Share This Page

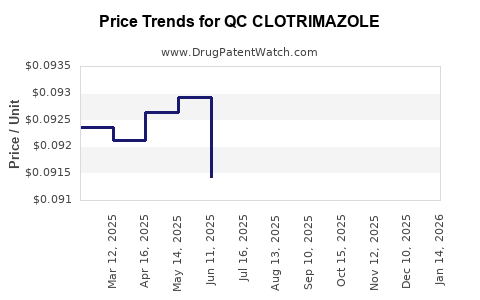

Drug Price Trends for QC CLOTRIMAZOLE

✉ Email this page to a colleague

Average Pharmacy Cost for QC CLOTRIMAZOLE

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| QC CLOTRIMAZOLE 1% VAG CREAM | 83324-0154-15 | 0.08742 | GM | 2025-12-17 |

| QC CLOTRIMAZOLE 1% VAG CREAM | 83324-0154-15 | 0.08644 | GM | 2025-11-19 |

| QC CLOTRIMAZOLE 1% VAG CREAM | 83324-0154-15 | 0.08691 | GM | 2025-10-22 |

| QC CLOTRIMAZOLE 1% VAG CREAM | 83324-0154-15 | 0.08658 | GM | 2025-09-17 |

| QC CLOTRIMAZOLE 1% VAG CREAM | 83324-0154-15 | 0.08776 | GM | 2025-08-20 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for QC Clotrimazole

Introduction

Clotrimazole, a broad-spectrum antifungal agent primarily used to treat fungal infections such as athlete's foot, yeast infections, and ringworm, operates within a well-established pharmaceutical market. The emergence of QC Clotrimazole, a proprietary formulation or a new-entry branded variant, warrants a comprehensive market analysis. This report examines current market dynamics, competitive landscape, regulatory environment, and projects future pricing trends for QC Clotrimazole over the next five years.

Market Overview

Global Market Landscape

The global antifungal drugs market was valued at approximately USD 12.8 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 4.2% through 2030, driven by rising prevalence of fungal infections, increasing awareness, and expanding healthcare infrastructure in emerging markets [1].

Clotrimazole remains among the top OTC antifungal medications, especially in developing regions where accessibility and affordability are pivotal. The existing market leaders include brands like Lotrimin and Canesten, with significant generic competition. The incorporation of QC Clotrimazole into this landscape influences regional pricing and market share dynamics.

Segment Analysis

- OTC Segment: Dominant in developed and developing markets owing to ease of access.

- Prescription Segment: Gaining importance with formulation improvements and combination therapies.

- Formulation Types: Creams, topical solutions, vaginal tablets, and lozenges. Cream formulation accounts for approximately 60% of sales.

Key Market Drivers

- Rising Incidence of Fungal Conditions: Factors such as immunosuppression, diabetes, and antibiotic use increase population susceptibility.

- Growing Geriatric Population: Older adults tend to have a higher prevalence of fungal infections.

- Increased Healthcare Access: Emerging economies expanding healthcare infrastructure facilitate drug availability.

- Product Innovation: Development of novel formulations enhances therapeutic efficacy and patient compliance.

Competitive Landscape and Key Players

Market Competition

The market is highly fragmented with multiple generic manufacturers and some branded players. Key companies include Bayer, Johnson & Johnson, Novartis, and Mylan, among others. The introduction of QC Clotrimazole, whether as a generic or branded product, influences competition intensity.

Perceived Differentiation of QC Clotrimazole

- Formulation Efficacy: If QC Clotrimazole offers improved bioavailability or reduced side effects, it could command premium pricing.

- Regulatory Approvals: Approval status across jurisdictions impacts marketability.

- Manufacturing Quality: High-quality manufacturing standards (e.g., GMP compliance) bolster brand reputation.

- Marketing Strategies: Focused awareness campaigns and healthcare provider education influence product uptake.

Regulatory Environment

Regulations governing antifungal medications vary globally. In the US, FDA approval is mandatory for prescription products; OTC formulations require compliance with labeling and safety standards. In Europe, EMA guidelines apply. Emerging markets often have expedited processes or reliance on established safety data for generic entry.

The regulatory status of QC Clotrimazole critically affects market penetration and pricing potentials.

Pricing Trends and Projections

Current Pricing Dynamics

In developed markets, retail prices for clotrimazole creams range between USD 8-15 per tube (30g), with generic products generally priced lower (USD 4-8). Branded products command premium prices due to perceived quality and marketing.

In developing markets, prices are significantly lower (USD 2-4), often driven by local manufacturing and competition.

Factors Influencing Future Pricing

- Regulatory Approvals: Broader approval expands market access, potentially stabilizing or reducing prices due to increased competition.

- Market Penetration: Higher sales volumes may offset lower unit prices.

- Manufacturing Costs: Advances in production technology can decrease costs, influencing retail prices.

- Demand-Fluctuating Factors: Rising infection rates and healthcare awareness sustain demand, supporting stable or increasing prices.

Projected Price Trends (2023–2028)

| Year | Developed Markets (USD/tube) | Emerging Markets (USD/tube) | Commentary |

|---|---|---|---|

| 2023 | 10-15 | 3-6 | Stable, with minor price adjustments |

| 2024 | 9-14 | 3-5 | Slight reductions due to increased competition |

| 2025 | 8-13 | 3-4 | Market penetration deepens, prices stabilize |

| 2026 | 8-12 | 3-4 | Price plateau, driven by generic competition |

| 2027 | 8-11 | 2-4 | Innovation-driven premium pricing declines when generics dominate |

| 2028 | 7-10 | 2-3 | Price erosion continues, barring new formulations |

These projections assume the entry of QC Clotrimazole as a generic with comparable efficacy, regulated in major markets, and assumes no major disruptions such as patent litigations or supply chain constraints.

Key Market Risks and Opportunities

Risks:

- Regulatory Delays: Slower approval processes can delay market entry, impacting revenues.

- Pricing Pressures: Entry of competitors or falling demand may compress margins.

- Patent Challenges: Patent disputes could affect exclusivity and pricing power.

Opportunities:

- Differentiated Formulations: Developing enhanced delivery systems or combination therapies can command premium pricing.

- Expansion in Emerging Markets: Strategic alliances and manufacturing localizations can facilitate access and competitive pricing.

- Digital Marketing: Leveraging e-commerce and telemedicine increases accessibility and brand visibility.

Conclusion

The introduction of QC Clotrimazole into the existing antifungal market will navigate a landscape characterized by high generic competition, price sensitivity, and regulatory nuances. Price projections indicate a trend toward stabilization with gradual declines, especially in mature markets. Strategic positioning—whether emphasizing formulation improvements, regulatory advantages, or cost leadership—will define market success.

Key Takeaways

- The global antifungal market remains robust, with steady growth driven by increasing fungal infections and healthcare awareness.

- QC Clotrimazole’s market success hinges on regulatory approval, formulation differentiation, and competitive pricing strategies.

- Price projections over five years suggest a gradual decrease, influenced by generic competition and market maturation.

- Expanding into emerging markets offers significant growth opportunities with favorable pricing dynamics.

- Innovation in formulations and strategic alliances are vital to maintaining profitability amidst price pressures.

FAQs

1. How does QC Clotrimazole differ from existing formulations?

If QC Clotrimazole offers superior bioavailability, reduced side effects, or novel delivery systems, it can differentiate itself in efficacy and patient compliance, justifying premium pricing and market share growth.

2. What regulatory hurdles could impact QC Clotrimazole’s market entry?

Depending on the target markets, regulatory approval processes such as FDA, EMA, or local agencies could delay launch or restrict access. Stringent safety and efficacy data submissions are essential.

3. How competitive is the price point for QC Clotrimazole?

In mature markets, generic formulations sell for USD 4-8 per tube, setting a price benchmark. Premium formulations may command higher prices, but market penetration depends on perceived value and brand trust.

4. What are the key growth regions for QC Clotrimazole?

Emerging economies in Asia, Africa, and Latin America present lucrative opportunities owing to rising infection rates, increasing healthcare access, and market liberalization.

5. What factors could influence the price trend of QC Clotrimazole in the next five years?

Regulatory approval speed, patent status, competitive launches, formulation innovations, and overall demand dynamics are critical factors shaping future prices.

References

[1] Market Research Future, “Global Antifungal Drugs Market Forecast,” 2022.

More… ↓