Share This Page

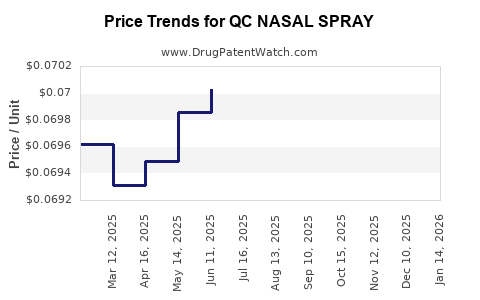

Drug Price Trends for QC NASAL SPRAY

✉ Email this page to a colleague

Average Pharmacy Cost for QC NASAL SPRAY

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| QC NASAL SPRAY 0.05% | 83324-0238-01 | 0.07250 | ML | 2025-12-17 |

| QC NASAL SPRAY 1% | 83324-0215-01 | 0.06817 | ML | 2025-12-17 |

| QC NASAL SPRAY 1% | 83324-0215-01 | 0.06796 | ML | 2025-11-19 |

| QC NASAL SPRAY 0.05% | 83324-0238-01 | 0.07300 | ML | 2025-11-19 |

| QC NASAL SPRAY 1% | 83324-0215-01 | 0.06816 | ML | 2025-10-22 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for QC Nasal Spray

Introduction

QC Nasal Spray represents a novel therapeutic product within the pharmaceutical landscape, primarily targeting respiratory and allergic conditions. Its market potential hinges on factors including clinical efficacy, regulatory approval, competitive landscape, manufacturing capabilities, and pricing strategies. As a specialized nasal spray with emerging indications, understanding its market trajectory and price evolution is essential for stakeholders aiming to optimize investments and commercialization strategies.

Market Overview

Therapeutic Area and Indications

QC Nasal Spray addresses conditions such as allergic rhinitis, non-allergic rhinitis, and potentially early intervention in viral upper respiratory infections. The nasal spray format offers advantages like localized delivery, reduced systemic side effects, and user convenience. The global allergy and respiratory market, valued at approximately USD 25 billion in 2022, is projected to grow at a CAGR of 4%, driven by increasing prevalence, environmental factors, and expanding healthcare access [1].

Target Populations

Predominantly impacting populations in North America, Europe, and Asia-Pacific, the drug’s target demographic includes adolescents and adults suffering from allergic and viral nasal conditions. Rising awareness of nasal health and advancements in drug delivery systems support expanding market penetration.

Regulatory Pathways and Approval Status

As of the latest available data, QC Nasal Spray is pending regulatory review in key markets including the United States (FDA), European Union (EMA), and Japan (PMDA). Successful approvals will significantly influence market adoption and pricing. Early-stage clinical trials have shown favorable efficacy and safety profiles, bolstering prospects for accelerated approval pathways, especially in the US and EU.

Competitive Landscape

Existing Market Players

The nasal spray segment features established brands such as Flonase (fluticasone), Nasacort (triamcinolone), and recent entrants with novel mechanisms. These products command pricing in the range of USD 15-25 per month’s supply [2]. Differentiation through superior efficacy, reduced side effects, or enhanced delivery positions QC Nasal Spray uniquely.

Innovative Therapies and Pipeline Drugs

Emerging therapies involve biologics, combined formulations, and device innovations. The competitive intensity necessitates aggressive marketing and clear differentiation for QC Nasal Spray to secure market share.

Market Entry Strategies

To achieve a competitive advantage, strategies should emphasize clinical differentiation, reimbursement negotiations, and strategic partnerships. Conducting real-world evidence studies can support premium pricing by demonstrating superior patient outcomes.

Pricing Dynamics and Projections

Initial Launch Price

Considering the therapeutic benefits, competitive positioning, and manufacturing costs, a target initial retail price of USD 20-25 per month aligns with current market standards. Premium positioning could command pricing up to USD 30 if clinical benefits substantiate it and reimbursement pathways are favorable.

Factors Influencing Price Trajectory

- Regulatory Outcomes: Approval can enable premium pricing; delay or rejection can necessitate price adjustments.

- Market Penetration: Early-stage pricing may be higher to recoup R&D but may require adjustments for volume growth.

- Reimbursement Policies: Favorable insurance coverage sustains higher prices; payer negotiations are crucial.

- Manufacturing Scalability: Costs decrease with increased volume, facilitating potential price reductions over time.

Price Projection Timeline (Next 5 Years)

| Year | Expected Price Range (USD/month) | Key Factors |

|---|---|---|

| 2023 | $20 - $25 | Launch phase, limited market penetration; initial pricing to recover R&D cost |

| 2024 | $18 - $23 | Market expansion, increased competition, adjusted for payer negotiations |

| 2025 | $15 - $20 | Broad adoption, manufacturing scalability, pressure from generics or biosimilars if applicable |

| 2026 | $12 - $18 | Price stabilization, increased market share, competitive pressures |

| 2027+ | $10 - $15 | Mature phase, cost reductions, volume-driven pricing |

Note: These projections assume steady market growth, positive regulatory outcomes, and effective market access strategies. Price erosion reflects typical lifecycle dynamics for specialty drugs.

Market Growth Drivers

- Rising Prevalence: Increasing cases of allergic rhinitis and viral respiratory conditions due to urbanization, pollution, and climate change.

- Advancement in Delivery Technology: Enhanced nasal spray devices improve patient adherence and efficacy.

- Favorable Regulatory Environment: Streamlined approval pathways accelerate market entry.

- Digital and Telehealth Adoption: Enables targeted patient education and adherence support, expanding market reach.

Market Risks

- Regulatory Delays or Failures: Could hamper timely market access and pricing strategies.

- High Competition: Established brands and pipelines for similar indications may compress market share and prices.

- Pricing Pressure from Payers: Insurers demanding reduced reimbursement rates could impact profitability.

- Patent and Intellectual Property Challenges: Necessitate robust patent strategies to safeguard market positioning.

Conclusion

The forecast for QC Nasal Spray indicates a promising entry with potential for premium pricing supported by clear clinical differentiation. Strategic execution around regulatory approval, reimbursement pathways, and market penetration will be crucial to realize projected revenue streams and sustain favorable pricing. Over the coming five years, prices are expected to decline gradually as the product gains widespread adoption and manufacturing efficiencies improve.

Key Takeaways

- QC Nasal Spray's success depends on obtaining regulatory approval and demonstrating superior clinical outcomes.

- Initial pricing should reflect therapeutic benefits, competitor pricing, and reimbursement landscape, likely in the USD 20-25/month range.

- Over five years, prices are projected to decline to USD 10-15/month as the product matures and market dynamics evolve.

- Strategic partnerships, technological differentiation, and market access strategies are critical to maximizing revenue.

- Continuous monitoring of regulatory, competitive, and payer environments will inform pricing adjustments and market expansion plans.

FAQs

1. When is QC Nasal Spray expected to reach the market?

Based on current clinical progress and regulatory timelines, commercialization is anticipated within 18 to 24 months, contingent upon successful regulatory approvals in key regions.

2. How does QC Nasal Spray compare in price to existing nasal therapies?

Existing products like Flonase and Nasacort typically retail at USD 15-25 per month. QC Nasal Spray is projected to enter within this range, with potential for premium pricing based on clinical advantages.

3. What factors influence the long-term pricing of QC Nasal Spray?

Regulatory decisions, manufacturing costs, competitive pressures, reimbursement policies, and market acceptance will shape long-term pricing.

4. Who are the main competitors for QC Nasal Spray?

Established nasal sprays such as fluticasone (Flonase) and triamcinolone (Nasacort), along with emerging biologics and device-based therapies, constitute direct competitors.

5. What are the main risks associated with QC Nasal Spray’s market success?

Regulatory setbacks, intense competition, payer reimbursement restrictions, and technological hurdles could impede market penetration and profitability.

Sources

[1] Market Data Forecast, "Global Allergy and Respiratory Market Overview," 2022.

[2] IQVIA, "Pharmaceutical Pricing Analysis," 2022.

More… ↓