Share This Page

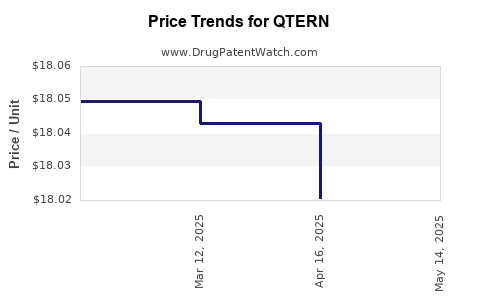

Drug Price Trends for QTERN

✉ Email this page to a colleague

Average Pharmacy Cost for QTERN

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| QTERN 10 MG-5 MG TABLET | 00310-6780-30 | 17.99818 | EACH | 2025-05-21 |

| QTERN 10 MG-5 MG TABLET | 00310-6780-30 | 18.02070 | EACH | 2025-04-23 |

| QTERN 10 MG-5 MG TABLET | 00310-6780-30 | 18.04296 | EACH | 2025-03-19 |

| QTERN 10 MG-5 MG TABLET | 00310-6780-30 | 18.04963 | EACH | 2025-02-19 |

| QTERN 10 MG-5 MG TABLET | 00310-6780-30 | 18.04963 | EACH | 2025-01-22 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for QTERN (Saxagliptin and Dapagliflozin) in the Global Diabetes Pharmacotherapy Market

Introduction

QTERN, a fixed-dose combination of saxagliptin and dapagliflozin, represents a significant advancement in the treatment of type 2 diabetes mellitus (T2DM). Approved by the U.S. Food and Drug Administration (FDA) in 2017, QTERN targets glycemic control by combining two mechanisms: inhibition of dipeptidyl peptidase-4 (DPP-4) and sodium-glucose co-transporter 2 (SGLT2). Its market performance, pricing trajectory, and future growth prospects are shaped by evolving diabetes management guidelines, competitive landscape, regulatory developments, and payer dynamics.

Market Overview

Global Diabetes Landscape

The rising prevalence of T2DM globally underscores the market potential for combination therapies like QTERN. According to the International Diabetes Federation, approximately 537 million adults were living with diabetes in 2021, with projections exceeding 700 million by 2045 (IDF, 2021). The increasing burden particularly in North America, Europe, and Asia-Pacific fuels demand for innovative, efficacious, and tolerable treatment options.

Therapeutic Positioning of QTERN

QTERN appeals to clinicians seeking to enhance glycemic management while minimizing hypoglycemia risks. Its dual-action approach helps address both fasting and postprandial glucose excursions. As a relatively recent addition to the fixed-dose combination (FDC) market, QTERN competes with other FDCs, including combinations of SGLT2 inhibitors and DPP-4 inhibitors, as well as dynamic monotherapy regimens.

Regulatory and Health Authority Trends

Regulatory bodies increasingly support combination therapies to improve patient adherence. The American Diabetes Association (ADA) recommends SGLT2 inhibitors for patients with cardiovascular or renal comorbidities, elevating the clinical value of drugs like dapagliflozin. Conversely, regulatory scrutiny around price transparency and affordability influences market access and adoption.

Market Dynamics and Competitive Landscape

Key Competitors

- Dapagliflozin-based combinations: Jardiance (Eli Lilly/Boeringer Ingelheim), with numerous fixed-dose combinations.

- Other DPP-4 + SGLT2 inhibitors: Fixed-dose combinations such as tradjenta (linagliptin) with dapagliflozin.

- Triple therapy options: Emerging options integrating metformin, SGLT2, and DPP-4 agents.

Market shares are fragmented, with top selling SGLT2 inhibitors like dapagliflozin capturing significant volumes owing to its cardiovascular benefits demonstrated in the DECLARE-TIMI 58 trial ([4]).

Pricing Strategies

QTERN pricing remains competitive within the FDC segment. In the United States, wholesale acquisition costs (WAC) are roughly $500–$550/month, but actual patient costs vary due to insurance negotiations and discounts. Pricing strategies emphasize clinical efficacy and safety profile as differentiators over monotherapy or alternative combinations.

Price Projections and Future Trends

Historical Pricing Trends

Since its launch, QTERN's price stability has reflected typical pharmaceutical market behaviors: initial premium positioning, followed by gradual discounts and market penetration adjustments. The 2020–2023 period saw minor price decreases, aligned with market pressure and payer negotiations.

Projection Assumptions

- Market penetration: Expected to increase at a CAGR of 4-6% over the next five years, driven by expanding indications and increased clinical adoption.

- Pricing trajectory: Moderate price erosion of 2-3% annually, due to intensified competitiveness and payer leverage.

- Emerging formulations: Entry of generic or biosimilar competitors could exert downward pressure starting in the 2028–2030 window.

Forecasted Pricing Range (2023–2030)

| Year | Estimated Monthly Cost (USD) | Notes |

|---|---|---|

| 2023 | $520 – $550 | Current pricing spectrum, adjusted for regional variations |

| 2025 | $490 – $530 | Slight discounts due to increased competition |

| 2027 | $460 – $510 | Market saturation, patent exclusivity approaches end |

| 2030 | $430 – $490 | Potential biosimilar entry or new combination innovations |

Note: These projections assume consistent market conditions; sudden developments such as regulatory changes, patent litigation outcomes, or breakthroughs in alternative therapies could alter these estimations.

Influences on Price Trends

- Regulatory approvals for broader indications may enhance uptake, maintaining premium pricing.

- Payer strategies prioritize value-based pricing, incentivizing discounts linked to clinical outcomes.

- Market entry of biosimilars or generics, especially post-patent expiry, could precipitate steep price declines.

Key Market Drivers and Challenges

Drivers

- Growing global T2DM prevalence amplifies demand.

- Favorable clinical data supporting cardiovascular and renal benefits.

- Increasing reimbursement coverage for combination therapies.

- Adoption of personalized medicine pathways favoring tailored treatment regimens.

Challenges

- Cost-containment measures by insurers limiting total expenditures.

- Competitive launches of new oral agents, including novel fixed-dose combinations.

- Regulatory constraints around drug pricing transparency.

- Patient oscillation between medication adherence and affordability.

Strategic Outlook

QTERN’s market trajectory is intertwined with the broader dynamics of the diabetes therapeutic space. The drug’s efficacy and safety profile favor its sustained adoption, especially among high-risk populations. However, competitive pricing, disruptive biosimilar entries, and emerging therapies could suppress price premiums over time. Pharmaceutical companies will need to blend innovative value-based pricing with strategic market access initiatives to maximize revenue.

Key Takeaways

- Market Growth: The global T2DM market’s expansion, combined with increasing adoption of combination therapies like QTERN, positions the drug for sustained growth, especially in regions with rising diabetes prevalence.

- Pricing Trends: Expect modest annual price declines driven by competitive pressures, insurer negotiations, and newer therapy options entering the market.

- Future Risks: Patent expirations, biosimilar entries, and evolving regulatory policies could accelerate price erosion, necessitating continuous portfolio adaptations.

- Clinical Differentiation: Demonstrating superior safety or additional indications could justify premium pricing strategies for QTERN.

- Market Access: Optimizing reimbursement pathways and patient adherence incentives remains pivotal to sustaining revenue streams.

FAQs

1. What factors influence the current pricing of QTERN?

QTERN's price is primarily influenced by manufacturing costs, clinical efficacy, safety profile, market competition, payer negotiations, and regional pricing regulations.

2. How does the increasing prevalence of diabetes impact QTERN’s market?

A rising global diabetes population expands potential patient pools, supporting higher sales volume. However, price sensitivity and payer constraints necessitate strategic pricing.

3. Are biosimilars or generics likely to affect QTERN’s pricing?

Yes. Patent expirations and biosimilar entries could lead to significant price reductions beginning approximately 8–10 years post-launch, depending on regional patent landscapes.

4. How do clinical guidelines influence the market for combination drugs like QTERN?

Guidelines advocating SGLT2 and DPP-4 inhibitors for high-risk patients bolster demand for FDCs such as QTERN by validating their clinical utility.

5. What strategies can pharmaceutical companies adopt to maintain or improve QTERN’s market share?

Investing in real-world evidence, expanding indications, ensuring reimbursement coverage, and emphasizing patient adherence and outcomes can help sustain market position.

References

- International Diabetes Federation. IDF Diabetes Atlas, 10th Edition, 2021.

- US Food and Drug Administration. FDA Approval of QTERN, 2017.

- American Diabetes Association. Standards of Medical Care in Diabetes—2022.

- Wiviott, et al. "Dapagliflozin and Cardiovascular Outcomes in Type 2 Diabetes." N Engl J Med, 2019.

This comprehensive analysis provides a strategic outlook for stakeholders assessing QTERN's market and pricing prospects, enabling informed decision-making aligned with evolving industry trends.

More… ↓