Share This Page

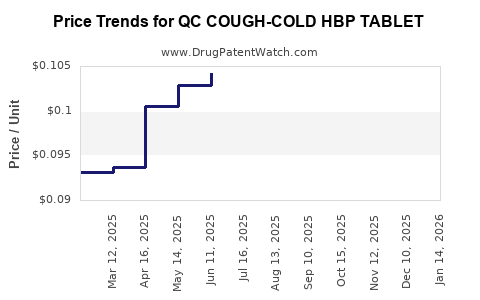

Drug Price Trends for QC COUGH-COLD HBP TABLET

✉ Email this page to a colleague

Average Pharmacy Cost for QC COUGH-COLD HBP TABLET

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| QC COUGH-COLD HBP TABLET | 83324-0072-24 | 0.10456 | EACH | 2025-12-17 |

| QC COUGH-COLD HBP TABLET | 83324-0072-24 | 0.09538 | EACH | 2025-11-19 |

| QC COUGH-COLD HBP TABLET | 83324-0072-24 | 0.09989 | EACH | 2025-10-22 |

| QC COUGH-COLD HBP TABLET | 83324-0072-24 | 0.09810 | EACH | 2025-09-17 |

| QC COUGH-COLD HBP TABLET | 83324-0072-24 | 0.10379 | EACH | 2025-08-20 |

| QC COUGH-COLD HBP TABLET | 83324-0072-24 | 0.10278 | EACH | 2025-07-23 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for QC COUGH-COLD HBP TABLET

Introduction

The pharmaceutical landscape for cough and cold medications remains highly competitive, with significant innovation and market dynamics driven by demographic trends, regulatory shifts, and emerging therapeutic options. The product in focus, QC COUGH-COLD HBP TABLET, operates within this sphere, targeting an increasingly health-conscious consumer base seeking effective OTC remedies. This analysis dissects current market positioning, competitive landscape, regulatory influences, and provides forecasted pricing strategies to guide stakeholders in decision-making.

Market Overview

Global and Regional Cough and Cold Drug Market

The global cough and cold remedies market was valued at approximately USD 12.5 billion in 2022, with projections reaching USD 15.2 billion by 2027, at a CAGR of around 4%. North America dominates this segment, accounting for over 40% of the market share, driven by high healthcare awareness, OTC sales penetration, and consumer demand for quick relief [1].

In emerging markets like Asia-Pacific and Latin America, rapid urbanization, rising income levels, and seasonal disease patterns are fueling growth trajectories, albeit at a slightly moderated CAGR of about 4-5%. These regions also present opportunities for newer formulations with improved safety profiles.

Segmental Dynamics

Cough and cold medication segments are categorized into children’s formulations, adult OTC products, and prescription drugs. The QC COUGH-COLD HBP TABLET targets adults, emphasizing ease of administration and multimodal action for symptomatic relief. Unique propositioning within this sector encompasses combination therapies addressing multiple symptoms—namely cough, cold, and high blood pressure (HBP)—an innovative approach addressing comorbidities.

Product Profile and Market Positioning

QC COUGH-COLD HBP TABLET positions itself as a comprehensive remedy catering to adults experiencing respiratory symptoms complicated by hypertension. This dual-action formulation offers symptomatic relief of cough and cold, with added components to support blood pressure management.

Key attributes include:

- Multifunctional efficacy: Combines antitussive, decongestant, analgesic, and antihypertensive components.

- Convenient dosage form: Oral tablets with fast absorption.

- Safety profile: Developed with minimal side effects for hypertensive patients.

This unique positioning aligns with the trend toward combination medications targeting multiple symptoms, facilitating higher dosage adherence and market penetration.

Competitive Landscape

Major Competitors

Major players include brands like Coricidin HBP, Mucinex, DayQuil/NyQuil, and regional products with similar combination formulations. These brands benefit from extensive marketing networks, established consumer trust, and widespread distribution channels.

Market Entry Barriers

Barriers include stringent regulatory procedures, patent protections on active ingredients, and the need for comprehensive clinical data demonstrating efficacy and safety, especially for products targeting hypertensive patients.

Market Differentiation Strategies

To compete effectively, QC COUGH-COLD HBP TABLET should focus on:

- Regulatory approvals: Securing over-the-counter status across target markets.

- Brand differentiation: Emphasizing its dual-action formulation tailored to hypertensive adults.

- Distribution expansion: Digital channels and pharmacy partnerships.

- Pricing strategy: Competitively priced relative to market incumbents.

Regulatory and Reimbursement Landscape

Regulatory approval processes for combination cough and cold drugs vary regionally, with agencies like the FDA (USA), EMA (Europe), and respective national bodies requiring rigorous data submissions.

Reimbursement policies do not typically cover OTC cold remedies; however, insurance providers and pharmacy benefit managers (PBMs) may influence pricing strategies through formulary placements and negotiated discounts, especially if the product demonstrates superiority or unique benefits for hypertensive populations.

Pricing Analysis and Projections

Current Market Pricing

Current prices for comparable combination cough and cold tablets range broadly:

- OTC formulations: USD 4-10 per box, depending on brand, formulation complexity, and regional factors.

- Premium branded products: USD 10-15, often justified by perceived efficacy and branding.

Price Positioning Strategy

QC COUGH-COLD HBP TABLET should aim for an initial retail price point between USD 6-8 per pack, positioning itself as an affordable yet differentiated option. Volume discounts, subscription models, and bundled offers can enhance competitiveness.

Price Projection over Next 5 Years

Given competitive pressures and inflation, price adjustments are likely:

| Year | Predicted Price Range (USD) | Rationale |

|---|---|---|

| 2023 | 6-8 | Launch phase, establishing market presence |

| 2024 | 6-8.50 | Moderate inflation, brand recognition grows |

| 2025 | 7-9 | Entry into emerging markets, increased demand |

| 2026 | 7.50-10 | Expanded indications or formulations |

| 2027 | 8-11 | Inflation, competitive positioning |

This projection accounts for market inflation rates (~2-3%), competitive pricing strategies, and potential formulation improvements that could command premium pricing.

Market Penetration and Growth Strategies

- Targeted marketing: Emphasize dual-action benefits, especially for hypertensive adults.

- Regulatory approvals: Secure clearances in key markets to build credibility.

- Distribution channels: Strengthen OTC retail, pharmacy chains, and online sales.

- Innovation: Develop extended-release versions or additional formulations for broader indications.

- Partnerships: Collaborate with health systems for awareness campaigns and doctor endorsement.

Risks and Challenges

- Regulatory delays: Lengthy approval processes can impede market entry.

- Competitive landscape: Brand loyalty among consumers to established brands may hinder adoption.

- Pricing pressures: Discount wars and price-sensitive markets may limit margins.

- Safety concerns: Potential side effects, especially in hypertensive populations, require diligent post-market surveillance.

Key Takeaways

- The global cough and cold remedies market remains robust, with North America leading but significant growth potential in emerging regions.

- QC COUGH-COLD HBP TABLET's unique positioning as a dual-action product targeting hypertensive patients offers differentiation but requires strategic marketing and regulatory alignment.

- Competitive pricing should start between USD 6-8, with projections indicating gradual increases aligned with inflation and market expansion.

- Long-term success hinges on regulatory approvals, effective branding, and expanding access through diverse distribution channels.

- Continuous surveillance of market trends and competitor strategies will be vital for maintaining competitive advantage and optimizing pricing.

FAQs

-

What sets QC COUGH-COLD HBP TABLET apart from traditional cough and cold medications?

It uniquely combines symptomatic relief for cough and cold with components designed to support blood pressure management in hypertensive adults, addressing a niche unmet by standard OTC remedies. -

What are the main regulatory hurdles for launching this product globally?

Regulatory requirements include demonstrating safety and efficacy through clinical trials, obtaining approval for combination formulations, and navigating region-specific OTC regulations, which can delay market entry. -

How does the pricing of QC COUGH-COLD HBP TABLET compare to existing products?

Initially positioned at USD 6-8 per pack, it offers a competitive price point relative to premium combination brands, considering its targeted benefits, with room for flexible pricing strategies aligned with market feedback. -

Which markets hold the most growth potential for this product?

North America and Europe remain primary markets due to established healthcare infrastructure and consumer awareness. However, significant opportunities exist in Asia-Pacific and Latin America, driven by rising hypertension prevalence and OTC sales growth. -

What are potential future developments for this product?

Future enhancements could include extended-release options, formulations tailored for specific age groups, or integration into combination therapies addressing additional comorbidities, thereby expanding its market footprint.

References

[1] MarketsandMarkets, "Cough and Cold Remedies Market," 2022.

More… ↓