Share This Page

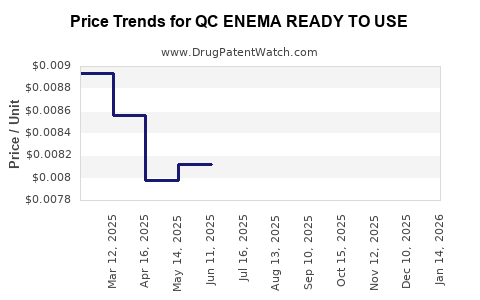

Drug Price Trends for QC ENEMA READY TO USE

✉ Email this page to a colleague

Average Pharmacy Cost for QC ENEMA READY TO USE

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| QC ENEMA READY TO USE TWIN PAK | 83324-0293-90 | 0.00629 | ML | 2025-12-17 |

| QC ENEMA READY TO USE | 83324-0292-45 | 0.00629 | ML | 2025-12-17 |

| QC ENEMA READY TO USE TWIN PAK | 83324-0293-90 | 0.00652 | ML | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for QC ENEMA READY TO USE

Introduction

The pharmaceutical sector continually adapts to evolving healthcare needs, with enema formulations remaining integral for bowel management and diagnostic procedures. "QC ENEMA READY TO USE," a proprietary enema product, exemplifies the shift toward convenience and ready-to-use solutions. This analysis dissects the market landscape, examines competitive dynamics, reviews treatment trends, and projects future pricing trajectories for QC ENEMA READY TO USE.

Market Overview

Global Enema Market Landscape

The global enema market, valued at approximately USD 1.2 billion in 2021, is projected to grow at a compound annual growth rate (CAGR) of 6.2% through 2028 [1]. This growth is underpinned by increasing prevalence of gastrointestinal disorders, aging populations, and a rising preference for minimally invasive procedures.

Segment Focus: Ready-to-Use Dental and Gastrointestinal Enemas

Innovations in enema formulations have fostered a surge in ready-to-use products, favored for their convenience, reduced contamination risk, and ease of administration. The segment caters to both clinical settings and consumer markets, driven by patient-centric approaches and regulatory pushes for safer, standardized solutions.

Therapeutic Indications

Key indications include constipation, bowel cleansing prior to colonoscopy, and detoxification therapies. The robustness of this market is further reinforced by the rising incidence of chronic constipation globally, affecting all age groups but notably the elderly.

Market Drivers and Restraints

Drivers

- Rising GI Disorders: Increased prevalence of gastrointestinal ailments, particularly in aging populations, amplifies demand.

- Patient Convenience: The shift toward ready-to-use formulations enhances compliance and reduces administration complexity.

- Regulatory Changes: Stringent hygiene standards promote prefilled, sterile enema products over traditional solutions.

- Innovations and Product Launches: New formulations with improved tolerability and user experience boost market acceptance.

Restraints

- Pricing Pressures: Competitive markets induce pricing limitations on innovative enema products.

- Regulatory Hurdles: Slow approval processes and regulatory disparities impede rapid market entry.

- Alternative Treatments: Growing preference for oral laxatives and non-invasive therapies can dampen demand.

Competitive Landscape

Major players include Becton Dickinson, Ferring Pharmaceuticals, and Pacira Pharmaceuticals, with a rising number of regional manufacturers expanding their product portfolios. The market exhibits a high degree of fragmentation, with regional preferences influencing product availability and pricing.

Product Differentiation Factors:

- Formulation quality

- Packaging safety features

- Ease of use

- Brand reputation

- Pricing strategies

Market entry often necessitates adhering to stringent regulatory frameworks and establishing distribution channels, especially in clinical environments.

Price Trajectory and Projections

Current Pricing Landscape

The retail price of QC ENEMA READY TO USE products varies across regions:

- North America: USD 12- USD 20 per unit, with premium brands commanding higher prices.

- Europe: EUR 10- EUR 18 per unit, influenced by healthcare reimbursement policies.

- Asia-Pacific: USD 8- USD 15 per unit, driven by cost-sensitive markets.

Factors Influencing Price Movements

- Raw Material Costs: Fluctuations in packaging materials and pharmaceutical-grade components.

- Regulatory Costs: Certification and compliance expenses can impact unit prices.

- Market Competition: Increased competition typically compresses margins, driving prices downward.

- Innovation and Differentiation: Introduction of enhanced formulations with added features can command premium pricing.

Future Price Projections (2023-2028)

Based on current trends and projected industry developments, the following are anticipated:

- Moderate Price Stabilization: Existing products are likely to maintain current price ranges with minimal fluctuations.

- Premium Segment Growth: Innovative formulations with improved safety or efficacy could see a 5-8% annual increase.

- Price Compression in Mature Markets: Competition may suppress prices by approximately 3-5% annually in highly saturated regions.

The overall trend indicates gradual depreciation in unit prices driven by commoditization, counterbalanced by strategic premium offerings. These factors suggest an average price per unit of USD 10-17 regionally by 2028.

Regulatory and Market Dynamics Impacting Pricing

Regulatory Harmonization

International guidelines, such as those from the FDA and EMA, influence manufacturing standards, affecting production costs and, consequently, the final product pricing. Stricter registration requirements may initially elevate prices but could foster consumer trust and justify premium positioning.

Reimbursement Policies

In regions with universal healthcare, reimbursement schemes can stabilize prices, but variability across nations influences retail pricing. The adoption of clear reimbursement pathways benefits market stability and predictable pricing.

Supply Chain Evolution

Supply chain optimization, including sourcing and logistics, rapidly affects costs. Companies adopting integrated supply chain management are positioned to offer competitive pricing.

Strategic Considerations for Industry Stakeholders

- Investment in R&D: Developing formulations with enhanced safety, convenience, and patient compliance arguments can justify premium pricing.

- Market Expansion: Entering emerging markets with unmet needs offers growth opportunities, albeit with competitive pricing strategies.

- Partnerships and Alliances: Collaborations with healthcare providers and regulators facilitate market penetration and influence pricing strategies.

- Brand Positioning: Building trust through quality assurance and safety reputation supports premium pricing, even in cost-sensitive markets.

Key Takeaways

- Growing Demand: The global enema market, particularly prefilled ready-to-use products like QC ENEMA READY TO USE, is set for sustained growth driven by demographic trends and patient preferences.

- Pricing Stability with Segment Differentiation: While general prices are expected to stabilize, innovative, safety-enhanced formulations can command higher margins.

- Competitive Dynamics and Market Entry: Fragmented landscape provides opportunities for new entrants but necessitates compliance with strict regulatory standards and strategic positioning.

- Impact of Regulation and Reimbursement: Harmonized standards and supportive reimbursement policies can maintain or elevate pricing levels.

- Future Pricing Outlook: Expect a gradual decline in average unit prices due to commoditization, with select premium products maintaining higher prices through differentiation.

FAQs

1. What is the primary market driver for QC ENEMA READY TO USE?

The main driver is the increasing prevalence of gastrointestinal conditions, particularly constipation, and the growing demand for convenient, ready-to-use enema products that ensure hygiene and ease of administration.

2. How will regulatory changes influence the pricing of QC ENEMA READY TO USE?

Stringent regulatory standards may initially increase manufacturing costs but can lead to higher consumer trust and allow for premium pricing strategies, especially for formulations with enhanced safety and efficacy.

3. Are there regional differences impacting pricing strategies for QC ENEMA READY TO USE?

Yes. Developed regions such as North America and Europe tend to have higher prices due to regulatory requirements and healthcare reimbursement schemes, whereas emerging markets focus on affordability, leading to lower prices.

4. What is the forecast for prices of QC ENEMA READY TO USE over the next five years?

Prices are expected to largely stabilize globally, with incremental increases for premium formulations. In mature markets, downward pressure may reduce prices by 3-5% annually, whereas innovative products could sustain higher price points.

5. How can companies capitalize on market trends for enema products?

By investing in R&D for formulations that address safety and patient compliance, establishing strategic partnerships, navigating regulatory pathways efficiently, and positioning products within targeted markets, companies can strengthen their market presence and optimize profitability.

References

[1] Grand View Research. Enema Market Size, Share & Trends Analysis Report, 2022-2030.

More… ↓