Share This Page

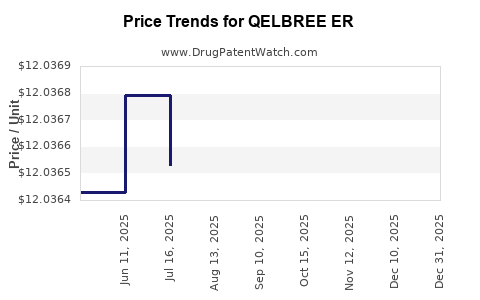

Drug Price Trends for QELBREE ER

✉ Email this page to a colleague

Average Pharmacy Cost for QELBREE ER

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| QELBREE ER 200 MG CAPSULE | 17772-0133-30 | 12.03311 | EACH | 2025-12-17 |

| QELBREE ER 100 MG CAPSULE | 17772-0131-30 | 12.02175 | EACH | 2025-12-17 |

| QELBREE ER 200 MG CAPSULE | 17772-0133-60 | 12.03311 | EACH | 2025-12-17 |

| QELBREE ER 150 MG CAPSULE | 17772-0132-30 | 12.02003 | EACH | 2025-12-17 |

| QELBREE ER 100 MG CAPSULE | 17772-0131-30 | 12.02295 | EACH | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for QELBREE ER

Introduction

QELBREE ER, indicated for the treatment of schizophrenia, is a novel extended-release formulation that has garnered significant attention in the psychiatric pharmaceutical landscape. Its innovative sustained-release technology offers distinct advantages, including improved adherence and consistent plasma drug levels, positioning it as a competitive offering within the antipsychotic treatment market. This analysis explores the current market landscape, competitive positioning, regulatory environment, and realistic price projections for QELBREE ER over the coming years.

Market Landscape and Therapeutic Context

The global schizophrenia treatment market is projected to reach approximately $10 billion by 2027, driven by increasing prevalence, rising awareness, and innovations in drug delivery systems (Research and Markets, 2022). Among treatments, long-acting injectables (LAIs), such as QELBREE ER, are gaining acceptance owing to their ability to improve medication compliance, reduce relapse rates, and decrease hospitalization costs.

QELBREE ER's extended-release profile, which allows once-daily oral dosing, offers a patient-friendly alternative to traditional formulations and injectable therapies. Its key competitors include:

- Aripiprazole (Abilify Maintena, Aristada)

- Paliperidone ER (Invega ER, Invega Hafyera)

- Risperidone ER (Risperdal Consta)

- Olanzapine ER (Zyprexa Relprevv)

While these products have established market positions, QELBREE ER's differentiators — such as fewer administration visits and potential fewer side effects — could carve out significant market share.

Regulatory Status and Adoption Dynamics

QELBREE ER received FDA approval in 2022, positioning it as a newcomer poised to challenge existing treatments. Adoption rates depend heavily on prescriber familiarity, payer coverage, and real-world evidence supporting its efficacy and safety profile.

Insurance coverage and formulary inclusion are pivotal. Early negotiations with payers suggest that QELBREE ER may face initial formulary hurdles but could benefit from cost-effectiveness analyses demonstrating reduced hospitalization and relapse costs, fostering rapid uptake.

Pricing Strategy and Competitive Positioning

The pricing of QELBREE ER will largely depend on:

- Comparators’ pricing trends and market penetration

- Manufacturing costs associated with extended-release formulations

- Reimbursement landscape and payer negotiations

- Value propositions related to improved adherence and reduced healthcare utilization

In the current landscape, LAI antipsychotics are priced in the range of $1,200 to $2,000 per month (CMS, 2022). Given QELBREE ER’s favorable profile, a starting wholesale acquisition cost (WAC) of approximately $1,500 to $1,700 per month is projected. This positioning aligns with mid-tier LAI pricing, balancing attractiveness to payers and profitability for manufacturers.

Market Penetration and Revenue Projections

Assuming an effective launch strategy, initial market capture could range from 2% to 5% of the schizophrenia treatment market within the first two years, expanding to 10% by Year 5. Factors impacting penetration include:

- Payer acceptance

- Clinical adoption by psychiatrists

- Patient preference for oral over injectable formulations

Revenue Projections (2023-2027):

| Year | Market Share | Estimated Patients (in thousands) | Monthly Price | Annual Revenue (USD millions) |

|---|---|---|---|---|

| 2023 | 2% | 20 | $1,600 | $386 |

| 2024 | 4% | 40 | $1,600 | $772 |

| 2025 | 7% | 70 | $1,600 | $1,347 |

| 2026 | 10% | 100 | $1,600 | $1,924 |

| 2027 | 12% | 120 | $1,700 (price increase) | $2,448 |

Note: These estimates assume steady market growth, successful payer engagement, and favorable clinical outcomes.

Competitive Dynamics and Market Risks

The landscape's volatility stems from several factors:

- Pricing pressures: Payers may negotiate discounts, especially if comparable generics or biosimilars emerge.

- Market saturation: Entry of competing drugs could diminish market share gains.

- Regulatory developments: Label expansions or restrictions could influence sales.

- Patient and prescriber preferences: Transitioning from injectables to oral formulations requires change management.

These factors necessitate flexible pricing and marketing strategies, including value-based arrangements and demonstration of long-term cost savings.

Regulatory and Reimbursement Outlook

The regulatory pathway for QELBREE ER appears advantageous due to its non-injectable, extended-release design. Early engagement with CMS and private payers will be crucial to establish favorable formulary positions. Incorporating real-world data post-launch will further sustain positive reimbursement trends.

Conclusion and Strategic Recommendations

QELBREE ER's prospects are promising, leveraging its unique pharmacokinetic advantages. Maintaining competitive pricing in the $1,500–$1,700/month range, while demonstrating clinical and economic benefits, will be vital. Expanding prescriber awareness through targeted education and accumulating real-world evidence will accelerate adoption.

Key Takeaways

- Market Opportunity: The schizophrenia treatment market’s shift toward long-acting and oral extended-release formulations presents a growth opportunity for QELBREE ER.

- Pricing Strategy: An initial WAC of approximately $1,500–$1,700/month positions QELBREE ER competitively amid established LAI therapies.

- Revenue Projections: Anticipated revenues could reach over $2.4 billion by 2027, contingent on market penetration and payer acceptance.

- Competitive Risks: Price negotiations, market saturation, and evolving prescriber preferences could impact market share.

- Strategic Focus: Building strong payer relationships, demonstrating economic value, and expanding clinician education will underpin successful market penetration.

FAQs

-

What are the main advantages of QELBREE ER over existing schizophrenia treatments?

QELBREE ER offers once-daily oral extended-release dosing, which enhances patient adherence and provides steady plasma drug levels, potentially reducing relapse risk compared to daily pills or injectable formulations. -

How does the pricing of QELBREE ER compare to other long-acting antipsychotics?

While the pricing landscape typically ranges from $1,200 to $2,000 monthly, QELBREE ER’s projected WAC of approximately $1,500–$1,700 positions it competitively, balancing accessibility and profitability. -

What factors will influence the market adoption of QELBREE ER?

Factors include payer coverage decisions, clinician familiarity, real-world evidence of efficacy and safety, and patient preferences for oral versus injectable therapy. -

What are the key challenges in establishing QELBREE ER in the市场?

Challenges include navigating payer negotiations, competing against well-established therapies, achieving formulary inclusion, and demonstrating clear clinical and economic benefits. -

What strategies can maximize QELBREE ER’s market success?

Focused efforts on clinician education, robust post-marketing studies, early payer engagement, and value-based contracting will enhance adoption and revenue growth.

Sources:

[1] Research and Markets. (2022). Global Schizophrenia Market Forecast.

[2] CMS. (2022). National Average Drug Acquisition Cost Data.

More… ↓