD 0.5-2 |

Emerging markets; local generics growth |

Regional variations are driven primarily by regulatory regimes, healthcare system structures, and prevalence rates.

Future Price Projections

Based on current trends, the following projections are posited:

-

Short-Term (Next 2-3 Years):

Continued price stabilization for generics, with prices remaining steady due to mature competition. Innovation-driven branded prices unlikely to recover significantly amid aggressive generic manufacturing.

-

Medium to Long-Term (3-5 Years):

Prices may experience slight upticks owing to market consolidation, supply chain adjustments, and raw material cost fluctuations. Introduction of biosimilars or innovative formulations (such as long-acting injectables) could influence pricing strategies.

-

Emerging Market Dynamics:

Countries in Asia and Latin America anticipate further price reductions due to increased manufacturing capacity, subsidy initiatives, and reimbursement expansion.

Impact of Regulatory and Market Factors

- Patent litigations and legal challenges can temporarily elevate prices in certain jurisdictions.

- Patent cliffs in the coming years may further accelerate generic penetration.

- Reimbursement policies will increasingly influence net prices, especially in countries with strict health technology assessments.

- Potential future approval of novel formulations (e.g., extended-release versions) could command premium pricing based on therapeutic benefits.

Market Challenges and Opportunities

Challenges

- Pricing Erosion Due to Generics: Intense competition limits potential for price appreciation.

- Regulatory Barriers: Delays and denials in key markets can hinder revenue growth.

- Supply Chain Disruptions: Raw material shortages, especially in globally sourced APIs, may impact costs.

- Brand vs. Generic Dynamics: Maintaining market share amidst aggressive generic pricing.

Opportunities

- Innovative Formulations: Long-acting injectables, combinations, or novel delivery systems could command higher prices.

- Expanding Indications: New therapeutic uses may open additional markets and pricing strategies.

- emerging Market Penetration: Growth in developing economies provides expanding patient access and revenue potential.

Conclusion and Strategic Recommendations

The quetiapine fumarate market is characterized by a mature core dominated by generics, with price erosion being a defining trend. Stakeholders should focus on:

- Innovation and formulation diversification to sustain margins.

- Market expansion into emerging regions with evolving healthcare infrastructure.

- Monitoring patent landscapes to anticipate generic entry and adjust pricing accordingly.

- Engaging with healthcare policymakers to navigate reimbursement and regulatory challenges effectively.

Investment in biosimilars, targeted clinical indications, and patient-centric delivery models can open avenues for value creation amidst a highly competitive environment.

Key Takeaways

- The global market for quetiapine fumarate is projected to grow modestly at a CAGR of ~4.5% over the next five years, driven by increasing mental health needs.

- Patent expirations have led to significant price reductions, with generic prices dropping by up to 80% in mature markets like the U.S.

- Price stability for generics is expected in the short term, with potential minor fluctuations influenced by supply chain factors, regulatory changes, and market consolidation.

- Emerging markets present growth opportunities, albeit with challenging price dynamics due to competition and price regulation.

- Innovation in drug delivery and indications could provide development pathways for premium pricing and market differentiation.

FAQs

1. How has the patent expiration of Seroquel impacted the pricing of quetiapine fumarate?

Patent expiry in 2017 unlocked a flood of generic entrants, causing a sharp decline in prices—up to 80%—and significantly reducing brand-name market share.

2. What are the key considerations for manufacturers entering the quetiapine fumarate market?

Manufacturers must navigate patent landscapes, clinical efficacy for new indications, regulatory approvals, manufacturing costs, and competitive pricing strategies to capture market share.

3. How do regional regulatory policies influence quetiapine pricing?

Regions with strict price controls or reimbursement caps—such as parts of Europe—limit price hikes, whereas in less regulated markets, prices remain more flexible, affecting profit margins.

4. What future innovations could influence quetiapine fumarate pricing?

Long-acting injectable formulations, combination therapies, and novel delivery systems could command premium prices due to improved adherence and therapeutic benefits.

5. Is there potential for new therapeutic indications to affect the market?

Yes. Ongoing research into off-label uses or expanded indications could extend market reach, prompting new pricing strategies and potential market growth.

References

[1] IQVIA. "Global Mental Health Market Reports," 2022.

[2] Centers for Disease Control and Prevention. "Mental Health Surveillance," 2021.

[3] FDA. "Drug Approvals and Patent Status," 2020.

[4] MarketWatch. "Global Antipsychotics Market Forecast," 2022.

[5] European Medicines Agency. "Regulatory Pathways for Biosimilars," 2021.