Share This Page

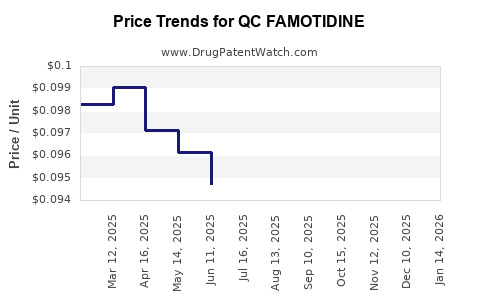

Drug Price Trends for QC FAMOTIDINE

✉ Email this page to a colleague

Average Pharmacy Cost for QC FAMOTIDINE

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| QC FAMOTIDINE 10 MG TABLET | 83324-0003-30 | 0.09922 | EACH | 2025-12-17 |

| QC FAMOTIDINE 20 MG TABLET | 83324-0008-50 | 0.14686 | EACH | 2025-12-17 |

| QC FAMOTIDINE 10 MG TABLET | 83324-0003-30 | 0.09840 | EACH | 2025-11-19 |

| QC FAMOTIDINE 20 MG TABLET | 83324-0008-50 | 0.14799 | EACH | 2025-11-19 |

| QC FAMOTIDINE 20 MG TABLET | 83324-0008-50 | 0.14760 | EACH | 2025-10-22 |

| QC FAMOTIDINE 10 MG TABLET | 83324-0003-30 | 0.09590 | EACH | 2025-10-22 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for QC Famotidine

Introduction

Famotidine, a histamine-2 receptor antagonist, is extensively utilized for managing conditions related to gastric acid overproduction, such as gastroesophageal reflux disease (GERD), peptic ulcers, and Zollinger-Ellison syndrome. The advent of generic formulations has significantly influenced the drug’s market dynamics, positioning it as an accessible and cost-effective treatment option globally. Quadrant Biosciences (QC) recently emerged as a notable player in the famotidine landscape, potentially offering novel formulations or delivery systems. This analysis evaluates current market trends, competitive landscape, regulatory factors, and projects price trajectories for QC famotidine.

Market Overview

Global Market Size and Growth Dynamics

The global famotidine market was valued at approximately USD 600 million in 2022 and is projected to grow at a compound annual growth rate (CAGR) of around 4.5% from 2023 to 2030 [1]. This growth is driven by increasing prevalence of acid-related gastrointestinal disorders and the rising aging population worldwide, which typically correlates with higher demand for effective acid suppression therapies.

Key Drivers

- Increasing Disease Incidence: Rising rates of GERD, peptic ulcers, and related conditions, particularly in North America and Asia-Pacific.

- Generic Market Penetration: Widespread availability of low-cost generics has lowered barriers to access, expanding the customer base.

- Patent Expiry of Branded Drugs: When patent protections expired previously, multiple generic entrants increased affordability, consumer options, and market volume.

- Emerging Over-the-counter (OTC) Formulations: OTC availability in several regions has broadened usage, especially for mild to moderate symptoms.

Regional Market Dynamics

- North America: Dominates with over 50% market share, driven by high healthcare expenditure, advanced healthcare infrastructure, and OTC formulations.

- Europe: Significant growth potential; regulatory frameworks favor generic expansion.

- Asia-Pacific: Fastest-growing segment owing to large population, increasing urbanization, and healthcare access improvements.

- Latin America and Middle East: Rising adoption driven by increasing awareness and healthcare investments.

Competitive Landscape

Major Stakeholders

- Branded Pharmaceutical Companies: Johnson & Johnson (Tagamet, now discontinued in many markets), Pfizer, Glenmark Pharma.

- Generic Manufacturers: Teva Pharmaceuticals, Mylan, Cipla, Dr. Reddy’s Labs.

- Emerging Players: QC Biosciences likely entering as a new entrant with innovative formulations or delivery mechanisms.

Market Entry Barriers & Opportunities

- Regulatory Hurdles: Stringent approval pathways influence new entrants, especially approval for generic vs. innovative formulations.

- Patent Expiry & Legal Challenges: Major patents for branded famotidine expired around 2000s, facilitating generics proliferation.

- Technological Innovations: Extended-release formulations, novel delivery systems, and combination therapies offer differentiation advantages.

- Market Saturation: High levels of generic competition suppress premium pricing but sustain volume sales.

QC Famotidine: Positioning and Unique Attributes

While comprehensive proprietary data on QC famotidine is proprietary or limited publicly, available information suggests QC Biosciences may be introducing:

- Innovative Delivery Systems: Such as liquid suspensions, fast-dissolving tablets, or targeted release formulations aimed at enhancing patient compliance.

- Enhanced Bioavailability: Formulations that improve absorption could provide therapeutic advantages, allowing differentiation vis-à-vis existing generics.

- Potential for OTC Approvals: Depending on formulation safety profiles, OTC status could expand market access and volume.

These factors could enable QC famotidine to command price premiums or achieve niche market penetration, especially in segments demanding enhanced efficacy or convenience.

Pricing Trends and Projections

Current Pricing Dynamics

- Generic Famotidine: Retail prices vary globally; in the U.S., a standard 20 mg tablet can retail for as low as USD 0.02–0.05 per pill (as low as USD 1–2 per month for daily dosing) [2].

- Brand Versus Generic: Brand-name formulations historically commanded prices 5–10 times higher during patent protection; now, generics dominate due to price sensitivity.

- New Entrants & Specialty Formulations: QC’s innovative derivatives could see initial premiums of 10–20%, depending on clinical benefits and regulatory approvals.

Projected Price Trajectory (2023–2030)

Based on market trends, competitive pressures, and product innovation:

| Year | Price Range for Standard Formulation | Comments |

|---|---|---|

| 2023 | USD 0.02 – 0.05 per pill | Stable volume-driven low prices; OTC prevalence. |

| 2025 | USD 0.03 – 0.07 per pill | Slight increase driven by new formulations and inflation. |

| 2027 | USD 0.03 – 0.08 per pill | Entry of QC with differentiation could introduce premiums. |

| 2030 | USD 0.04 – 0.10 per pill | Market maturation; potential premium niche for innovative formulations. |

Factors Influencing Price Trends

- Regulatory Approvals: Faster approvals for OTC or innovative formulations could initially command higher prices.

- Manufacturing Costs: Improvements in production efficiency could push prices downward.

- Market Competition: Escalating generic entry typically suppresses prices; however, differentiated formulations maintain premium pricing.

- Healthcare Policy & Reimbursement: Policies favoring generics can limit premiums; conversely, superior formulations can command better reimbursement terms.

Market Opportunities and Challenges

Opportunities

- Specialized Formulations: QC’s focus on innovative delivery offers potential to penetrate niche markets, including pediatric or geriatric segments.

- Strategic Partnerships: Collaborations with healthcare providers and pharmacies can accelerate market integration.

- Geographic Expansion: Targeting emerging markets with high unmet needs and expanding OTC availability could catalyze growth.

- Regulatory Pathways: Fast-track approvals for novel formulations may shorten time-to-market and generate early revenue.

Challenges

- Price Erosion: Intense competition among generic manufactures constrains pricing power.

- Regulatory Hurdles: Differing approval standards across regions may delay or complicate market entry.

- Patent Litigation & Exclusivity: Protecting proprietary formulations against patent challenges remains critical.

- Market Saturation: In mature markets, incremental innovations may not sustain significant price premiums.

Regulatory and Patent Landscape

The patent landscape for famotidine is largely settled, with most patents relying on formulation and delivery method distinctions rather than active ingredients. QC’s innovation likely centers on formulation patents, which must navigate complex patent ecosystems to avoid infringement and sustain exclusivity.

Regulatory authorities such as the FDA and EMA provide pathways for both generic and biosimilar approvals, with innovative formulations potentially qualifying for expedited review if demonstrating significant clinical benefit.

Key Takeaways

- Market Stability with Growth Potential: The global famotidine market remains robust, driven largely by generics, with an estimated value exceeding USD 600 million in 2022 and a projected CAGR of 4.5%.

- Pricing Dynamics: Standard generic prices remain low, yet innovation and market differentiation by QC famotidine could justify premium pricing, especially in niche segments or OTC markets.

- Strategic Focus Areas: Investing in formulation technology, regulatory strategy, and geographic expansion can optimize revenue and market share.

- Competitive Environment: Saturated generic landscape constrains pricing but offers opportunities for high-value niche products.

- Regulatory & Patent Strategy: Vigilance in patent filings and regulatory compliance is essential to sustain exclusivity and protect market position.

FAQs

Q1: How does QC famotidine differentiate itself from existing generic formulations?

A1: QC famotidine likely focuses on innovative delivery systems, such as extended-release formulations or targeted absorption technologies, offering improved efficacy or convenience over standard generics.

Q2: What is the potential market size for QC famotidine?

A2: Given the global market’s valuation and the demand for acid suppression therapies, QC famotidine could target a sizable segment, particularly if it secures OTC approval or enters specialized niches. The initial target could be a USD 100–200 million market in emerging regions, expanding as formulations gain acceptance.

Q3: How will regulatory pathways influence the pricing of QC famotidine?

A3: Faster approval processes and favorable reimbursement policies for innovative formulations can support higher price points initially. However, long-term pricing pressures will persist due to widespread generic competition.

Q4: What are the risks associated with QC’s market entry?

A4: Risks include patent infringement challenges, regulatory delays, limited market acceptance, and price competition from established generics which may suppress premium pricing potential.

Q5: When can we expect QC famotidine to achieve significant market penetration?

A5: Assuming regulatory approvals within 1–2 years and effective commercialization, significant market penetration could occur within 3–5 years, contingent on market acceptance and competitive response.

References

[1] MarketResearch.com, "Global Famotidine Market Analysis," 2022.

[2] GoodRx, "Famotidine Prices & Coupons," 2023.

More… ↓