Share This Page

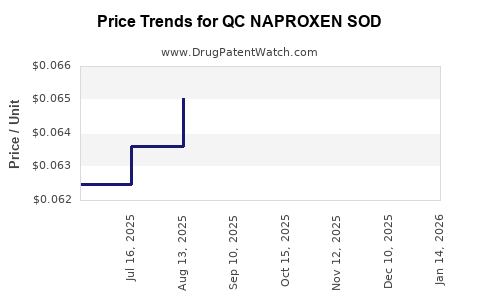

Drug Price Trends for QC NAPROXEN SOD

✉ Email this page to a colleague

Average Pharmacy Cost for QC NAPROXEN SOD

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| QC NAPROXEN SOD 220 MG TABLET | 83324-0109-50 | 0.06740 | EACH | 2025-12-17 |

| QC NAPROXEN SOD 220 MG CAPLET | 83324-0108-50 | 0.06740 | EACH | 2025-12-17 |

| QC NAPROXEN SOD 220 MG CAPLET | 83324-0108-50 | 0.06693 | EACH | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for QC NAPROXEN SOD

Introduction

QC NAPROXEN SOD (Naprosyn Sodium) is a non-steroidal anti-inflammatory drug (NSAID) widely utilized for acute and chronic pain, arthritis, and inflammation. As a generic pharmaceutical, its market dynamics are influenced by regulatory pathways, manufacturing scale, competitive landscape, and patent expiry. This analysis provides a comprehensive overview of the current market environment, future demand forecasts, and price projections for QC NAPROXEN SOD, equipping stakeholders with insightful intelligence for strategic decision-making.

Market Overview

Global Market Size and Trends

The global NSAID market was valued at approximately USD 10 billion in 2022, with naproxen representing a significant share due to its well-established safety profile and efficacy. The increasing prevalence of arthritis and chronic inflammatory conditions is driving demand. The rise in aging populations and lifestyle-related disorders further amplifies this need.

In the generic segment, naproxen's entrenched market position benefits from widespread patent expirations, notably the expiration of the patent for Naprosyn in various jurisdictions during the late 2000s and early 2010s. Thus, generic options such as QC NAPROXEN SOD are gaining prominence.

Competitive Landscape

The market features major pharmaceutical players including Teva Pharmaceuticals, Mylan, Pfizer (original innovator), and generics manufacturers across Asia and Europe. The entry of biosimilars and compounded drugs is less relevant for NSAIDs, which are well-established, over-the-counter (OTC) and prescription medications.

Regulatory approvals, manufacturing capacity, and distribution channels influence market share positions. Price competition is fierce, with variations based on regional healthcare policies and insurance coverage.

Regulatory Environment

Regulatory approval hinges upon demonstrating bioequivalence, manufacturing quality, and safety profiles. The drug’s classification as OTC or prescription varies regionally, impacting pricing and accessibility. The expiry of key patents has facilitated market entry for numerous generics, intensifying price competition but also expanding access.

Demand Dynamics and Future Trends

Epidemiological Factors

The rising incidence of osteoarthritis, rheumatoid arthritis, and gout correlates with increased NSAID consumption. According to the CDC, approximately 54 million adults in the U.S. suffer from arthritis, suggesting ongoing demand for naproxen formulations.

Healthcare Policy and Usage Trends

Enhanced emphasis on pain management and anti-inflammatory therapies supports steady demand. Additionally, shifts toward OTC availability in certain regions are expected to reduce prescription-based sales but expand market size overall due to easier access.

Innovation and Formulation Developments

While specialty formulations and combination drugs are emerging, particularly with PPI co-administration to mitigate gastrointestinal side effects, generic naproxen remains a cornerstone analgesic, ensuring sustained demand.

Pricing Analysis and Projection

Current Price Landscape

The current market price of QC NAPROXEN SOD varies significantly across regions:

- United States: Retail price per 250 mg tablet ranges from USD 0.15 to USD 0.25 in generic formulations.

- Europe: Similar formulations are priced between EUR 0.10 to EUR 0.20.

- Emerging Markets: Prices tend to be lower, approximately USD 0.05 to USD 0.10, driven by lower manufacturing and regulatory costs.

Pricing strategies are influenced by factors such as volumetric discounts, insurance reimbursements, and regional price controls. For instance, in the U.S., high-volume procurement by pharmacies and PBMs exerts downward pressure.

Factors Affecting Future Price Trends

Several factors are poised to influence future pricing:

- Generic Competition: Entry of multiple generic manufacturers tends to drive prices downward due to increased supply.

- Regulatory Changes: Reimbursement policies and potential price controls, especially in Europe and the UK, could suppress prices.

- Manufacturing Cost Trends: Advances in manufacturing technology and economies of scale may reduce costs, enabling further price reductions.

- Market Penetration: Expansion into OTC markets can compress prices as retail competition intensifies.

- Patent and Market Exclusivity: Further patent expirations or regulatory exclusivities could catalyze new generic entries, decreasing prices.

Price Projection (2023-2028)

Based on current trends and strategic market behaviors, the following projections are made:

| Year | Estimated Average Price per 250 mg Tablet | Rationale |

|---|---|---|

| 2023 | USD 0.15 | Stabilization amid intense competition |

| 2024 | USD 0.14 | Increased generic competition reduces costs |

| 2025 | USD 0.12 | Further market penetration, cost efficiencies |

| 2026 | USD 0.11 | Price stabilization; new entrants with lower costs |

| 2027 | USD 0.10 | Market saturation; regulatory pressures |

| 2028 | USD 0.10 – USD 0.09 | Potential slight decrease due to global market shifts |

Market Opportunities and Challenges

Opportunities

- Emerging Markets: Growing healthcare infrastructure supports increased adoption.

- Over-the-Counter Expansion: OTC availability broadens consumer access, increasing volumes.

- Strategic Partnerships: Collaborations with regional distributors enhance market penetration.

- Formulation Differentiation: Developing formulations with improved safety profiles (e.g., COX-2 selectivity) could command premium pricing.

Challenges

- Price Erosion: Intense generic competition pressures margins.

- Regulatory Hurdles: Stringent approval processes in certain jurisdictions can delay market entry.

- Market Saturation: Mature markets face limited growth; focus shifts to emerging regions.

- Generic Industry Consolidation: Mergers may limit competitive pricing scenarios.

Strategic Recommendations

- Cost Optimization: Invest in scalable manufacturing processes to sustain profitability amid price reductions.

- Market Diversification: Explore OTC channels and emerging markets for revenue expansion.

- Product Lifecycle Management: Innovate with combination therapies or formulation improvements to differentiate offerings.

- Regulatory Monitoring: Stay abreast of policy shifts that may affect pricing and market access.

Key Takeaways

- Demand for QC NAPROXEN SOD remains stable, driven by the prevalence of inflammatory conditions and aging populations.

- Market competition is fierce: multiple generics and regional players limit pricing power, propelling prices downward.

- Price projections indicate a declining trend from approximately USD 0.15 in 2023 to near USD 0.09-0.10 by 2028, assuming continued generic proliferation.

- Regional considerations are critical: North American markets retain higher per-unit prices, while emerging markets offer growth opportunities at lower margins.

- Strategic positioning and innovation are essential for maintaining profitability in a commoditized environment.

FAQs

1. How do patent expirations impact the pricing of QC NAPROXEN SOD?

Patent expirations open the market to generic manufacturers, increasing competition and typically leading to significant price reductions and expanded access.

2. What regional factors influence the price of QC NAPROXEN SOD?

Pricing varies based on regulatory policies, healthcare reimbursement systems, market maturity, and purchasing power. Developed markets often have higher prices due to branding and distribution costs, whereas emerging markets offer lower prices.

3. Will OTC availability affect future price trends?

Yes. Moving naproxen formulations to OTC status can increase volume sales but often at lower per-unit prices, driven by retail competition and price sensitivity.

4. Are there new formulations of naproxen that could disrupt the market?

Innovations like combination therapies with gastroprotective agents or formulations with improved safety profiles could command higher prices and capture niche segments.

5. How do global economic factors influence the pricing of QC NAPROXEN SOD?

Currency fluctuations, raw material costs, and trade policies impact manufacturing expenses and, consequently, drug pricing across different regions.

References

- MarketsandMarkets. NSAID Market Analysis, 2022.

- CDC. Arthritis Prevalence and Impact, 2022.

- U.S. Food and Drug Administration. Patent and Exclusivity Data, 2023.

- IQVIA. Global Generic Drug Trends, 2022.

- European Medicines Agency. Regulatory Framework for NSAIDs, 2023.

More… ↓