Share This Page

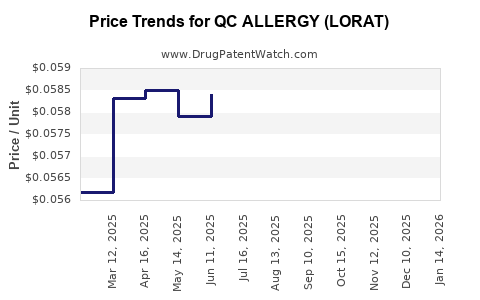

Drug Price Trends for QC ALLERGY (LORAT)

✉ Email this page to a colleague

Average Pharmacy Cost for QC ALLERGY (LORAT)

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| QC ALLERGY (LORAT) 10 MG TAB | 83324-0150-01 | 0.05535 | EACH | 2025-12-17 |

| QC ALLERGY (LORAT) 10 MG TAB | 83324-0146-30 | 0.05535 | EACH | 2025-12-17 |

| QC ALLERGY (LORAT) 10 MG TAB | 83324-0147-10 | 0.05535 | EACH | 2025-12-17 |

| QC ALLERGY (LORAT) 10 MG TAB | 83324-0150-01 | 0.05642 | EACH | 2025-11-19 |

| QC ALLERGY (LORAT) 10 MG TAB | 83324-0146-30 | 0.05642 | EACH | 2025-11-19 |

| QC ALLERGY (LORAT) 10 MG TAB | 83324-0147-10 | 0.05642 | EACH | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for QC ALLERGY (LORAT)

Introduction

QC ALLERGY (Loratadine), a widely used antihistamine, addresses allergic rhinitis and chronic urticaria. As a second-generation non-sedating antihistamine, Loratadine benefits from a well-established market, supported by extensive clinical data, regulatory approvals, and broad consumer acceptance. This analysis evaluates current market dynamics, competitive landscape, regulatory factors, and future pricing trajectories for QC ALLERGY (LORAT), providing actionable insights for stakeholders.

Market Landscape for Loratadine

Global and Regional Market Size

The global antihistamine market, valued at approximately USD 4.1 billion in 2022, is projected to grow at a CAGR of approximately 5-6% through 2030 [1]. This growth reflects increasing prevalence of allergic diseases, rising awareness, and expanding healthcare infrastructure.

The Loratadine segment dominates a significant share due to its safety profile, OTC availability, and favorable patient compliance. North America and Europe remain key markets, accounting for over 70% of sales, driven by high disease burden and mature healthcare ecosystems. Asia-Pacific is emerging rapidly, propelled by urbanization, environmental factors, and expanding healthcare access.

Competitive Landscape

Major competitors for QC ALLERGY include:

- Clarityne (Schering-Plough/AbbVie)

- Alavert (McNeil)

- Generic Loratadine products from multiple manufacturers, both branded and unbranded.

The competitive advantages of QC ALLERGY hinge on formulation stability, bioavailability, and brand recognition, which influence market penetration.

Regulatory Environment

Regulatory approval in key jurisdictions such as the U.S. (FDA), European Union (EMA), and China influences market access and pricing strategies. Patent status and exclusivity periods significantly impact pricing power. The expiration of patents for many Loratadine formulations has increased generic competition, exerting downward pressure on prices.

Market Drivers and Challenges

Drivers

- Increasing prevalence of allergic rhinitis: Affects over 20% of the global population, indicating expanding demand.

- Shift towards OTC medications: Facilitates wider access and consumer-driven sales.

- Enhanced safety profile: Non-sedating, minimal systemic side effects bolster consumer preference.

Challenges

- Intense price competition: With numerous generics available, margins are compressed.

- Regulatory variances: Differing approval processes can delay market entry or expansion.

- Market saturation: Especially in mature regions, limiting growth potential.

Pricing Analysis and Projections

Current Pricing Dynamics

In established markets, Loratadine OTC products retail at approximately USD 0.10 - 0.25 per tablet, with variations based on brand, formulation, and region. Brand-name products like Clarityne or Alavert typically command premiums of 20-30% over generics due to brand recognition and perceived quality.

QC ALLERGY’s position as a branded product can influence initial pricing strategies, allowing for premium pricing, especially in markets valuing brand trust. However, with patent expiry and generic proliferation, sustainable premium margins are challenging.

Factors Influencing Future Price Trends

- Generic competition: Will continue exerting downward pressure on prices, especially in mature markets.

- Regulatory and reimbursement policies: Can either restrict or facilitate pricing.

- Market penetration strategies: Volume-driven approaches and formulary positioning impact average prices.

- Manufacturing efficiencies and scale: Larger production capacity can lower unit costs, enabling more competitive pricing.

Price Projection Outlook (2023-2030)

| Year | Price Range (per unit) | Key Assumptions | Comments |

|---|---|---|---|

| 2023 | USD 0.10 - 0.25 | Existing competition, patent loss in some markets | Price stabilization, slight declines |

| 2025 | USD 0.08 - 0.20 | Increased generic penetration | Margin compression, price convergence |

| 2027 | USD 0.07 - 0.18 | Market saturation in mature regions | Focus on volume, new markets entry |

| 2030 | USD 0.06 - 0.15 | Broader global adoption, biosimilar/generic surge | Potential further price declines |

Note: These projections assume typical generic price reductions and market dynamics without significant patent extensions or new formulations.

Strategic Insights for Stakeholders

- Brand Differentiation: Investing in formulation improvements, patient education, and brand recognition can justify premium pricing temporarily.

- Market Expansion: Penetration into emerging markets with increasing allergy burdens offers growth opportunities.

- Cost Optimization: Improving manufacturing efficiencies can sustain profitability amid declining prices.

- Regulatory Trends: Monitoring policies affecting patent status and reimbursement can influence pricing power.

Conclusion

The Loratadine market, exemplified by QC ALLERGY, faces a mature landscape dominated by generic competition, with prices trending downward over the coming years. While brand equity offers some advantage, sustainability depends on strategic differentiation, expansion into high-growth regions, and optimized cost structures. Stakeholders should prioritize innovative formulations, market diversification, and adaptive pricing strategies to maximize profitability.

Key Takeaways

- The global Loratadine market is large and growing, driven by rising allergy prevalence and OTC availability.

- Price erosion is inevitable given patent expirations and increased generic competition; prices are projected to decline by approximately 40-50% over the next decade.

- Strategic brand differentiation and expanding into emerging markets are vital for maintaining margins.

- Regulatory environments and reimbursement policies significantly influence pricing strategies.

- Cost efficiencies and volume strategies will be crucial to sustain profitability amidst declining prices.

Frequently Asked Questions

1. How does patent expiration impact QC ALLERGY’s pricing?

Patent expiration typically leads to increased generic competition, reducing the market exclusivity that allows for premium pricing. As generics flood the market, prices tend to decline, emphasizing the importance of brand differentiation and cost management.

2. Are biosimilars relevant in the Loratadine market?

Currently, biosimilars are not applicable to Loratadine, which is a small-molecule drug. The primary market competition stems from generics rather than biosimilars.

3. Which regions offer the highest growth potential for QC ALLERGY?

Emerging markets in Asia-Pacific and Latin America are promising due to increasing allergy prevalence, expanding healthcare access, and growing OTC drug acceptance.

4. What strategies can manufacturers employ to sustain profitability?

Focusing on cost efficiencies, expanding into new markets, enhancing formulations, and promoting brand loyalty can offset declining prices from generic competition.

5. How will regulatory changes influence future Loratadine prices?

Policies favoring biosimilar and generic entry, as well as reimbursement reforms, will likely intensify price competition, necessitating proactive compliance and strategic adjustments.

Sources

[1] Grand View Research, "Antihistamines Market Size & Share Analysis," 2022.

More… ↓