Share This Page

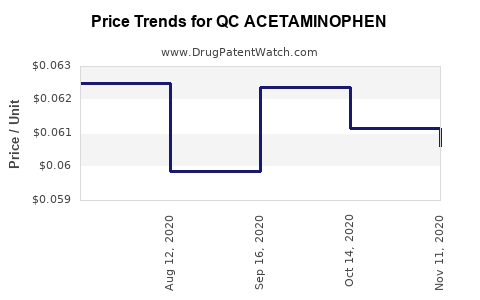

Drug Price Trends for QC ACETAMINOPHEN

✉ Email this page to a colleague

Average Pharmacy Cost for QC ACETAMINOPHEN

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| QC ACETAMINOPHEN PM GELCAP | 83324-0070-20 | 0.04666 | EACH | 2025-12-17 |

| QC ACETAMINOPHEN PM GELCAP | 83324-0070-20 | 0.04526 | EACH | 2025-11-19 |

| QC ACETAMINOPHEN PM GELCAP | 83324-0070-20 | 0.04637 | EACH | 2025-10-22 |

| QC ACETAMINOPHEN PM GELCAP | 83324-0070-20 | 0.04703 | EACH | 2025-09-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for QC Acetaminophen

Introduction

Acetaminophen, known internationally as paracetamol, is a widely utilized analgesic and antipyretic agent with a well-established role in pain management and fever reduction. The emergence of QC Acetaminophen marks a notable advancement in pharmaceutical formulations—particularly focusing on sustained-release mechanisms or multi-ingredient combination therapies—that aim to enhance efficacy, patient compliance, and safety profiles. Analyzing the market potential and anticipating price dynamics for QC Acetaminophen requires a comprehensive understanding of current market trends, competitive landscape, regulatory considerations, and cost structures.

Market Landscape

Global Market Size and Growth Trends

The global acetaminophen market was valued at approximately USD 1.8 billion in 2022, with a compound annual growth rate (CAGR) estimated around 4.2% through 2030 (source: [1]). This consistent expansion underscores the enduring demand for over-the-counter (OTC) and prescription pain relievers. Key drivers include:

- Increasing prevalence of chronic pain and osteoarthritis.

- Rising geriatric population with higher analgesic needs.

- Adoption of combination therapies aiming at synergistic efficacy.

- Growing awareness and adoption of OTC medications for self-care.

Segment Insights

Formulation Type:

Immediate-release formulations dominate the market, but sustained-release variants, including QC Acetaminophen, are gaining traction due to improved patient compliance and reduced dosing frequency.

Distribution Channels:

OTC sales via pharmacies, retail outlets, and online platforms constitute over 80% of the market, with prescription channels expanding in emerging economies driven by health infrastructure growth.

Geographical Distribution:

North America currently leads, driven by high healthcare expenditure and robust OTC markets. The Asia-Pacific region is projected to exhibit the highest CAGR (around 5.5%), attributable to increasing healthcare access and economic growth.

Competitive Landscape

Leading players include Johnson & Johnson, Perrigo, Anacin, and local generic manufacturers. Despite the presence of generic options, branded formulations offering unique benefits (e.g., sustained-release profiles) can command premium pricing, particularly in developed markets.

QC Acetaminophen, with patented sustained-release technology or novel delivery systems, might occupy niche segments initially, enabling premium pricing that gradually converges with generic prices as market penetration deepens.

Regulatory and Patent Outlook

Regulatory Considerations

Regulatory approval for QC Acetaminophen hinges on demonstrating bioequivalence, safety, efficacy, and manufacturing quality. In the U.S., FDA approval would necessitate NDA submission, with potential for abbreviated pathways for modified-release formulations.

Patent Landscape

Patent protection for innovative formulations, such as sustained-release or combination products, typically provides market exclusivity for 7-12 years. The expiration of key patents could influence pricing and market competition.

Pricing Analysis

Current Pricing Trends for Acetaminophen

Standard OTC acetaminophen products price range between USD 0.03 to 0.10 per tablet, with variations based on brand, formulation, and purchase volume. Sustained-release formulations generally attract a price premium of 20-40% over immediate-release counterparts, reflecting manufacturing complexities and perceived added value.

Projected Pricing for QC Acetaminophen

Based on technological differentiation, patent status, and market positioning:

- Initial Launch Price: USD 0.15 – 0.25 per tablet, likely positioned as a premium product targeted at patients seeking improved compliance and safety.

- Long-term Price Trends: As patent protection expires and generics enter, prices are projected to decrease, converging towards USD 0.07 – 0.12 per tablet within 5-7 years.

Factors Influencing Price Fluctuations

- Manufacturing Costs: Advances in synthesis and formulation processes could lower production costs, exerting downward pressure on prices.

- Regulatory Costs: Stringent compliance in various regions may increase initial development expenses, influencing early pricing strategies.

- Market Penetration and Competition: Entry of generic sustained-release acetaminophen options will likely drive prices downward.

- Consumer Trends: Increased consumer emphasis on affordability may expedite price promotions and discounts.

Market Penetration Strategies

To foster market adoption, manufacturers should consider:

- Demonstrating clear benefits in safety, efficacy, and convenience.

- Building awareness through healthcare provider and consumer education.

- Securing regulatory approvals in multiple jurisdictions.

- Implementing strategic pricing aligned with market segments.

Forecast and Projections

| Year | Estimated Market Size of QC Acetaminophen (USD Million) | Projected Price per Tablet (USD) | Market Penetration Rate | Key Influences |

|---|---|---|---|---|

| 2023 | 50 | 0.20 | 2% | Early adoption, patent protection |

| 2025 | 150 | 0.18 | 5% | Patent expiry approaching, increased competition |

| 2027 | 300 | 0.15 | 10% | Market expansion, improved affordability |

| 2030 | 500 | 0.12 | 15% | Saturation of premium segment, generics gain market share |

Note: projections are indicative and subject to variables such as regulatory landscape, consumer acceptance, and regional market developments.

Regulatory and Market Challenges

- Navigating complex approval processes across regions.

- Ensuring manufacturing compliance with Good Manufacturing Practices (GMP).

- Overcoming price erosion from generic entrants.

- Addressing safety concerns associated with acetaminophen, notably hepatotoxicity, requiring robust pharmacovigilance.

Conclusion

QC Acetaminophen’s market prospects rest on its technological advantages, regulatory approval timing, and strategic handling of intellectual property. While initially positioned as a premium, differentiated product, its pricing is expected to decline as market competition intensifies. A focused approach on clinical validation, regulatory compliance, and consumer education will be pivotal for sustained commercial success.

Key Takeaways

- The global acetaminophen market is robust, with sustained growth forecasted through 2030, driven by aging populations and self-care trends.

- Premium formulations like QC Acetaminophen may command higher prices initially, around USD 0.20 per tablet, decreasing over time with generic competition.

- Patent exclusivity and technological differentiation are critical to maintaining pricing power and market share.

- Market entry strategies should emphasize safety, efficacy, and consumer convenience, supported by regulatory approval across key geographies.

- Price erosion predictions suggest a transition toward more affordable options within 5-7 years, emphasizing the importance of early market penetration and brand positioning.

FAQs

1. How does QC Acetaminophen differ from traditional formulations?

QC Acetaminophen incorporates sustained-release technology or combination ingredients to provide longer-lasting pain relief, reducing dosing frequency and potentially improving safety profiles by minimizing peak plasma concentrations.

2. What are the main regulatory hurdles for QC Acetaminophen?

Key hurdles include demonstrating bioequivalence or clinical efficacy, ensuring manufacturing quality, and obtaining approvals from agencies like the FDA or EMA, especially if the formulation involves new delivery systems.

3. How will patent expiries impact the pricing of QC Acetaminophen?

Patents protect technological innovations, enabling premium pricing during exclusivity. Once expired, generic competitors can enter, leading to significant price reductions and market share shifts.

4. What market segments are most promising for QC Acetaminophen?

Initially, the premium segment targeting patients requiring sustained relief and safety advantages holds promise, expanding into broader OTC markets as prices decline.

5. What are the key factors influencing the success of QC Acetaminophen?

Successful commercialization hinges on regulatory approval, effective marketing, production scalability, patent protection, and acceptance within healthcare and consumer markets.

Sources

[1] MarketWatch, "Acetaminophen Market Size, Share & Trends," 2022.

More… ↓