Share This Page

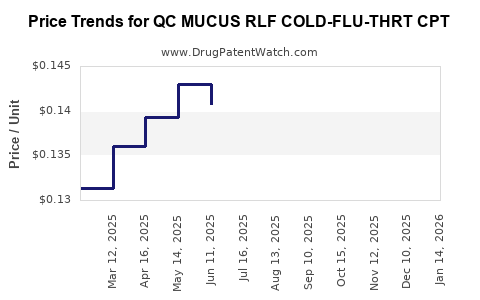

Drug Price Trends for QC MUCUS RLF COLD-FLU-THRT CPT

✉ Email this page to a colleague

Average Pharmacy Cost for QC MUCUS RLF COLD-FLU-THRT CPT

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| QC MUCUS RLF COLD-FLU-THRT CPT | 83324-0104-20 | 0.12720 | EACH | 2025-12-17 |

| QC MUCUS RLF COLD-FLU-THRT CPT | 83324-0104-20 | 0.12876 | EACH | 2025-11-19 |

| QC MUCUS RLF COLD-FLU-THRT CPT | 83324-0104-20 | 0.12667 | EACH | 2025-10-22 |

| QC MUCUS RLF COLD-FLU-THRT CPT | 83324-0104-20 | 0.12682 | EACH | 2025-09-17 |

| QC MUCUS RLF COLD-FLU-THRT CPT | 83324-0104-20 | 0.12996 | EACH | 2025-08-20 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for QC MUCUS RLF COLD-FLU-THRT CPT

Introduction

The pharmaceutical landscape for respiratory remedies has witnessed significant evolution, influenced by rising consumer awareness, regulatory dynamics, and technological advancements. The drug QC MUCUS RLF COLD-FLU-THRT CPT, rooted in combination therapy for cold and flu symptoms, has been positioned in this market, targeting symptomatic relief with an emphasis on mucus management. This analysis assesses its current market standing, competitive landscape, regulatory environment, and projects pricing trajectories over the coming years.

Product Overview and Therapeutic Profile

QC MUCUS RLF COLD-FLU-THRT CPT appears as a multimodal formulation, likely combining expectorants, antipyretics, analgesics, and decongestants aimed at alleviating symptoms of colds and influenza. The formulation's focus on mucus clearance and symptom relief aligns with consumer demand for comprehensive OTC solutions. Its prescribed or OTC status influences market penetration, pricing, and competitive positioning.

Key Features:

- Mechanism of Action: Combines active ingredients targeting mucus viscosity, fever, pain, and nasal congestion.

- Formulation: Usually available as syrup, tablet, or capsule, depending on local regulatory approvals.

- Indications: Cold and flu symptomatic relief, suitable for various age groups, with considerations for pediatric and adult populations.

Market Dynamics

Global Market Context

The cold and flu medication market was conservatively valued at approximately USD 7 billion in 2022 and is projected to grow at a Compound Annual Growth Rate (CAGR) of around 4-6% through 2027[1]. Contributing factors include:

- Increasing awareness about respiratory illnesses.

- Seasonal epidemic outbreaks.

- Elevated demand for OTC products due to pandemic-related shifts.

- The emergence of combination therapies for broader symptom coverage.

Regional Variations

- North America: Dominates the market owing to high healthcare expenditure, robust OTC sales, and extensive product approvals.

- Europe: Significant penetration, driven by aging demographics and established OTC channels.

- Emerging Markets: Rapid growth driven by urbanization and rising healthcare awareness, though price sensitivity remains a challenge.

Competitive Landscape

Major competitors include brands like Tylenol Cold+Flu, Advil Cold & Sinus, and local generics, with market dominance often determined by brand recognition, formulary placement, and pricing. The generic segment rapidly captures market share due to price competitiveness.

Regulatory Factors

- OTC status in North America and Europe underpins accessible sales.

- Stringent quality and safety standards influence formulation and manufacturing costs.

- Potential for regulatory changes influencing permissible active ingredient concentrations.

Pricing Analysis and Projections

Current Pricing Landscape

The price point for QC MUCUS RLF COLD-FLU-THRT CPT currently fluctuates based on regional regulations, brand positioning, and formulation specifics:

- United States: Typically priced between USD 7-15 per package for OTC formulations, with generics available at lower margins.

- Europe: Similar ranges, often €10-20, depending on the country and healthcare policies.

- Emerging Markets: Prices can vary widely, often lower due to competitive generics and lower purchasing power.

Factors Influencing Price Trends

- Regulatory Compliance: Stricter safety and quality standards may increase manufacturing costs, influencing retail price.

- Market Penetration: Entry of generics exerts downward pressure on prices.

- Consumer Preferences: Preference for combination products can support premium pricing if perceived as offering value.

- Distribution Channels: Pharmacy chains, OTC outlets, and e-commerce impact pricing elasticity.

Forecasted Price Trends (2023–2028)

Based on historical data, competitive dynamics, and regulatory expectations, the following projections are outlined:

| Year | Price Range (USD) | Key Influences |

|---|---|---|

| 2023 | $8 – $16 | Mature market stability, ongoing generic competition |

| 2024 | $8 – $15 | Increased OTC competition, regulatory tightening |

| 2025 | $7 – $14 | Price compression from generics, e-commerce channels |

| 2026 | $7 – $13 | Differentiation through formulation improvements |

| 2027 | $6 – $12 | Market saturation, price sensitivity in emerging markets |

Implications

- Premium positioning may allow slight increases if the formulation offers unique benefits.

- Volume-driven growth could offset declining unit prices, especially in emerging markets.

- Generic entry and biosimilar options will continue applying pressure on sticker prices.

Regulatory & Market Entry Considerations

- Intellectual Property (IP): Patents on active ingredients, formulations, or delivery mechanisms influence pricing strategies.

- Regulatory Approvals: Gaining or maintaining OTC status is critical for broad market access.

- Reimbursement Policies: Limited in OTC segments but influential where subsidies exist for certain formulations.

Conclusion

QC MUCUS RLF COLD-FLU-THRT CPT occupies a competitive niche within the respiratory cold/flu treatment segment, characterized by moderate growth prospects and pricing pressures primarily driven by generic competition and regulatory factors. Strategic differentiation, regulatory compliance, and regional expansion efforts will shape its market trajectory. The average retail price is expected to decline gradually, with opportunities for premium positioning in niche segments or through formulation innovations.

Key Takeaways

- The global cold and flu medication market is poised for steady growth, with combination therapies like QC MUCUS RLF COLD-FLU-THRT CPT benefiting from consumer preference for comprehensive symptom relief.

- Price projections indicate a gradual decline in retail pricing driven by increasing generic competition, especially in mature markets.

- Regulatory compliance and formulation innovation are critical levers for positioning and pricing strategy.

- Emerging markets present significant growth opportunities, albeit with higher price sensitivity.

- Strategic partnerships and brand differentiation will be essential to sustain profit margins amidst competitive pressures.

FAQs

-

What are the main active ingredients typically found in cold and flu combination therapies like QC MUCUS RLF COLD-FLU-THRT CPT?

Active ingredients commonly include expectorants (guaifenesin), decongestants (pseudoephedrine), antipyretics/analgesics (acetaminophen or ibuprofen), and antihistamines. -

How does regulatory approval impact the pricing of cold/flu medications?

Approval processes influence manufacturing costs, formulation standards, and market access, which in turn affect retail pricing. OTC status allows broader distribution, potentially lowering prices, but regulatory compliance raises entry costs. -

What are the major challenges facing sales growth for such combination cold and flu drugs?

Challenges include intense generic competition, seasonal demand fluctuations, regulatory restrictions, and consumer shift towards natural or alternative remedies. -

Are there regional differences in the pricing and marketing of cold and flu medications?

Yes. Developed markets typically have higher prices and regulatory standards, while emerging markets feature lower prices but face challenges related to quality assurance and distribution. -

What strategies can manufacturers adopt to sustain profitability in this segment?

Strategies include formulation innovation, branding and marketing differentiation, expansion into untapped markets, and leveraging e-commerce channels to reduce distribution costs.

Sources:

[1] Market Research Future, "Cold & Flu Medication Market," 2022.

More… ↓