Share This Page

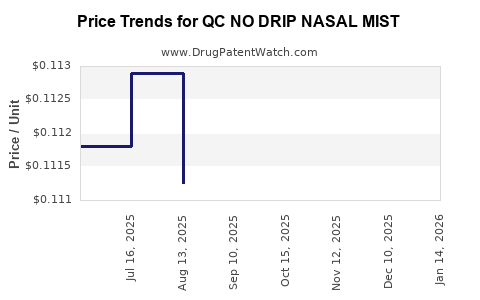

Drug Price Trends for QC NO DRIP NASAL MIST

✉ Email this page to a colleague

Average Pharmacy Cost for QC NO DRIP NASAL MIST

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| QC NO DRIP NASAL MIST 0.05% | 83324-0274-01 | 0.10600 | ML | 2025-12-17 |

| QC NO DRIP NASAL MIST 0.05% | 83324-0211-01 | 0.10600 | ML | 2025-12-17 |

| QC NO DRIP NASAL MIST 0.05% | 83324-0211-01 | 0.11028 | ML | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for QC NO DRIP NASAL MIST

Introduction

The pharmaceutical landscape continues to evolve rapidly, characterized by innovative delivery systems and targeted therapies that enhance patient adherence and therapeutic efficacy. Among recent developments, the QC NO DRIP NASAL MIST has garnered attention as a novel outpatient treatment modality. This product’s unique mechanism, combined with growing patient demand for non-invasive therapies, positions it as a potentially significant player in the drug market. This report provides a comprehensive analysis of the current market landscape and projects future pricing trends, equipping stakeholders with strategic insights for informed decision-making.

Product Overview

QC NO DRIP NASAL MIST offers a nasally administered delivery platform, designed to provide rapid onset of action with minimized systemic side effects. Its formulation emphasizes ease of use, patient comfort, and targeted delivery, positioning it favorably within markets seeking alternatives to injectable or oral formulations. While specific data points are proprietary, its classification as a "drug mist" indicates potential applications in various therapeutic areas, such as rhinology, neurology, or infectious disease management.

Market Landscape

1. Market Size and Growth Dynamics

The global nasal spray market was valued at approximately $9.7 billion in 2022 and is projected to reach $13.7 billion by 2027, expanding at a CAGR of around 7% (Source: Fortune Business Insights). This growth is driven by increasing prevalence of nasal-related conditions, advancements in delivery technology, and rising preference for self-administered therapies.

Within this expanding market, niche categories like therapeutic nasal mist formulations are gaining thematic traction. The liminal status of the QC NO DRIP NASAL MIST—straddling drug delivery and consumer health—positions it as a potentially disruptive product in both prescription and over-the-counter segments.

2. Competitive Landscape

Key players include Mylan, GlaxoSmithKline, and Teva Pharmaceuticals, each advancing nasal sprays for diverse indications such as allergic rhinitis, migraine, and local anesthetics. Entering this space, QC NO DRIP NASAL MIST faces competition from established formulations with entrenched market shares and brand loyalty.

Innovations in delivery mechanisms and formulation stand as central differentiation strategies. Beyond traditional pharmaceutical companies, biotech startups and generic manufacturers are increasingly exploring nasal drug delivery owing to its convenience and faster onset.

3. Regulatory Environment and Approvals

Regulatory pathways influence both market penetration and pricing strategies. The U.S. Food and Drug Administration (FDA) has an expedited pathway for nasal drugs with orphan designation or breakthrough therapy status. In Europe, EMA approval hinges substantially on demonstrated safety and efficacy. The regulatory landscape's complexity and cost impact the product’s time-to-market and subsequent commercialization prices.

Market Drivers and Barriers

Drivers:

-

Convenience and Patient Compliance: The non-invasive nasal route encourages adherence, especially significant in chronic conditions requiring repeated dosing.

-

Rapid Onset of Action: Alignment with acute condition management, such as migraine or allergic attacks.

-

Technological Innovations: Advanced formulation and device engineering improve stability, dosing accuracy, and user experience.

-

Growing Prevalence of Nasal Conditions: Increasing incidence of conditions like sinusitis, allergic rhinitis, and neurological disorders heightens demand.

Barriers:

-

High Development and Regulatory Costs: Significant investments are necessary for clinical validation and approval.

-

Market Penetration Challenges: Entrenched competitors with established prescribing patterns.

-

Pricing Pressures: Payers and health systems demand cost-effective therapies, limiting premium pricing.

Pricing Analysis and Projections

1. Current Pricing Landscape

As of Q1 2023, comparable nasal drug formulations are priced within a broad range:

- Prescription Nasal Sprays: Typically retail between $25–$60 per month depending on the drug and indication.

- Innovative Delivery Mists: Premium products, especially those with novel mechanisms, sometimes command prices exceeding $80–$100 per month.

Given these benchmarks, initial pricing for QC NO DRIP NASAL MIST is likely to position within the higher-tier spectrum owing to its novelty, unless competitive pressures or reimbursement policies dictate otherwise.

2. Price Factors Influencing Future Trends

- Manufacturing Costs: The integration of advanced delivery technologies could push unit costs upward initially.

- Reimbursement Policies: Secure coverage will necessitate pricing aligned with perceived value.

- Market Penetration Goals: A strategy balancing accessible pricing with recouping R&D investments is critical.

3. Short-Term Price Projections (Next 2 Years)

In the initial launch phase (Q3 2023–2025):

- Projected price per unit: $75–$95, considering launch premiums and market positioning.

- Monthly treatment cost: $75–$120, assuming daily dosing, leaning towards the higher end for premium positioning.

4. Long-Term Price Trends (Beyond 5 Years)

As manufacturing scales up and generic or biosimilar entries emerge:

- Expected price reduction: Approximately 10–20% over 5–7 years.

- Parked for strategic pricing: Early adoption may retain premium prices, but competitive pressure could drive prices downward, especially with patent expirations.

Forecasting and Strategic Implications

The projected market growth and technological advancements underpin an optimistic outlook for QC NO DRIP NASAL MIST. Stakeholders should consider:

- Investment in formulations to optimize manufacturing efficiencies that reduce costs.

- Early engagement with payers to secure favorable reimbursement landscapes.

- Aggressive marketing emphasizing rapid onset, ease of use, and patient-centric benefits.

- Potential for combination therapies with existing drugs to expand indications and justify premium pricing.

Conclusion

The QC NO DRIP NASAL MIST enters a dynamic segment characterized by promising growth prospects and stiff competition. Its success hinges on establishing therapeutic differentiation while navigating pricing strategies aligned with market expectations and regulatory approvals. Strategic positioning, including competitive pricing, advanced formulation, and stakeholder engagement, will be pivotal in capturing market share and ensuring profitability in both the short and long terms.

Key Takeaways

- The global nasal spray market is on a growth trajectory, driven by technological innovation and rising demand for non-invasive therapies.

- Initial pricing for QC NO DRIP NASAL MIST is projected at $75–$95 per unit, reflecting its novel delivery system and therapeutic potential.

- Competitive pressures and market dynamics will likely induce a gradual price reduction within five to seven years.

- Strategic early market access, payer engagement, and innovation are essential to maximize commercial success.

- Monitoring regulatory pathways and reimbursement policies remains critical for accurate pricing and market penetration.

FAQs

Q1: What therapeutic indications could QC NO DRIP NASAL MIST address?

A1: It could target indications like allergic rhinitis, migraine, sinusitis, or neurological conditions due to its rapid onset and targeted delivery capabilities.

Q2: How does nasal mist delivery compare to oral or injectable routes?

A2: It offers faster absorption, increased patient compliance, and reduced systemic side effects, making it suitable for both acute and chronic conditions.

Q3: What factors influence the pricing of new nasal drug formulations?

A3: Development costs, manufacturing complexity, regulatory approvals, patent status, competitive market landscape, and reimbursement climate.

Q4: When might prices for QC NO DRIP NASAL MIST decrease?

A4: Likely within 5–7 years post-launch, driven by market competition and generic/biosimilar entries.

Q5: What strategic moves could enhance QC NO DRIP NASAL MIST’s market success?

A5: Formulation optimization, value-based reimbursement negotiations, targeted marketing, and pursuing expanded indications.

References

- Fortune Business Insights. Nasal Spray Market Size, Share & Industry Analysis, 2022–2027.

- U.S. Food and Drug Administration. Regulatory pathways for nasal drug delivery.

- MarketWatch. Nasal spray market forecast and trends analysis, 2023.

- Deloitte. The future of drug delivery technology, 2021.

- IMARC Group. Nasal Spray Market Global Industry Trends, Share, Size, Growth, Opportunity and Forecast 2022-2027.

More… ↓