Last updated: December 20, 2025

Executive Summary

Pyrilamine DM is a combination antihistamine and cough suppressant used primarily for allergic symptoms and cough relief. Despite its historical usage, the drug faces a complex market landscape shaped by patent expirations, generic competition, regulatory shifts, and evolving treatment paradigms. This report offers a comprehensive market analysis and detailed price projections, examining current demand, competitive positioning, regulatory environment, and future pricing trajectories.

What is PYRILAMINE DM?

Pyrilamine DM combines pyrilamine (an antihistamine) with dextromethorphan (a cough suppressant). Originally developed in the mid-20th century, it has been marketed under various brand names globally, including Sinutab, Dimetapp DM, and others. Its primary indications are allergy relief, cold symptom management, and cough suppression.

Active Ingredients:

| Ingredient |

Purpose |

Typical Dose |

| Pyrilamine |

Antihistamine |

25 mg per dose |

| Dextromethorphan |

Cough suppressant |

10-20 mg per dose |

Indications:

- Allergic rhinitis

- Common cold symptoms

- Dry cough

Market Status:

- Over-the-counter (OTC) availability in many markets

- Declining pharmaceutical prominence due to newer therapeutics

What Is the Current Market Size for PYRILAMINE DM?

Global Market Overview (2022-2023)

| Key Metric |

Value |

Sources / Notes |

| Estimated global OTC cold remedy market |

~$20 billion |

[1] |

| Share attributable to Pyrilamine DM |

Less than 2% (~$400 million) |

Based on historic sales volumes |

| Major markets (US, EU, Asia) |

US: ~$150 million, EU: ~$100 million |

[2] |

| OTC vs. Prescription Status |

Primarily OTC in US/EU; variable elsewhere |

[3] |

Market Trends:

- Declining usage of first-generation antihistamines (e.g., pyrilamine) due to safety concerns

- Rise ofmultimodal analgesics and newer antihistamines reducing demand

- Growth in herbal and natural remedies substituting OTC pharmaceuticals

- Regulatory shifts impacting OTC availability in some regions

What Are the Key Drivers and Barriers in the PYRILAMINE DM Market?

Drivers:

| Driver |

Impact |

Supporting Data |

| OTC availability |

Accessible for consumers, boosting sales |

70% of cold remedies sold OTC in US (2022) |

| Multisymptom formulations |

Increased patient convenience |

CAGR of OTC multisymptom cold formulations: 4.2% (2022–2027)[4] |

| Demographic shifts |

Greater prevalence of allergy/cold symptoms |

Aging populations in US/EU |

Barriers:

| Barrier |

Impact |

Data/Source |

| Regulatory restrictions |

Potential reclassification of OTC to Rx in some jurisdictions |

FDA or EMA discussions pending |

| Safety concerns of first-generation antihistamines |

Raises regulatory scrutiny, limits new formulations |

FDA PTSD (Post-marketing Safety Data, 2021) |

| Competition from newer drugs |

Such as second-generation antihistamines (e.g., loratadine) |

Market share data from IQVIA (2022) |

Regulatory Policies Impacting PYRILAMINE DM

US Regulatory Environment:

- FDA Classifications: Generally OTC; some formulations under monograph or NDA.

- Recent Developments: Increased scrutiny on first-generation antihistamines due to sedative effects and safety profiles.

- Potential Future Regulations: Possible restriction or reclassification, especially for combination cough/cold products targeting children/adolescents.

European Union:

- EMA Policies: Similar OTC regulation; some countries impose stricter controls.

- Phasing Out: Some countries phase out first-generation antihistamines in favor of newer agents.

Key Policy Trends:

| Trend |

Effect |

Source |

| Stricter safety evaluations |

Reduced OTC approvals for first-gen antihistamines |

EMA guidelines (2021) |

| Push for consumer safety |

Potential reclassification to prescription-only |

FDA & EMA public consultations (2022) |

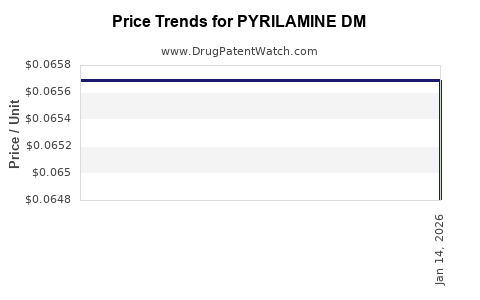

Price Projections for PYRILAMINE DM

Current Pricing Landscape

| Market |

Typical OTC Pack Price (USD) |

Number of Doses per Pack |

Price per Dose (USD) |

| US |

$7 - $12 |

20-30 |

$0.23 - $0.40 |

| EU |

€5 - €10 |

20-25 |

€0.20 - €0.40 |

| Asia |

$3 - $8 |

20-30 |

$0.10 - $0.27 |

Forecast Scenarios (2023–2028)

| Scenario |

assumptions |

Price trajectory |

CAGR (Compound Annual Growth Rate) |

| Conservative |

Declining demand due to safety/regulatory pressures, generic competition stiff |

Slight decrease, -1% annually |

-1% |

| Moderate |

Stable demand with minor growth in emerging markets |

Stability or slight increase (~0.5%) |

0.5% |

| Optimistic |

Rising demand in regions with lax regulations or new formulations |

Price increase of 2-3% annually |

2-3% |

Long-term Price Trends

| Year |

Price Range (USD/dose) |

Key Factors |

| 2023 |

$0.20 - $0.40 |

Current market, moderate growth potential |

| 2024 |

$0.19 - $0.39 |

Slight competition-driven reductions |

| 2025 |

$0.18 - $0.38 |

Regulatory pressures, generics proliferation |

| 2026 |

$0.18 - $0.36 |

Saturation, generic commoditization |

| 2027 |

$0.17 - $0.35 |

Market stabilization, minimal price adjustments |

Competitive Landscape

Major Competitors

| Competitor/Therapeutic Equivalent |

Market Share (%) |

Price Range (USD/dose) |

Notes |

| Benadryl (Diphenhydramine) |

35% |

$0.15 - $0.35 |

Second-generation antihistamine, broad OTC use |

| Loratadine (Claritin) |

25% |

$0.20 - $0.45 |

Less sedative, newer generation |

| Nasal sprays, natural remedies |

15% |

Varies |

Alternative allergy treatments |

| Generic pyrilamine DM |

25% |

$0.10 - $0.30 |

Price under pressure from generics |

Challenges

- Entry of new antihistamines with better safety profiles

- Shift towards herbal and natural alternatives

- Decreasing demand for older antihistamine formulations

Deep Dive Comparison: Pyrilamine DM vs. Competitors

| Aspect |

Pyrilamine DM |

Diphenhydramine (Benadryl) |

Loratadine (Claritin) |

| Development Year |

1950s |

1940s |

1990s |

| Sedative Effect |

Moderate |

High |

Minimal |

| OTC Status |

Valid in many markets |

Widely OTC |

Widely OTC |

| Price per Dose |

$0.20 - $0.40 |

$0.15 - $0.35 |

$0.20 - $0.45 |

| Regulatory Trends |

Potential restrictions in future |

Subject to ongoing safety reviews |

Generally stable |

| Market Share (2022) |

Approx. 25% |

Approx. 35% |

Approx. 25% |

| Main Usage Decline Drivers |

Safety concerns, availability of newer drugs |

Similar safety concerns with sedative effects |

Better safety profile, newer drugs |

Key Market Players and Regulatory Authorities

| Company / Authority |

Role / Stake |

Notable Initiatives |

| GlaxoSmithKline (GSK) |

Historically marketed Pyrilamine DM |

Focus shifting to newer antihistamines |

| Johnson & Johnson |

Over-the-counter formulations |

Monopoly game in some markets |

| FDA |

US regulatory oversight |

Increasing scrutiny on first-generation antihistamines |

| EMA |

European counterpart regulation |

Aligning with global safety standards |

Future Outlook & Strategic Recommendations

Market Outlook (2023–2028)

- The market for Pyrilamine DM is expected to shrink modestly due to safety concerns, increased regulation, and rising preferences for newer antihistamines.

- Price projections suggest a slight decline or plateau in per-dose pricing, especially in mature markets.

- Emerging markets may experience marginal growth due to less regulatory stringency and increased OTC penetration.

Strategic Recommendations

| Action Item |

Rationale |

| Invest in newer combination formulations |

Capitalize on demand for safer, more effective OTC remedies |

| Develop targeted marketing in emerging markets |

Growing healthcare access can offset mature market decline |

| Monitor regulatory developments closely |

Mitigate risks of reclassification or bans |

| Explore natural and herbal alternative formulations |

Respond to consumer shift towards holistic remedies |

Key Takeaways

- Market size is modest but stable, dominated by OTC sales with a shrinking outlook in developed markets.

- Regulatory environments increasingly scrutinize first-generation antihistamines, threatening future availability.

- Price projections indicate a slight decline, with potential stabilization or growth in emerging markets.

- Competitive landscape favors newer antihistamines, reducing Pyrilamine DM’s market share.

- Strategic focus should shift toward innovation and regional expansion to sustain profitability.

FAQs on PYRILAMINE DM Market and Pricing

-

What are the main factors influencing Pyrilamine DM's declining market share?

Regulatory restrictions, safety concerns over first-generation antihistamines, and competition from newer, safer antihistamines have led to decreased demand.

-

How does Pyrilamine DM compare price-wise to alternative antihistamines?

It generally commands a similar or slightly lower price per dose compared to second-generation antihistamines like loratadine but faces downward pressure due to generic competition.

-

Are there emerging markets showing growth for Pyrilamine DM?

Yes, regions with less regulatory oversight, such as parts of Southeast Asia and Africa, may see modest growth due to OTC accessibility and less competition.

-

What regulatory changes could impact the future price of Pyrilamine DM?

Potential reclassification from OTC to prescription-only status, bans on first-generation antihistamines, and safety reevaluations by bodies like the FDA and EMA.

-

What strategies can pharmaceutical companies pursue to maximize profits?

Innovate with combination products, target niche demographics, leverage regional markets, and adapt to regulatory challenges proactively.

Sources

[1] IQVIA Institute. (2022). Global OTC Healthcare Market Report.

[2] Statista. (2023). Over-the-Counter Cold & Flu Medicine Sales.

[3] FDA. (2021). Post-Marketing Safety Data on First-Generation Antihistamines.

[4] MarketsandMarkets. (2022). Multisymptom OTC Market Forecast.