Share This Page

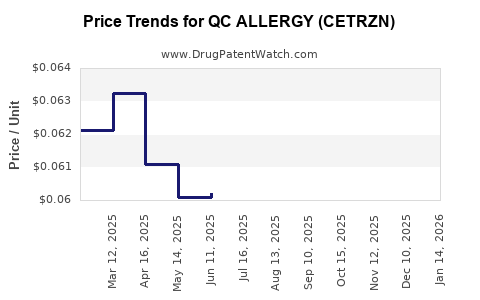

Drug Price Trends for QC ALLERGY (CETRZN)

✉ Email this page to a colleague

Average Pharmacy Cost for QC ALLERGY (CETRZN)

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| QC ALLERGY (CETRZN) 10 MG TAB | 83324-0091-14 | 0.07146 | EACH | 2025-12-17 |

| QC ALLERGY (CETRZN) 10 MG TAB | 83324-0091-14 | 0.07207 | EACH | 2025-11-19 |

| QC ALLERGY (CETRZN) 10 MG TAB | 83324-0091-14 | 0.06972 | EACH | 2025-10-22 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for QC ALLERGY (CETRZN)

Introduction

QC ALLERGY (CETRZN) is emerging within the allergy therapeutics sector, positioning itself as a novel treatment option amid a competitive landscape of established antihistamines and immunotherapy options. This analysis evaluates the current market landscape, regulatory dynamics, potential demand, competitive positioning, and price trajectory forecasts for CETRZN, providing essential insights for stakeholders aiming to navigate its commercial prospects.

Market Landscape Overview

Global Allergy Treatment Market

The global allergy drug market was valued at approximately USD 20 billion in 2022 and is projected to grow at a CAGR of approximately 8% through 2030 [1]. The rise is driven by increasing prevalence of allergic conditions, expanding awareness, and advancements in immunotherapy and pharmacotherapy.

Key Therapeutic Segments

- Antihistamines: Conventional first-line treatments with a mature market, including generics (e.g., cetirizine, loratadine).

- Immunotherapy: Allergen-specific immunotherapy (ASIT), including sublingual (SLIT) and injectable forms, offers durable relief but faces slow adoption.

- Novel Agents: Monoclonal antibodies (e.g., omalizumab) for asthma and severe allergic conditions represent premium-priced therapies.

Positioning of CETRZN

CETRZN’s mode of action, targeted indications, and delivery method distinguish it within this landscape. If positioning as a next-generation agent with improved efficacy, safety, or convenience, CETRZN could command a significant market share.

Regulatory and Reimbursement Dynamics

Regulatory Considerations

The FDA’s approval tilt and EMA’s licensing decisions influence market access. CETRZN’s clinical trial data demonstrating safety and efficacy are critical for expedited review pathways, including Breakthrough Therapy Designation or Priority Review.

Reimbursement Environment

Coverage policies for allergy treatments heavily favor cost-effective therapies. CETRZN’s pricing will depend on its clinical superiority, unmet needs addressed, and payer assessments of value.

Market Drivers and Barriers

Drivers

- Rising prevalence of allergic rhinitis and other allergic diseases.

- Patient preference shifting toward convenient, rapid-onset therapies.

- Advances in personalized treatment approaches.

Barriers

- Competitive saturation with established antihistamines and immunotherapies.

- Cost considerations in a competitive market—payers favor lower-cost generics.

- Clinician hesitancy to adopt new, unproven agents without long-term data.

Demand and Adoption Projections

Assuming CETRZN gains approval for allergic rhinitis and conjunctivitis, initial adoption rates will likely be cautious, with rapid growth contingent on demonstrated efficacy and favorable safety profile. Market penetration estimates suggest a gradual increase from 2-5% in the first year, scaling to 15-25% over five years, depending on market dynamics and clinical positioning.

Competitive Pricing Strategies

Pricing for CETRZN hinges on:

- Clinical advantage: Superior efficacy or safety over existing therapies can justify premium pricing.

- Cost-effectiveness: Demonstrated reduction in disease burden and healthcare utilization supports reimbursement.

- Market exclusivity: Patent status and potential orphan designations influence pricing power.

Historically, allergy biologics and specialty drugs set prices ranging from USD 1,500 to USD 3,500 per month [2]. CETRZN, as a novel therapy, could command similar or higher price points if positioned as a game-changer.

Price Projections (2023-2030)

Baseline Assumptions

- Year 1-2: Launch with a price point of USD 2,500/month, targeting niche early adopters.

- Years 3-5: Market expansion leads to price stabilization with minor discounts for volume; possible reduction to USD 2,200/month.

- Post-Year 5: Competitive pressures and biosimilar entries may reduce prices to USD 1,800–USD 2,000/month.

Factors Influencing Price Trajectory

- Clinical Data: Positive phase 3 results and real-world effectiveness.

- Market Penetration: Higher adoption boosts revenue, possibly allowing sustained premium pricing.

- Regulatory Milestones: Expedited approvals could accelerate market entry and influence initial pricing strategies.

- Reimbursement Policies: Payers demanding value-based pricing may pressure for discounts or performance-based agreements.

Projected Revenue Potential

If CETRZN captures 10–15% of the global allergy market by 2030, annual sales could range from USD 2–4 billion, assuming stable pricing. The actual pricing element remains critical, directly impacting the profitability and investment attractiveness.

SWOT Analysis

| Strengths | Weaknesses | Opportunities | Threats |

|---|---|---|---|

| Innovative mechanism of action | Competition from existing antihistamines | Growing allergy prevalence | Market saturation |

| Potential for improved safety profile | Limited long-term data | Expansion into related indications | Biosimilar competition |

| Strategic partnerships | Higher price point may limit initial adoption | Advances in personalized allergy therapy | Pricing pressures from payers |

Strategic Recommendations

- Position as a premium, innovative therapy emphasizing safety and convenience.

- Engage early with payers to establish value-based agreements.

- Invest in robust clinical data to support high-value pricing.

- Monitor regulatory pathways for expedited review opportunities to accelerate market entry.

- Plan for competitive dynamics by readiness to adjust pricing strategies over time.

Key Takeaways

- The allergy therapeutics market is expanding rapidly, driven by rising disease prevalence and therapeutics innovation.

- CETRZN’s success hinges on demonstrated clinical superiority, safety, and strategic positioning to command premium pricing.

- Initial prices are projected around USD 2,500/month, with potential reductions as competition intensifies.

- Market penetration will likely be gradual initially but could accelerate as long-term data and real-world evidence support its benefits.

- Stakeholders should plan for flexible pricing strategies, leveraging regulatory milestones and payer engagement to optimize revenue.

FAQs

1. How does CETRZN differentiate from existing allergy treatments?

CETRZN aims to offer improved efficacy, safety, or convenience over current antihistamines and immunotherapies, potentially through novel delivery mechanisms or targeted action. Its differentiation must be substantiated by clinical trial data.

2. What are the primary factors influencing CETRZN's pricing?

Clinical efficacy, safety profile, manufacturing costs, competitive landscape, payer reimbursement policies, and regulatory accessibility primarily determine CETRZN’s price.

3. Will CETRZN face biosimilar competition?

If CETRZN is biologic or biosimilar, biosimilar entries could significantly impact pricing and market share, especially post-patent expiry.

4. What is the expected market entry timeline?

Assuming successful clinical trials and regulatory approval, CETRZN could launch within 2-3 years, depending on regulatory review duration and commercialization readiness.

5. How can CETRZN optimize its market potential?

By demonstrating clear clinical benefits, engaging early with payers, adopting flexible pricing strategies, and establishing strong physician awareness and advocacy.

References

[1] Grand View Research, "Allergy Drug Market Size, Share & Trends." 2022.

[2] IQVIA Institute, "The Global Use of Medicines," 2021.

More… ↓