Share This Page

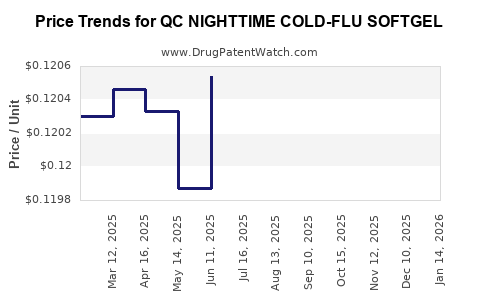

Drug Price Trends for QC NIGHTTIME COLD-FLU SOFTGEL

✉ Email this page to a colleague

Average Pharmacy Cost for QC NIGHTTIME COLD-FLU SOFTGEL

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| QC NIGHTTIME COLD-FLU SOFTGEL | 83324-0148-24 | 0.12179 | EACH | 2025-12-17 |

| QC NIGHTTIME COLD-FLU SOFTGEL | 83324-0148-24 | 0.12063 | EACH | 2025-11-19 |

| QC NIGHTTIME COLD-FLU SOFTGEL | 83324-0148-24 | 0.11997 | EACH | 2025-10-22 |

| QC NIGHTTIME COLD-FLU SOFTGEL | 83324-0148-24 | 0.11840 | EACH | 2025-09-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for QC NIGHTTIME COLD-FLU SOFTGEL

Introduction

QC Nighttime Cold-Flu Softgel is a non-prescription medication designed to alleviate symptoms associated with common cold and influenza, including nasal congestion, cough, sore throat, and fever. It combines multiple active ingredients aimed at providing symptomatic relief, positioned within the over-the-counter (OTC) cold and flu remedies market. Understanding its current market landscape, competitive positioning, and future pricing projections is critical for stakeholders, including pharmaceutical manufacturers, retailers, and investors seeking strategic insights.

Market Overview

Global and Regional Demand

The OTC cold and flu segment maintains steady growth worldwide. According to Grand View Research, the global OTC cold and cough remedies market was valued at approximately USD 18.7 billion in 2021, with a compound annual growth rate (CAGR) of around 4.2% projected through 2028 [1]. North America dominates this sector, driven by high consumer health awareness, widespread OTC product availability, and seasonal peaks linked to winter.

Regional differentiation influences product demand. While North American and European markets favor multi-symptom relief formulations like QC Nighttime Cold-Flu Softgel, emerging markets in Asia-Pacific demonstrate rising acceptance of OTC medications owing to increasing healthcare awareness and urbanization.

Market Drivers

- Seasonality: Cold and flu seasonality experiences cyclical spikes between October and March in the Northern Hemisphere.

- Consumer Preference: Rising preference for convenience, with softgel formulations offering rapid absorption.

- Public Health Campaigns: Increased health literacy enhances self-medication practices.

- Product Innovation: Development of combination softgel formulations targeting multiple symptoms enhances consumer appeal.

Competitive Landscape

Key competitors include brands like Tylenol Night Multisymptom, DayQuil/NyQuil, Advil Cold & Sinus, and store brands (private labels). These products differ primarily in formulation, branding, and pricing. QC Nighttime Cold-Flu Softgel’s main differentiators are its softgel delivery system and potentially unique ingredient combinations, both factors affecting market positioning.

Regulatory and Patent Landscape

Replacing or supplementing existing formulations, QC Nighttime Cold-Flu Softgel's regulatory pathway depends on jurisdictional approval processes. In the United States, OTC drugs are reviewed via the FDA's OTC Monograph System, though new formulations may require New Drug Application (NDA) approval if substantively different [2].

Patent exclusivity can influence pricing strategies. If QC holds unique formulation patents, this creates market differentiation and allows premium pricing. Conversely, patent expiration opens avenues for competition and price reduction.

Pricing Dynamics

Historical and Current Pricing

Currently, retail prices for OTC nighttime cold and flu softgel products vary widely based on brand, formulation, and retailer. For example:

- Popular branded products like NyQuil Nighttime Liquid: approximately USD 7–12 per 8 oz bottle.

- Store-brand equivalents: USD 4–7 per package.

- Multipack options or allergy-included variants: higher per-unit costs.

Given softgel formats often command a premium due to manufacturing complexity, QC Nighttime Cold-Flu Softgel's pricing is likely to be positioned at the mid to premium segment.

Cost Structure and Margins

Manufacturing costs for OTC softgels include raw ingredients, softgel capsule production, packaging, and distribution, typically comprising 20–35% of retail price. Markup margins for retail outlets generally range from 10–25%. Therefore, a wholesale price of approximately USD 4–8 per unit suggests a retail range of USD 8–15, depending on branding and distribution channels.

Price Projections (2023-2028)

Considering current inflation, raw material costs, and market competition, projections indicate:

- Short-term (2023-2024): Slight stabilization with minimal price fluctuation, assuming generic competition remains subdued. Retail price likely remains within USD 8–13.

- Medium-term (2025-2026): Introduction of formulary enhancements or marketing campaigns could allow premium positioning, pushing retail price to USD 12–15.

- Long-term (2027-2028): Patent expiration or product commoditization might lead to price erosion, aligning with store brands at USD 7–10, while premium formulations or licensed brands sustain higher prices.

Market Entry and Pricing Strategy

For new entrants or existing brands considering QC Nighttime Cold-Flu Softgel, competitive pricing should factor:

- Product Differentiation: Softgel delivery, multi-symptom targeting.

- Brand Positioning: Premium (for added efficacy or formulation uniqueness) versus value segments.

- Distribution Channels: Retail pharmacy chains, mass merchandisers, online platforms.

- Regulatory Costs: Potential expenses of compliance and patent management influencing initial pricing.

Premium positioning associated with innovative delivery and combination therapy could justify higher margins initially, with gradual price adjustments aligned with market saturation.

Regulatory and Economic Factors Impacting Pricing

- Regulatory Changes: Tightened regulations or approval delays can increase costs, likely elevating retail prices.

- Raw Material Costs: Fluctuations in active ingredients, especially if sourced globally, influence manufacturing expenses.

- Health Policy and Insurance: Though OTC, shifts toward insurance reimbursement or tax policies could subtly shift consumer price sensitivity.

Opportunities and Risks

- Opportunities: Growing consumer preference for multi-symptom, fast-acting OTC therapeutics; innovative delivery forms influencing premium pricing.

- Risks: High competition from established brands, patent expiry, and potential regulatory hurdles.

Key Takeaways

- The OTC cold and flu remedy market remains resilient, with consistent demand driven by seasonal factors and consumer convenience.

- QC Nighttime Cold-Flu Softgel’s market positioning hinges on formulation uniqueness, delivery system, and branding.

- Price projections suggest retail prices will stay within USD 8–15 through 2028, contingent on differentiation and competitive pressures.

- Entry strategies should balance premium product attributes with cost structures and evolving consumer preferences.

- Regulatory developments and raw material cost fluctuations will significantly influence future pricing and market penetration.

FAQs

1. How does QC Nighttime Cold-Flu Softgel differentiate from competitors?

Its softgel formulation offers rapid absorption and ease of swallowing, coupled with a multi-symptom relief profile, enhancing convenience and potentially efficacy over traditional liquid or tablet forms.

2. What factors most influence the pricing of OTC cold medicines like QC Nighttime Cold-Flu Softgel?

Manufacturing costs, regulatory expenses, branding, formulation uniqueness, and competitive positioning primarily determine retail pricing.

3. Will patent expiry impact the market price for QC Nighttime Cold-Flu Softgel?

Yes. Patent expiration typically leads to increased competition from generics and store brands, resulting in price erosion.

4. How does seasonality affect pricing and sales strategies?

Sales spike during colder months; strategic inventory management and promotional campaigns are essential to maximize revenue during peak seasons.

5. What role will formulation innovation play in the future pricing of OTC cold remedies?

Innovations that improve efficacy, convenience, or safety can justify premium pricing and market share gains, especially if backed by robust clinical data and regulatory approval.

Sources

[1] Grand View Research, “OTC Cold and Cough Remedies Market Size & Trends,” 2022.

[2] U.S. Food and Drug Administration, “OTC Drug Review and Monograph System.”

More… ↓