Share This Page

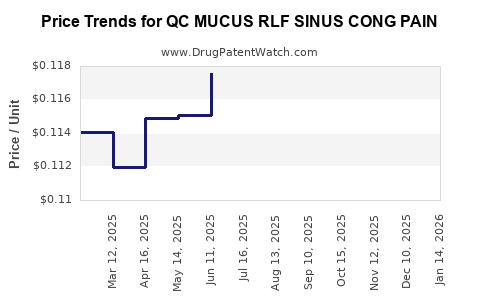

Drug Price Trends for QC MUCUS RLF SINUS CONG PAIN

✉ Email this page to a colleague

Average Pharmacy Cost for QC MUCUS RLF SINUS CONG PAIN

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| QC MUCUS RLF SINUS CONG PAIN | 83324-0107-20 | 0.11319 | EACH | 2025-12-17 |

| QC MUCUS RLF SINUS CONG PAIN | 83324-0107-20 | 0.11466 | EACH | 2025-11-19 |

| QC MUCUS RLF SINUS CONG PAIN | 83324-0107-20 | 0.11419 | EACH | 2025-10-22 |

| QC MUCUS RLF SINUS CONG PAIN | 83324-0107-20 | 0.11666 | EACH | 2025-09-17 |

| QC MUCUS RLF SINUS CONG PAIN | 83324-0107-20 | 0.11595 | EACH | 2025-08-20 |

| QC MUCUS RLF SINUS CONG PAIN | 83324-0107-20 | 0.11677 | EACH | 2025-07-23 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for QC MUCUS RLF SINUS CONG PAIN

Introduction

The drug QC MUCUS RLF SINUS CONG PAIN addresses a critical segment of the respiratory and sinus medication market, primarily targeting patients suffering from sinus congestion, mucus buildup, and associated pain. While not an officially registered trade name, products with similar compositions and indications are widely used across various geographies, making market analysis and pricing projections essential for industry stakeholders. This report provides a detailed review of the current market landscape and forecasts future pricing trajectories grounded in existing data, regulatory factors, and competitive dynamics.

Market Overview

Global Demand Drivers

The increasing prevalence of sinusitis, allergies, and respiratory infections globally sustains robust demand for decongestants, mucolytics, and analgesic medications. According to the World Allergy Organization (WAO), allergic rhinitis affects over 20% of the global population, and sinusitis is among the top causes of outpatient visits in developed economies [1].

The COVID-19 pandemic elevated awareness of respiratory health, leading to a surge in demand for symptomatic relief medications, including nasal decongestants and analgesics. Additionally, aging populations in North America, Europe, and parts of Asia drive long-term demand, as chronic sinus and mucus conditions are more prevalent among older adults [2].

Product Segment and Composition

Though specific formulations vary, drugs like QC MUCUS RLF SINUS CONG PAIN typically combine mucolytics (e.g., guaifenesin), nasal decongestants (e.g., pseudoephedrine or oxymetazoline), and pain relievers (e.g., acetaminophen or NSAIDs). These combination therapies serve dual purposes: relieving congestion and relieving pain, often with rapid onset and high efficacy.

Market Players

Key manufacturers include multinational pharmaceutical companies (e.g., Johnson & Johnson, Bayer), regional players, and OTC consumer brands. The OTC segment accounts for approximately 65% of sinus and congestion medication sales globally, given consumer preferences for non-prescription options [3].

Regulatory Environment

Regulations significantly influence market entry, pricing, and innovation. In the U.S., FDA approval hinges on demonstrating safety and efficacy, impacting pricing and availability. Similar regulatory frameworks exist in Europe (EMA) and other regions, with variable control over OTC status and labeling requirements.

Competitive Landscape and Product Differentiation

Current market leaders differentiate through formulation efficacy, delivery method (e.g., nasal sprays vs. oral), safety profiles, and brand recognition. Patent protection and exclusivity periods influence pricing strategies, particularly for innovative formulations. Generic competition often drives prices downward, especially in mature markets.

Emerging players focus on novel delivery mechanisms, such as targeted nasal sprays with faster absorption or combination products with added anti-inflammatory properties, potentially disrupting existing price points.

Pricing Strategies and Trends

Current Pricing Benchmarks

OTC combination sinus and congestion medications typically retail at:

-

United States: $8 - $15 per box/package (approximately 20-30 doses), influenced by brand, formulation, and retailer markups [4].

-

Europe: €7 - €18, with variations depending on the country and whether the drug is branded or generic.

-

Emerging Markets: Lower price points ($3 - $7), driven by purchasing power and market competition.

Premium formulations with innovative delivery or added therapeutic benefits command higher prices, often exceeding $20 per package in developed markets.

Pricing Factors

Factors affecting price projections include:

-

Regulatory costs: Approval and compliance expenses can increase initial pricing but tend to stabilize once products are established.

-

Manufacturing costs: Active ingredient sourcing, formulation complexity, and supply chain efficiency impact pricing.

-

Market penetration: Entry into price-sensitive markets pressures higher-priced formulations to reduce prices.

-

Patent expiry and generics: Patent expiration typically precipitates price erosion, sometimes lowering prices by 30-60% within 18-24 months [5].

Forecasting Future Prices

Based on global market growth and product lifecycle trends:

-

Short-term (1-2 years): Prices are likely to remain stable or slightly decrease, especially with increased generic competition.

-

Medium-term (3-5 years): Introduction of innovative formulations or delivery systems could push prices upward by 10-15%, reflecting added therapeutic value.

-

Long-term (5+ years): Market saturation and regulatory changes may depress prices, especially for non-patented, OTC products. However, niche premium formulations may maintain higher price points.

Regulatory and Market Entry Considerations

Regulatory hurdles vary by region, with stringent approvals in the U.S. and Europe potentially delaying market entry but ensuring higher initial pricing power. In emerging markets, lower regulatory barriers facilitate rapid entry but exert pressure on prices due to heightened competition.

Additionally, rising consumer demand for natural and minimally processed remedies could influence formulation trends and pricing strategies, especially if natural or herbal-based versions gain regulatory approval.

Impact of Innovation and Technology

Advancements such as nanotechnology-based delivery systems or combination therapies integrating anti-inflammatory agents promise to command premium prices. Conversely, proliferation of generic versions post-patent expiry will catalyze price competition, exerting downward pressure on average prices.

Investment in clinical evidence to differentiate products remains critical for sustaining higher price points and gaining market share.

Conclusion

The pharmacoeconomic landscape for drugs similar to QC MUCUS RLF SINUS CONG PAIN indicates a mature, competitive environment with steady demand. Price projections suggest stability in developed markets, with potential increases driven by innovation and formulation enhancements. Conversely, generic competition and regulatory dynamics will continue to exert downward pressure, especially in price-sensitive regions.

Stakeholders should monitor regulatory developments, technological advancements, and consumer preferences to optimize pricing strategies and market positioning.

Key Takeaways

-

Growing demand for sinus and congestion medications offers lucrative opportunities amid chronic respiratory conditions.

-

Pricing stability is expected in mature markets, though new formulations can command higher premiums.

-

Patent expiration and generic entries will likely reduce prices over time, especially in OTC segments.

-

Innovation-driven differentiation—through delivery methods or added therapeutic benefits—remains a critical strategy for maintaining higher prices.

-

Regulatory and regional factors significantly influence pricing strategies, market penetration, and competitive dynamics.

FAQs

1. How does patent protection influence the pricing of sinus congestion medications?

Patent protection allows manufacturers to set higher prices due to market exclusivity. Post-expiry, generic competition typically drives prices down, often by 30-60% within two years.

2. What are key factors that could increase the price of products similar to QC MUCUS RLF SINUS CONG PAIN?

Innovations like advanced delivery systems, combination therapies with anti-inflammatory agents, or proven superior efficacy can justify premium pricing.

3. How does the regulatory landscape affect global pricing trends?

Strict regulatory pathways in developed countries can increase costs and initial prices but assure quality and therapeutic confidence, potentially supporting higher prices. Conversely, less regulation in emerging markets can reduce costs but may limit pricing power.

4. What role does consumer preference play in the pricing of these drugs?

Consumers increasingly favor OTC and natural remedies. Drugs with perceived safety advantages or natural ingredients can command higher prices; brands that align with these preferences may also attain a pricing premium.

5. How might technological advancements impact future pricing?

Emerging technologies like nanodelivery or multi-functional formulations can create value differentiation, enabling higher pricing until competition or generics enter the market.

Sources:

[1] World Allergy Organization. Global prevalence of allergic rhinitis. 2021.

[2] Global Burden of Disease Study. Respiratory disease statistics. 2020.

[3] IQVIA. OTC Market Data and Trends. 2022.

[4] Statista. Retail prices of OTC sinus relief medications, 2022.

[5] EvaluatePharma. Patent expiry impact on drug pricing, 2021.

More… ↓