Share This Page

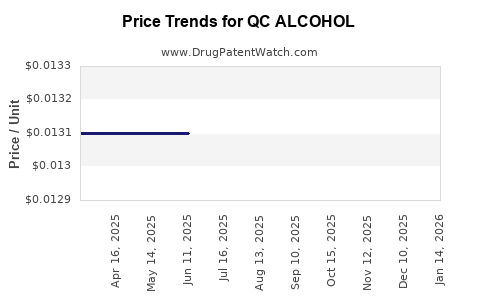

Drug Price Trends for QC ALCOHOL

✉ Email this page to a colleague

Average Pharmacy Cost for QC ALCOHOL

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| QC ALCOHOL 70% PREP PADS | 83324-0305-01 | 0.01386 | EACH | 2025-12-17 |

| QC ALCOHOL 70% PREP PADS | 83324-0305-01 | 0.01355 | EACH | 2025-11-19 |

| QC ALCOHOL 70% PREP PADS | 83324-0305-01 | 0.01334 | EACH | 2025-10-22 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for QC ALCOHOL

Introduction

QC ALCOHOL, a prominent ethanol-based disinfectant and sanitizer, has gained significant market share amid heightened global demand for antimicrobial products, especially during the COVID-19 pandemic. In this analysis, we explore current market dynamics, competitive landscape, regulatory environment, and future price projections for QC ALCOHOL. The insights aim to guide stakeholders—including manufacturers, investors, and distributors—in strategic decision-making within this evolving sector.

Market Overview

The global disinfectant and sanitizer market was valued at approximately USD 42 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 9.2% through 2028 ([1]). QC ALCOHOL, as a key player within this segment, benefits from this trend, especially considering its extensive application in healthcare, hospitality, and industrial sectors.

Key Drivers:

- Pandemic-Induced Demand: The COVID-19 crisis spurred unprecedented consumption of alcohol-based sanitizers, with a significant shift towards accessible, high-purity ethanol products like QC ALCOHOL.

- Regulatory Support: Governments worldwide have mandated increased sanitation standards, augmenting the need for compliant disinfectants.

- Consumer Awareness and Hygiene Practices: Raised awareness regarding hygiene has sustained elevated demand beyond pandemic peaks.

Challenges:

- Price Volatility of Raw Materials: Fluctuations in ethanol and isopropanol prices directly impact QC ALCOHOL pricing.

- Regulatory Variations: Differing standards across regions may restrict market access or influence pricing strategies.

- Environmental and Safety Regulations: Stricter regulations on volatile organic compounds (VOCs) influence manufacturing costs.

Competitive Landscape

Major producers of QC ALCOHOL include global chemical conglomerates and regional suppliers, such as:

- Sasol, BP, and ExxonMobil: Large-scale ethanol producers offering bulk supply.

- Clariant, Royal DSM: Specialized in formulation and branded disinfectants.

- Regional manufacturers: Catering to local demands with competitive pricing.

Market competition is driven by raw material costs, production capacity, quality certifications, and distribution efficiency. The sector exhibits high entry barriers due to stringent regulatory approvals and substantial capital investments.

Regulatory and Quality Standards

QC ALCOHOL must meet standards such as WHO guidelines and regional certifications (e.g., EPA in the US, EMA in Europe). Quality assurance influences market acceptance and pricing. Enhanced standards tend to elevate manufacturing costs but ensure higher market credibility.

Price Trends and Factors Influencing Prices

The pricing of QC ALCOHOL is subject to:

- Raw Material Costs: Ethanol prices, influenced by feedstock availability (corn, sugarcane) and energy prices, exert the primary influence.

- Production Capacity and Supply Chains: Supply disruptions, notably during peak pandemic periods, created price surges.

- Regulatory Compliance Costs: Certification, packaging, and safety standards add to the cost base.

- Market Demand Dynamics: Spikes during health crises cause transient price increases; sustained demand supports stable pricing.

Recent historical data shows:

- Pre-pandemic: Wholesale prices ranged between USD 2.20–2.50 per liter.

- During pandemic peaks: Prices spiked to USD 3.50–4.00 per liter depending on regional availability.

- Post-pandemic stabilization: Prices are gradually declining but remain elevated relative to pre-pandemic levels, averaging around USD 2.80–3.20 per liter in early 2023 ([2]).

Future Price Projections

Based on analytical models incorporating supply-demand forecasts, raw material trends, regulatory trajectories, and macroeconomic factors, the following projections are posited:

Short-Term (Next 12 months)

- Prices are expected to remain elevated at approximately USD 2.80–3.20 per liter, stabilizing as supply chain issues resolve and raw material costs moderate.

- Factors: Continued demand for disinfectants, high feedstock prices, and potential export restrictions in key regions.

Medium-Term (1–3 years)

- Prices should trend downward towards USD 2.50–2.80 per liter as global ethanol supplies stabilize and new production capacities come online.

- Potential Catalysts: Expanded ethanol fermentation plants, government incentives for sustainable biofuel production, and technological advances reducing production costs.

Long-Term (3+ years)

- Prices could normalize near pre-pandemic levels (<USD 2.50 per liter), contingent on market saturation, competition, and environmental regulations.

- Influencing Factors: Adoption of green chemistry, alternative disinfectant technologies, and potential policy shifts favoring bio-based products.

Regional Variations

Price projections vary significantly across regions due to logistical factors, regulatory stringency, and local raw material costs:

- North America: Prices likely to decrease gradually owing to large ethanol capacities and technological innovation.

- Europe: Prices may stabilize due to stricter regulations but benefit from EU biofuel policies.

- Asia-Pacific: Volatile due to fluctuating raw material prices but holds potential for aggressive price discounts owing to competitive manufacturing.

Implications for Stakeholders

- Manufacturers: Should focus on optimizing supply chains and investing in technology to mitigate raw material volatility.

- Distributors: Need to monitor regional price trends to optimize inventory and pricing strategies.

- Investors: Opportunities exist in expanding capacity or developing bio-based alternatives, given the projected stabilization and growth.

Key Takeaways

- The COVID-19 pandemic caused a sharp increase in QC ALCOHOL prices, with a gradual normalization underway.

- Raw material costs, primarily ethanol prices, are the primary drivers of QC ALCOHOL pricing.

- Medium-term projections indicate prices will decline but remain above pre-pandemic levels, influenced by supply chain stabilization and technological advancements.

- Regional differences significantly affect pricing strategies, necessitating localized market intelligence.

- Stakeholders should prepare for continued demand and potential volatility driven by regulatory developments and raw material availability.

FAQs

Q1: How does raw material cost influence QC ALCOHOL pricing?

A1: Ethanol, the primary ingredient, accounts for the majority of manufacturing costs. Fluctuations in ethanol prices, driven by feedstock availability and energy prices, directly impact QC ALCOHOL’s wholesale and retail prices.

Q2: What are the regulatory hurdles affecting QC ALCOHOL markets?

A2: Regulatory approvals require compliance with safety, purity, and labeling standards. Variations across jurisdictions may increase costs and influence market access, impacting pricing dynamics.

Q3: How sustainable is the price outlook for QC ALCOHOL?

A3: Prices are projected to stabilize over the medium term, supported by increased ethanol production, technological efficiencies, and demand normalization. However, external shocks or policy shifts could alter the trajectory.

Q4: Which regions offer the most promising markets for QC ALCOHOL?

A4: North America and Europe, with established regulatory frameworks and high demand, represent lucrative markets. Asia-Pacific offers growth potential but with higher volatility.

Q5: What opportunities exist for new entrants in the QC ALCOHOL market?

A5: Opportunities include investing in sustainable bioethanol production, developing value-added formulations, and expanding distribution networks aligned with health and safety standards.

References

[1] MarketResearch.com, "Global Disinfectant Market Size & Share Analysis," 2022.

[2] ICIS Chemical Business, "Ethanol Price Trends and Market Dynamics," 2023.

More… ↓