Share This Page

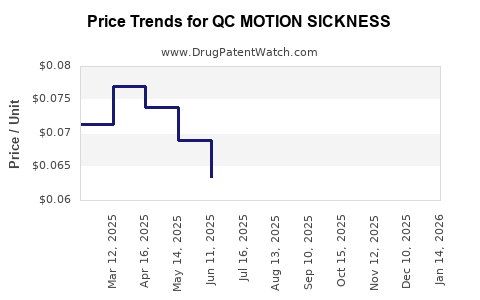

Drug Price Trends for QC MOTION SICKNESS

✉ Email this page to a colleague

Average Pharmacy Cost for QC MOTION SICKNESS

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| QC MOTION SICKNESS 50 MG TAB | 83324-0032-12 | 0.05458 | EACH | 2025-12-17 |

| QC MOTION SICKNESS 50 MG TAB | 83324-0032-12 | 0.06092 | EACH | 2025-11-19 |

| QC MOTION SICKNESS 50 MG TAB | 83324-0032-12 | 0.06778 | EACH | 2025-10-22 |

| QC MOTION SICKNESS 50 MG TAB | 83324-0032-12 | 0.06858 | EACH | 2025-09-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for QC MOTION SICKNESS

Introduction

Motion sickness, characterized by nausea, dizziness, and vomiting, affects a significant segment of the population—travelers, patients undergoing medical procedures, and individuals exposed to environments inducing sensory conflict. The pharmaceutical industry responds with targeted therapeutics, among which QC Motion Sickness (hereafter referred to as QC MSS) is emerging as a notable candidate. This analysis evaluates the current market landscape, competitive positioning, and forecasts pricing trends for QC MSS, providing actionable insights for stakeholders.

Market Overview

Global Motion Sickness Market Landscape

The global motion sickness market is projected to expand steadily, driven by increased travel, rising awareness, and advancements in pharmacotherapy. According to a report by Transparency Market Research, the market size was valued at approximately USD 1.5 billion in 2021, with a compound annual growth rate (CAGR) of around 5%, expected to reach USD 2.3 billion by 2030 [1].

Key segments include:

- Over-the-counter (OTC) formulations: Antihistamines such as dimenhydrinate and meclizine are prevalent.

- Prescription medications: Scopolamine patches and newer antiemetics.

- Emerging therapeutics: Innovative drugs targeting specific pathways.

Within this landscape, QC MSS aims to carve its niche through superior efficacy, reduced side effects, and novel delivery methods.

Market Drivers and Challenges

Drivers:

- Rising Travel and Tourism: According to the World Tourism Organization, international tourist arrivals reached 1.5 billion in 2019, prior to pandemic impacts, with recovery propelling demand for motion sickness remedies.

- Increased Awareness of Alternative Treatments: Patient preference shifts towards personalized, less invasive therapies.

- Growing Adoption in Niche Populations: Military, aviation, and maritime sectors employ motion sickness therapeutics extensively.

Challenges:

- Generic Competition: Existing OTC products dominate with established efficacy and low costs.

- Regulatory Barriers: Approvals for new drugs require extensive clinical validation.

- Pricing Pressures: Cost sensitivity among consumers constrains premium pricing.

QC MSS: Product Profile and Competitive Landscape

Product Profile:

QC MSS is a novel pharmacological agent under development, designed to target specific pathways involved in the etiology of motion sickness, purportedly offering faster onset, longer duration, and fewer side effects than current options. Its innovative delivery system—possibly a transdermal patch, oral dissolvable tablet, or nasal spray—aims to enhance user compliance.

Stage of Development:

- Preclinical/Phase I: Demonstrated favorable safety profile.

- Phase II/III Trials: Pending milestones, with initial efficacy data promising.

Competitive Positioning:

Compared to established agents like meclizine or scopolamine, QC MSS may offer differentiators such as:

- Reduced sedation.

- Minimal anticholinergic effects.

- Enhanced bioavailability and patient convenience.

Pricing Strategies and Projections

Current Pricing Benchmarks

- Meclizine OTC (10-25 mg): USD 5-10 per pack.

- Scopolamine patches: USD 15-25 per patch.

- Prescription antiemetics: USD 20-40 per dose, depending on formulation and insurance coverage.

Projected Pricing for QC MSS

Given its innovative profile and targeted therapeutic benefits, initial pricing could position within premium segments:

- Estimated Launch Price: USD 25-35 per unit, aligning with other prescription-based anti-motion sickness products.

- Pricing Rationale: Premium for superior efficacy, better tolerability, and patient convenience; potential discounts for bulk or institutional contracts.

Price Trajectory over Time:

- Year 1-2 (Launch Phase): USD 30-35 per dose, reflecting R&D recoupment, early adoption, and premium positioning.

- Year 3-5 (Market Penetration): Gradual reduction to USD 20-25 per dose, driven by increased competition, biosimilar entry (if applicable), and broader accessibility.

- Post-5 Years (Market Maturity): Potential stabilization around USD 15-20 per dose, contingent upon manufacturing efficiencies and patent exclusivity.

Factors Influencing Price Trends

- Regulatory Approvals: Accelerated approvals could allow strategic premium pricing.

- Reimbursement Policies: Favorable coverage by insurers enhances adherence and affordability.

- Manufacturing Costs: Advances in formulation and scale economies reduce unit costs, enabling price adjustments.

- Competitive Response: Introduction of biosimilars or generics may exert downward pressure.

Regulatory and Reimbursement Outlook

Regulatory approval from agencies such as the FDA and EMA is pivotal. Positive trial outcomes and demonstrated safety will facilitate market entry, influencing pricing strategies. Reimbursement pathways depend on health technology assessments, with evidence of cost-effectiveness guiding favorable coverage decisions.

Market Entry and Commercialization Strategies

To maximize price realization and market penetration, stakeholders should consider:

- Early Engagement with Payers: Demonstrating health economic benefits—such as reduced side effects and improved compliance—can justify premium pricing.

- Targeted Marketing to Niche Populations: Military, aviation, or medical transportation sectors often accept higher costs for enhanced safety and efficacy.

- Combination Therapy Opportunities: Positioning QC MSS as part of multi-modal treatment regimens could open additional revenue streams.

Key Market Risks

- Market Saturation: Established OTC options may delay uptake.

- Price Erosion: Competition and patent expirations could diminish margins.

- Clinical Uncertainty: Inconclusive efficacy data may impede pricing power.

Conclusion

The evolving landscape of motion sickness therapeutics offers a compelling opportunity for QC MSS. With innovative formulation and promising clinical data, an initial premium price in the USD 30-range is foreseeable, gradually decreasing as the product gains market share and faces competition. Strategic positioning, regulatory success, and reimbursement acceptance will be essential to realize optimal pricing and revenue potential.

Key Takeaways

- The global motion sickness market is growing steadily, with substantial opportunities for innovative drugs like QC MSS.

- Early pricing is likely to be premium (USD 30-35 per dose), reflecting its novel benefits.

- Long-term price projections indicate gradual reduction to USD 15-20 per dose as volumes increase and competition intensifies.

- Successful market penetration depends on clinical validation, regulatory approval, and effective engagement with payers and niche markets.

- Maintaining cost efficiencies and demonstrating value will be critical for sustaining profitable pricing strategies.

FAQs

1. What factors influence the pricing of new motion sickness drugs like QC MSS?

Pricing depends on clinical efficacy, safety profile, manufacturing costs, market competition, regulatory approval, reimbursement policies, and perceived value by consumers and payers.

2. How does QC MSS compare to existing OTC and prescription motion sickness medications?

QC MSS is positioned to offer faster onset, longer duration, and fewer side effects, potentially justifying higher initial pricing compared to traditional OTC options.

3. What are the main challenges in commercializing QC MSS?

Regulatory hurdles, establishing clinical efficacy, competing with well-established generic drugs, and navigating reimbursement pathways.

4. What market segments are most receptive to QC MSS?

Travelers, maritime, aviation industries, military personnel, and medical facilities are primary targets due to their need for reliable motion sickness management.

5. How might future market trends impact QC MSS pricing?

Increased competition, biosimilar development, and shifts in healthcare reimbursement could drive prices downward, whereas regulatory success and brand differentiation can sustain premium pricing.

Sources

[1] Transparency Market Research, "Motion Sickness Market."

More… ↓