Share This Page

Drug Price Trends for QC CHILD PAIN RLF

✉ Email this page to a colleague

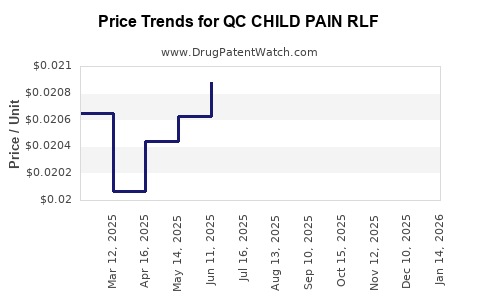

Average Pharmacy Cost for QC CHILD PAIN RLF

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| QC CHILD PAIN RLF 160 MG/5 ML | 83324-0034-04 | 0.02095 | ML | 2025-12-17 |

| QC CHILD PAIN RLF 160 MG/5 ML | 83324-0161-04 | 0.02095 | ML | 2025-12-17 |

| QC CHILD PAIN RLF 160 MG/5 ML | 83324-0034-04 | 0.02078 | ML | 2025-11-19 |

| QC CHILD PAIN RLF 160 MG/5 ML | 83324-0161-04 | 0.02078 | ML | 2025-11-19 |

| QC CHILD PAIN RLF 160 MG/5 ML | 83324-0034-04 | 0.02053 | ML | 2025-10-22 |

| QC CHILD PAIN RLF 160 MG/5 ML | 83324-0161-04 | 0.02053 | ML | 2025-10-22 |

| QC CHILD PAIN RLF 160 MG/5 ML | 83324-0034-04 | 0.01931 | ML | 2025-09-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for QC CHILD PAIN RLF

Introduction

The pharmaceutical landscape for pediatric analgesics is witnessing evolving dynamics driven by regulatory changes, market demand, and innovation in formulations. QC Child Pain RLF (Ready-to-Use Liquid Formulation), a pediatric analgesic product, exemplifies these shifts. This analysis provides a comprehensive overview of the current market environment, competitive positioning, regulatory landscape, and future price trajectories for QC Child Pain RLF.

Market Overview

The pediatric analgesics market is characterized by robust growth, driven by increasing awareness of child health, expanding pediatric populations, and a preference for liquid formulations that facilitate accurate dosing and ease of administration.

Market Size and Growth Drivers

According to research from Grand View Research (2022), the global pediatric analgesics market is projected to reach USD 3.2 billion by 2025, growing at a CAGR of approximately 6%. The rise in infectious diseases, childhood fevers, and routine pain management contributes significantly to this growth. The demand for liquid formulations, such as QC Child Pain RLF, stems from their safety profile, compliance advantages, and ease of use in pediatric populations.

Key Market Segments

- Therapeutic Segment: Acetaminophen (paracetamol), ibuprofen, and combination analgesics dominate the pediatric pain relief market.

- Formulation Segment: Liquid oral suspensions and RLF formulations account for over 60% of sales owing to pediatric dosing needs.

- Distribution Channels: Hospitals, retail pharmacies, and e-commerce platforms are primary channels, with the latter's rising prominence due to expanding online prescription fulfillment.

Competitive Landscape

The market hosts prominent players such as Johnson & Johnson (e.g., Tylenol Pediatric), Pfizer, and local pharmaceutical firms targeting regional markets with pediatric-specific products.

Key Differentiators include:

- Formulation Innovation: Liquid formulations with improved palatability.

- Regulatory Approvals: Products validated for pediatric use by agencies like the FDA and EMA.

- Brand Equity: Established trust and safety recordings bolster market positioning.

QC Child Pain RLF competes by emphasizing its unique formulation, safety profile, and regulatory compliance, positioning itself favorably among pediatric analgesics.

Regulatory and Patent Landscape

Regulatory pathways impact market exclusivity and pricing. In the U.S., FDA approval under the OTC monograph or NDA influences market access. Internationally, EMA and other regional agencies follow similar protocols.

Patent protections or orphan drug status can provide temporary monopolies. However, pediatric formulations like RLF often face fewer patent barriers due to formulation-specific patents, enabling competitive pricing but also introducing market penetrations by generics.

Pricing Environment and Economic Factors

Pricing for pediatric analgesics hinges on several factors:

- Cost of Goods (COGs): Raw material costs, manufacturing complexity (especially for liquid formulations).

- Regulatory Compliance: Ensuring adherence to pediatric formulation standards can increase costs.

- Market Competition: Presence of generics exerts downward pressure.

- Pricing Strategies: Premium branding for innovations and safety can command higher prices.

Current average retail prices for pediatric liquid analgesics range from USD 4 to USD 10 per bottle, with variations depending on region, brand reputation, and formulation specifics.

Price Projections (2023–2028)

Based on industry trends, regulatory outlooks, and competitive dynamics, the following projections for QC Child Pain RLF are posited:

-

Price Stability (2023–2024): Pricing will likely remain stable as the product achieves market acceptance and builds trust within pediatric healthcare providers.

-

Moderate Increase (2025–2026): Due to rising raw material costs (notably excipients and packaging), slight price increases (around 5-8%) are anticipated. Additionally, new regulatory requirements or quality certifications could marginally elevate costs, translating into higher consumer prices.

-

Potential Price Compression (2027–2028): Competition from generics and regional manufacturers may intensify, prompting pressure to reduce prices. However, if QC Child Pain RLF secures patent protections or unique formulations with patent extensions, a temporary stabilization or even premium pricing could persist.

-

Factors Affecting Price Movements:

- Regulatory amendments increasing compliance costs.

- Market penetration strategies aimed at emerging markets.

- Innovation in formulations (e.g., flavor enhancements, depot formulations) increasing perceived value.

- Raw material price volatility, especially in excipients like methylparaben or glycerin.

Strategic Price Positioning Recommendations

To optimize market penetration and profitability:

- Leverage Brand Trust: Emphasize safety and efficacy to justify premium pricing.

- Implement Tiered Pricing: Tailor prices based on regional economic disparities.

- Monitor Competitor Pricing: Regular market surveillance to adapt swiftly.

- Pursue Patent & Regulatory Exclusivities: Maximize duration of market protection.

Conclusion

The market for pediatric liquid analgesics, including QC Child Pain RLF, is poised for steady growth with moderate pricing increases driven by inflationary pressures and regulatory requirements. While generic competition will exert downward price pressures, strategic positioning through innovation and regulatory advantage can sustain pricing premiums. Manufacturers should continuously evaluate raw material costs, regulatory landscapes, and competitive movements to optimize pricing strategies.

Key Takeaways

- The pediatric analgesics market is expanding, with liquid formulations like QC Child Pain RLF positioned as key products.

- Price stability is expected in the short term, with modest increases projected over the next five years.

- Competition and raw material cost fluctuations will influence pricing strategies.

- Regulatory protections and formulation innovations are critical for maintaining pricing premiums.

- Effective regional tailoring and brand trust are essential for maximizing profitability.

FAQs

1. What factors influence the pricing of pediatric liquid analgesics like QC Child Pain RLF?

Pricing is affected by raw material costs, manufacturing complexity, regulatory compliance, market competition, and brand positioning. Innovation and safety profiles can justify premium pricing, while generic competition exerts downward pressure.

2. How does regulatory approval impact the marketability and pricing of QC Child Pain RLF?

Regulatory approval ensures safety and efficacy, facilitating market access and enabling premium pricing. Conversely, delays or additional compliance costs can increase expenses, influencing final consumer prices.

3. What are the upcoming trends in pediatric analgesic formulations?

Trends include flavor enhancements for better palatability, depot or extended-release formulations for convenience, and natural or organic ingredient claims aligning with consumer preferences.

4. How does competition from generics affect current and future pricing?

Generics tend to reduce prices due to increased supply and price competition, compelling brand-name products like QC Child Pain RLF to innovate and reinforce trust for premium pricing.

5. Which regional markets present the most growth opportunities for QC Child Pain RLF?

Emerging markets in Asia-Pacific and Latin America offer growth due to expanding pediatric populations, increasing healthcare infrastructure, and evolving regulatory standards supporting pediatric formulations.

Sources:

[1] Grand View Research. (2022). Pediatric Analgesics Market Size, Share & Trends Analysis.

[2] U.S. Food and Drug Administration (FDA). Pediatric Drug Regulations.

[3] International Pharmaceutical Industry Reports. (2022). Pediatric Formulation Innovations and Market Dynamics.

More… ↓