Share This Page

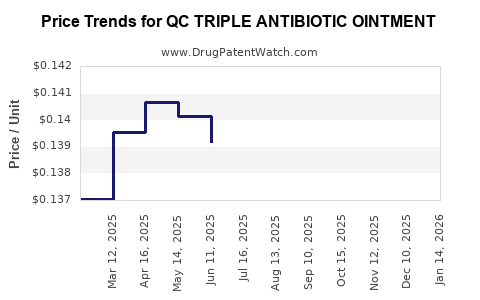

Drug Price Trends for QC TRIPLE ANTIBIOTIC OINTMENT

✉ Email this page to a colleague

Average Pharmacy Cost for QC TRIPLE ANTIBIOTIC OINTMENT

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| QC TRIPLE ANTIBIOTIC OINTMENT | 83324-0050-05 | 0.13736 | GM | 2025-12-17 |

| QC TRIPLE ANTIBIOTIC OINTMENT | 83324-0050-05 | 0.13569 | GM | 2025-11-19 |

| QC TRIPLE ANTIBIOTIC OINTMENT | 83324-0050-05 | 0.13441 | GM | 2025-10-22 |

| QC TRIPLE ANTIBIOTIC OINTMENT | 83324-0050-05 | 0.13686 | GM | 2025-09-17 |

| QC TRIPLE ANTIBIOTIC OINTMENT | 83324-0050-05 | 0.13776 | GM | 2025-08-20 |

| QC TRIPLE ANTIBIOTIC OINTMENT | 83324-0050-05 | 0.13879 | GM | 2025-07-23 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for QC Triple Antibiotic Ointment

Introduction

QC Triple Antibiotic Ointment, a combination pharmacological formulation comprising neomycin, polymyxin B, and bacitracin, remains a cornerstone in topical infection management. Its widespread application in dermatological infections, minor cuts, and abrasions underscores its significant market presence. This analysis examines current market dynamics, competitive landscape, regulatory influences, and price trajectory forecasts for QC Triple Antibiotic Ointment, providing stakeholders with actionable insights to navigate evolving industry conditions.

Market Overview

Global Market Size and Growth Trends

The global topical antibiotics market, inclusive of formulations such as QC Triple Antibiotic Ointment, was valued at approximately USD 4.2 billion in 2022, with a compound annual growth rate (CAGR) of around 4.5% projected through 2028 [1]. The rise in skin infections, increased surgical procedures, and prevalent wound management practices underpin this growth. The Asia-Pacific region dominates due to expanding healthcare infrastructure and increasing awareness about wound care.

Key Therapeutic Applications

- Minor skin injuries: Cuts, abrasions, and burns.

- Surgical prophylaxis: Prevention of post-operative wound infections.

- Dermatological conditions: Eczema, dermatitis with secondary bacterial infection.

Market Segments and Distribution Channels

- Hospitals & clinics: Major revenue contributor, owing to inpatient and outpatient wound care.

- Retail pharmacies: Significant sales volume driven by self-care.

- Online pharmacies: Growing prominence due to accessibility and convenience.

Competitor Landscape

The market features several other topical antibiotics and combination ointments, including brands like Neosporin, Polysporin, and generic equivalents. Patent expirations and the availability of generic formulations exert downward pressure on prices and encourage market penetration.

Regulatory Environment

Regulatory Status

In major markets such as the US and Europe, QC Triple Antibiotic Ointment is classified as over-the-counter (OTC) or prescription-only based on local regulations [2]. Regulatory pathways influence pricing strategies and market access. Stringent quality standards, ongoing post-market surveillance, and evolving antimicrobial stewardship policies may impact formulation approval and commercialization costs.

Impact on Pricing

Regulatory approvals that streamline generic entry typically lead to price reductions. Conversely, stringent regulations or extended approval processes could maintain higher price points temporarily.

Market Drivers and Constraints

Drivers

- Rising prevalence of skin infections due to increased outdoor activities and urbanization.

- Growth in outpatient care and self-medication.

- Expansion in developing countries with rising healthcare investments.

- Product innovation: New formulations with extended shelf life or enhanced efficacy.

Constraints

- Antimicrobial resistance (AMR): Growing concerns about overuse leading to regulatory restrictions.

- Market saturation: High penetration of generic products reduces premium pricing.

- Patient safety concerns: Side effects like contact dermatitis may reduce demand.

Pricing Dynamics and Projections

Current Pricing Landscape

As of 2023, retail prices for QC Triple Antibiotic Ointment vary globally:

- United States: Approximately USD 4.50 to USD 8.00 for a 15g tube, with generic versions available at lower prices.

- Europe: Prices range from EUR 3.50 to EUR 7.00.

- Asia-Pacific: Prices are often lower, around USD 2.00 to USD 5.00, driven by local manufacturing and generic competition.

Factors Influencing Price Trends

- Generic Market Penetration: Increased availability leads to price erosion.

- Manufacturing Costs: Inflation, raw material availability, and quality standards.

- Regulatory Changes: Approval of new formulations or restrictions on antibiotics.

- Market Demand: Fluctuates with infection rates and healthcare infrastructure development.

- Reimbursement Policies: Insurance coverage and government schemes.

Future Price Projections (2023-2028)

Based on current trends and market forces, the price of QC Triple Antibiotic Ointment is expected to experience a moderate decline of approximately 2-3% annually in mature markets such as North America and Europe due to generic commoditization [3].

However, in emerging markets, prices may remain stable or slightly increase—by 1-2% annually—driven by localized manufacturing, supply chain improvements, and rising demand.

Novel formulations or new combination therapies entering the market could temporarily elevate prices, but long-term trends favor cost reduction due to intensifying competition.

Potential Market Disruptors

- Antibiotic resistance and regulatory restrictions could lead to formulary discontinuation or replacement, impacting pricing.

- Development of alternative therapies, such as antiseptics with broader efficacy, may diminish demand and influence prices downward.

- Policy shifts toward antimicrobial stewardship could reduce over-the-counter availability, impacting retail prices.

Strategic Implications for Stakeholders

- Manufacturers should focus on cost-effective production and expand into underserved regions to sustain profitability amid price pressures.

- Distributors and pharmacies must navigate regulatory landscapes to maintain supply chain efficiency and optimize margins.

- Investors should monitor regulatory developments and market penetration strategies that may affect pricing and revenues.

Key Takeaways

- The global market for QC Triple Antibiotic Ointment is sizable, with steady growth driven by wound care and dermatological applications.

- Price trends forecast gradual decline in mature markets (-2 to -3% annually), influenced by generic competition and regulatory shifts.

- Emerging markets present opportunities for stable or slightly increasing prices, especially with localized manufacturing and increased healthcare access.

- Regulatory climate and antimicrobial resistance are critical factors shaping the competitive landscape and pricing strategies.

- Innovation and product differentiation will be essential to sustain margins amid consolidating generic markets.

Conclusion

QC Triple Antibiotic Ointment’s market remains resilient owing to its established efficacy, widespread use, and ongoing demand for minor wound care. While price pressures are imminent due to increasing generic competition, strategic positioning in emerging markets and adherence to regulatory standards can mitigate revenue erosion. Continuous monitoring of antimicrobial stewardship policies, technological advancements, and regional healthcare investments will be vital for stakeholders aiming to optimize market performance and price management.

FAQs

1. How does antimicrobial resistance affect the market for QC Triple Antibiotic Ointment?

Antimicrobial resistance (AMR) prompts regulatory agencies to restrict or modify antibiotic use, potentially limiting OTC availability or leading to formulation restrictions. This can decrease market size and pressure prices downward.

2. Are generic versions significantly cheaper than branded QC Triple Antibiotic Ointment?

Yes. Generics typically cost 30-50% less due to lower development costs, increasing price competition and reducing profit margins for branded versions.

3. What emerging markets present growth opportunities for QC Triple Antibiotic Ointment?

Regions such as Southeast Asia, Africa, and Latin America experience increasing healthcare access, rising infection rates, and demand for affordable wound care, making them attractive for market expansion.

4. What role does regulatory approval play in pricing strategies?

Regulatory approval streamlines market entry, affects patent status, and influences reimbursement rates. New approvals can command higher prices initially, but intensified regulation can lead to price reductions over time.

5. Will product innovation influence future pricing trends?

Yes. Innovations such as extended shelf life, increased efficacy, and reduced side effects can justify premium pricing and maintain market differentiation, potentially offsetting price pressures.

Sources

[1] MarketsandMarkets, "Topical Antibiotics Market by Product Type, Application, and Region — Global Forecast to 2028"

[2] U.S. Food and Drug Administration (FDA), "Over-the-Counter (OTC) Antibiotics Regulations"

[3] IQVIA, "Global Healthcare Market Trends 2023"

More… ↓