Share This Page

Drug Price Trends for QC ADULT TUSSIN CF LIQUID

✉ Email this page to a colleague

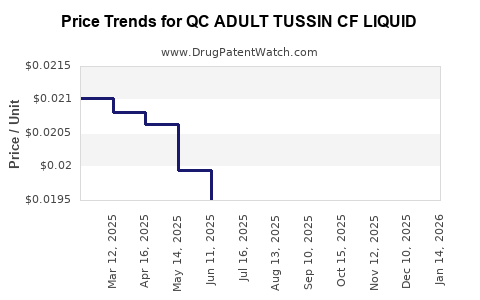

Average Pharmacy Cost for QC ADULT TUSSIN CF LIQUID

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| QC ADULT TUSSIN CF LIQUID | 83324-0155-04 | 0.01953 | ML | 2025-12-17 |

| QC ADULT TUSSIN CF LIQUID | 83324-0155-04 | 0.01944 | ML | 2025-11-19 |

| QC ADULT TUSSIN CF LIQUID | 83324-0155-04 | 0.01933 | ML | 2025-10-22 |

| QC ADULT TUSSIN CF LIQUID | 83324-0155-04 | 0.01940 | ML | 2025-09-17 |

| QC ADULT TUSSIN CF LIQUID | 83324-0155-04 | 0.01925 | ML | 2025-08-20 |

| QC ADULT TUSSIN CF LIQUID | 83324-0155-04 | 0.01922 | ML | 2025-07-23 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for QC ADULT TUSSIN CF LIQUID

Introduction

QC ADULT TUSSIN CF LIQUID, a notable over-the-counter (OTC) medication indicated for symptomatic relief of cough, congestion, and related respiratory issues, stands as a significant product within the cold and allergy segment. As consumer health preferences shift alongside regulatory trends, its market position, competitive landscape, and pricing strategies merit thorough examination. This analysis provides a comprehensive overview of current market dynamics, evaluates future pricing trajectories, and offers strategic insights for stakeholders.

Market Landscape

Product Overview and Therapeutic Indications

QC ADULT TUSSIN CF LIQUID combines expectorant (guaifenesin), decongestant (pseudoephedrine), and cough suppressant (dextromethorphan), addressing multi-symptom respiratory conditions common among adults. The liquid formulation offers ease of dosing, rapid absorption, and preferred compliance among consumers with swallowing difficulties.

Market Size and Demand Drivers

The global OTC cough and cold remedy market was valued at approximately USD 15 billion in 2022 [1], with North America accounting for a dominant share due to high healthcare awareness, OTC accessibility, and seasonal respiratory illness prevalence. The uprise in self-medication trends and pandemic-related health consciousness bolster demand for multi-symptom OTC products like QC ADULT TUSSIN CF.

Key demand drivers include:

- Increased incidence of respiratory infections due to seasonal variations.

- Consumer preference for combination therapies offering convenience.

- Growing aging population with chronic respiratory issues.

Competitive Landscape

The market features a broad array of OTC cough and cold products, including:

- Brand names: Robitussin (RTM), Mucinex, Delsym, and NyQuil.

- Private label/store brands: Offering competitive pricing.

- Alternatives: Natural remedies and homeopathic options.

QC ADULT TUSSIN CF LIQUID competes primarily on efficacy, formulation convenience, and trust in brand recognition. Its unique positioning involves a multi-symptom approach with a liquid format, appealing to adult consumers seeking rapid relief.

Regulatory Environment

OTC medications in the US are regulated by the Food and Drug Administration (FDA). The product must adhere to monograph standards, with strict controls on ingredients, labeling, and marketing. Recent trends emphasize transparency, safety, and limit the use of certain active ingredients amid concerns over misuse, notably pseudoephedrine’s regulation.

Pricing Dynamics

Current Price Point Analysis

As of 2023, typical retail pricing for QC ADULT TUSSIN CF LIQUID ranges from USD 8 to USD 12 per 4 fl oz bottle, depending on retail channel and geographic region. Online platforms tend to offer slightly discounted rates, sometimes below USD 8.50, driven by e-commerce competition.

Compared with branded competitors:

- Robitussin DM: USD 7–USD 11 for similar volume.

- Mucinex Multi-Symptom liquid: USD 10–USD 15 per bottle.

- Store brands: USD 6–USD 10, emphasizing price sensitivity within the OTC segment.

Factors Influencing Pricing Strategies

Price points are influenced by:

- Brand positioning: Established brands leverage perceived efficacy and trust, often maintaining premium pricing.

- Retail channel: Drugstores, supermarkets, online vendors exhibit varied pricing elasticity.

- Regulatory costs: Potential restrictions on pseudoephedrine sales may influence availability and thus, pricing.

- Supply chain stability: Ingredient procurement costs, manufacturing expenses, and distribution logistics impact retail pricing.

- Promotional campaigns: Discounts, bundling, and loyalty programs can temporarily alter price perceptions.

Market Trends Affecting Pricing

Emerging trends include:

- Generic and private label proliferation: increases price competition.

- Price discounts and value bundles: prevalent online and in big-box retail, pressuring premium brands.

- Regulatory constraints: Stricter pseudoephedrine controls could elevate production costs entailment, affecting retail prices.

Future Price Projections (2024-2028)

Given prevailing market dynamics and regulatory factors, the following price trends are anticipated:

Stability with Moderation

Short-term forecasts suggest minimal price fluctuation within the USD 8–USD 12 range, primarily due to established demand and moderate elasticity among adult OTC consumers. Manufacturers may adopt strategic promotions rather than significant price hikes to sustain market penetration.

Potential Incremental Increases

Between 2024 and 2026, incremental price increases of 3–5% could occur, driven by:

- Rising raw material costs, notably for active ingredients such as pseudoephedrine.

- Regulatory compliance expenses, including packaging, labeling, and distribution adjustments.

- Inflationary pressures affecting logistics and manufacturing.

Long-term Outlook (2027-2028)

The possibility of slight deflation or stabilization is plausible if:

- Increased generic competition diminishes brand premiums.

- Regulatory restrictions on pseudoephedrine sales tighten, fragmenting market channels.

- Consumer shift toward natural or alternative therapies gain traction, dampening demand and enabling price compression.

Conversely, if supply chain disruptions persist or formulation enhancements are introduced (e.g., added ingredients or improved bioavailability), prices could trend marginally upward, potentially reaching USD 13–USD 15 per bottle in premium retail outlets.

Strategic Implications for Stakeholders

- Manufacturers should monitor regulatory changes closely, as pseudoephedrine controls and safety regulations influence production costs and availability.

- Retailers need to balance competitive pricing with margin preservation, leveraging private labels and promotional strategies.

- Investors and analysts should approach the OTC respiratory segment with caution, considering patent expiries, regulatory shifts, and consumer preferences impacting future pricing.

- Developers of alternative or natural remedies might capitalize on the trend by offering lower-cost or differentiated therapies.

Key Takeaways

- QC ADULT TUSSIN CF LIQUID remains a vital product in the OTC respiratory market, favored for its multi-symptom relief in liquid form.

- Current retail pricing positions the product in a competitive range of USD 8–USD 12, with downward pressures from private labels and online competition.

- Market demand is reinforced by seasonal illness patterns, aging populations, and consumer preference for convenience.

- Future pricing is expected to experience modest growth aligned with inflation and ingredient costs, with a possibility of stabilization or slight reduction if market competition intensifies.

- Regulatory environment considerations, especially pseudoephedrine sales restrictions, will be critical for pricing and supply chain stability.

FAQs

-

How does the regulation of pseudoephedrine impact QC ADULT TUSSIN CF LIQUID pricing?

Pseudoephedrine’s regulatory controls, including purchase restrictions, can increase manufacturing and distribution costs, potentially leading to higher retail prices. Stricter controls may also reduce market availability, impacting supply and pricing stability. -

What are the main drivers behind the future price increases of OTC cough remedies like QC ADULT TUSSIN CF LIQUID?

Rising raw material costs, regulatory compliance expenses, inflation, and supply chain complexities are primary drivers. Market competition and consumer demand also influence pricing strategies. -

How does online retail affect the pricing of OTC medications like QC ADULT TUSSIN CF LIQUID?

E-commerce platforms often enable lower pricing through reduced overheads and promotional discounts, exerting price pressure on traditional brick-and-mortar channels. -

What competitive advantages does QC ADULT TUSSIN CF LIQUID hold?

Its multi-symptom formulation, liquid format for rapid absorption, and brand trust position it favorably. These factors justify premium pricing within its segment. -

Are there emerging alternatives that could disrupt the market for products like QC ADULT TUSSIN CF LIQUID?

Natural remedies, herbal supplements, and new formulations offering targeted or holistic approaches are gaining popularity, potentially impacting demand and pricing structures in the future.

References

[1] MarketWatch, 2022. "Over-the-Counter (OTC) Cough and Cold Remedies Market Size, Share & Trends Analysis."

More… ↓