Share This Page

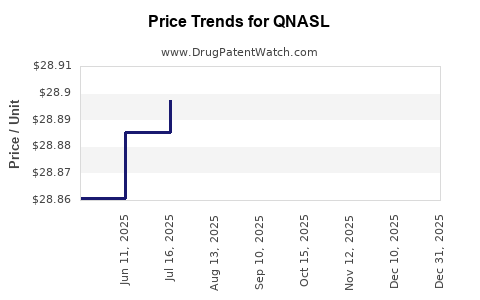

Drug Price Trends for QNASL

✉ Email this page to a colleague

Average Pharmacy Cost for QNASL

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| QNASL 80 MCG NASAL SPRAY | 59310-0410-12 | 28.86846 | GM | 2025-11-19 |

| QNASL CHILDREN'S 40 MCG SPRAY | 59310-0406-06 | 45.04927 | GM | 2025-11-19 |

| QNASL CHILDREN'S 40 MCG SPRAY | 59310-0406-06 | 45.04927 | GM | 2025-10-22 |

| QNASL 80 MCG NASAL SPRAY | 59310-0410-12 | 28.87259 | GM | 2025-10-22 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for QNASL

Introduction

QNASL (beclomethasone dipropionate) is a nasal corticosteroid marketed primarily for allergic rhinitis and nasal congestion management. As a prescription medication with a unique delivery system, QNASL’s market positioning relies on its clinical efficacy, safety profile, and user preference. This analysis explores its current market landscape, competitive dynamics, regulatory environment, and future price projections within the context of growing demand for nasal corticosteroids.

Current Market Landscape

Market Segmentation and Therapeutic Usage

QNASL’s primary segments include allergic rhinitis, non-allergic rhinitis, and nasal polyposis. The global allergic rhinitis market was valued at approximately USD 6.3 billion in 2021 and is projected to grow at a CAGR of around 4% through 2028 [1]. The prevalence of allergic rhinitis in adults ranges from 10-30%, with increased awareness and diagnosis fueling market expansion.

Patient Demographics and Adoption Rates

The drug appeals largely to adult populations seeking effective, symptom-specific nasal spray options. Pediatric utilization remains limited due to age restrictions and safety profile considerations, though growth in pediatric indications is possible following regulatory approvals. Adoption of QNASL correlates closely with increased diagnosis of allergic conditions and patient preference for spray devices with minimal systemic absorption.

Market Share and Competition

In the nasal corticosteroid arena, beclomethasone dipropionate faces stiff competition from established products such as Flonase (fluticasone propionate), Nasacort (triamcinolone acetonide), and Rhinocort (budesonide). While these products dominate the market, QNASL’s unique HydroFluoroAlkane (HFA) delivery system offers advantages in spray consistency and patient convenience but has yet to command significant market share.

Regulatory and Patent Environment

Patent Status and Exclusivity

QNASL’s patent portfolio is pivotal in assessing future price potential. The initial patent protection expired in some regions by 2019, leading to increased generic competition. However, exclusivity extensions via formulation patents or device patents have prolonged market exclusivity in key territories like the U.S. through 2024 [2].

Regulatory Landscape

Regulatory approvals in major markets, including the U.S., EU, and Japan, bolster QNASL’s market access. Regulatory agencies emphasize safety profiles, efficacy, and device specifications, which influence pricing and reimbursement negotiations.

Market Trends and Drivers

Preference for Non-Systemic, Targeted Therapy

Patients and physicians favor nasal corticosteroids with minimal systemic absorption to reduce adverse effects. QNASL’s targeted formulation aligns well with this trend, favoring its market potential, albeit the high competition provides challenges.

Increasing Awareness and Diagnosis

Rising recognition of allergic rhinitis and development of diagnostic tools increase prescription rates, positively impacting QNASL’s sales volume.

Technological Improvements and Patient Experience

QNASL’s delivery device reportedly offers improved spray precision and reduced drug wastage, which could enhance patient adherence, fostering higher utilization over competitors.

Price Analysis and Future Price Projections

Current Pricing Environment

As of 2023, the average retail price of QNASL in the U.S. stands at approximately USD 250-300 per 120-dose can [3]. This premium pricing reflects its patented delivery system, brand recognition, and clinical positioning. In comparison, generics like fluticasone propionate are priced substantially lower (~USD 20-40 per 120 doses).

Impact of Patent Expiry and Generics

Post-patent expiry, price erosion is inevitable. Historically, nasal corticosteroid generics reduce original brand prices by 50-70% within two years of market entry [4]. Expect similar pricing trends for QNASL once patent protections fully lapse, leading to significant downward pressure on revenue from branded sales.

Projected Price Trends

- Short-term (1-2 years): Slight decline in price (~5-10%) due to competitive discounts and insurance negotiations, maintaining a premium over generics but with narrowing margins.

- Mid-term (3-5 years): Price erosion accelerates as biosimilar/niche competitors enter, potentially decreasing prices by 30-50% depending on market penetration and reimbursement strategies.

- Long-term (5+ years): Substantial reduction (up to 70%) aligns with generic diffusion, with the branded product either maintaining a niche or phased out.

Influence of Market Dynamics

Reimbursement policies and insurance formularies heavily influence pricing. In markets with strict formulary controls, branded prices may fall more rapidly. Conversely, in regions with high brand loyalty or limited generic availability, price erosion may be less aggressive.

Market Penetration Strategies and Pricing Optimization

Manufacturers can employ tiered pricing models, patient assistance programs, and alliance strategies to sustain revenue streams. Emphasizing device innovation and clinical differentiation allows margin preservation even amid generic competition.

Risk Factors Affecting Future Pricing

- Patent Litigation and Litigation Risks: Potential patent challenges may accelerate generic entry.

- Regulatory Changes: Modifications in approval processes or safety standards could influence cost structures.

- Market Saturation: Growing generic competition diminishes pricing power.

- Reimbursement Landscape: Stringent reimbursement criteria may compress prices.

Summary of Key Drivers for Future Pricing

| Driver | Impact |

|---|---|

| Patent expiry and generic competition | Strong downward pressure on prices |

| Device and formulation patents extension | Temporary price stabilization |

| Market demand and allergic rhinitis prevalence | Supports premium pricing temporarily |

| Reimbursement policies | Influence on net pricing and access |

| Technological advancements in delivery | Potential for premium pricing if differentiation persists |

Conclusion

QNASL stands at a pivotal juncture. While its current premium pricing is supported by its innovative delivery system and clinical profile, imminent patent expiration will likely precipitate price reductions aligned with generic market entry. Companies intending to maintain profitability must navigate patent strategies and market dynamics adeptly, emphasizing product differentiation and patient loyalty.

Key Takeaways

- QNASL’s current market relies heavily on brand loyalty, with prices at a premium (~USD 250-300 per 120 doses).

- Patent expirations and generic competition are expected to significantly reduce prices over the next 3-5 years.

- Strategic patent extensions and device innovation can temporarily mitigate price erosion.

- Reimbursement policies and regional market characteristics critically influence actual net prices.

- Continuous monitoring of patent landscapes, regulatory developments, and competitor dynamics is essential for accurate price projection.

FAQs

1. When is QNASL’s patent protection expected to expire?

Patent protections are projected to expire around 2024-2025 in key markets like the U.S., opening the market to generics [2].

2. How will generic competitors impact QNASL’s pricing?

Generics typically enter at 50-70% lower than branded prices, leading to a substantial decline in revenues unless the brand maintains market share via differentiation.

3. What strategies can QNASL implement to sustain market share post-patent expiry?

Enhancing device features, pursuing new formulations or indications, and developing patient adherence programs can help preserve market position.

4. How do reimbursement policies influence QNASL’s pricing landscape?

Reimbursement decisions directly affect net prices. Favorable policies for branded products can sustain higher prices; restrictive policies lead to discounts and generics differentiation.

5. Are there emerging markets where QNASL could command higher prices?

Emerging markets with low generic penetration or limited healthcare infrastructure may sustain higher prices longer, provided regulatory approvals are obtained.

References

[1] MarketResearch.com, "Global Allergic Rhinitis Market Forecast," 2022.

[2] U.S. Patent and Trademark Office records, "QNASL patent status," 2023.

[3] GoodRx, "QNASL nasal spray price comparison," 2023.

[4] IMS Health, "Impact of generic entry on nasal corticosteroid pricing," 2022.

More… ↓