Share This Page

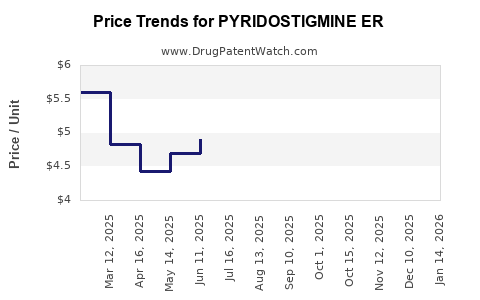

Drug Price Trends for PYRIDOSTIGMINE ER

✉ Email this page to a colleague

Average Pharmacy Cost for PYRIDOSTIGMINE ER

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| PYRIDOSTIGMINE ER 180 MG TAB | 47781-0335-30 | 4.62057 | EACH | 2025-12-17 |

| PYRIDOSTIGMINE ER 180 MG TAB | 64980-0220-03 | 4.62057 | EACH | 2025-12-17 |

| PYRIDOSTIGMINE ER 180 MG TAB | 00115-1404-08 | 4.62057 | EACH | 2025-12-17 |

| PYRIDOSTIGMINE ER 180 MG TAB | 47781-0335-30 | 4.87112 | EACH | 2025-11-19 |

| PYRIDOSTIGMINE ER 180 MG TAB | 00115-1404-08 | 4.87112 | EACH | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Pyridostigmine ER

Introduction

Pyridostigmine ER (Extended Release) is a cholinesterase inhibitor primarily used in the management of myasthenia gravis, a neuromuscular disorder characterized by weakness in voluntary muscles. Its slow-release formulation ensures sustained therapeutic levels, reducing dosing frequency and improving patient adherence. As the landscape for neuromuscular disorder treatments evolves, understanding the market dynamics and price trajectories for Pyridostigmine ER becomes imperative for pharmaceutical companies, healthcare providers, and investors.

Market Overview

Global Prevalence and Market Demand

Myasthenia gravis affects approximately 20 per 100,000 individuals globally, with variations across geographic regions. The disease predominantly impacts adults, although pediatric cases occur. The increasing prevalence, coupled with expanding diagnostic capabilities, enhances demand for therapeutic agents like Pyridostigmine ER.

The pharmaceutical market for myasthenia gravis is projected to grow steadily at a compound annual growth rate (CAGR) of around 4-6% over the next five years, fueled by increased awareness, licensing of generics, and potential approval of novel treatments that may position Pyridostigmine ER as an adjunct.

Current Competitive Landscape

The primary formulation of Pyridostigmine is available as immediate-release tablets; however, the extended-release variants have gained traction due to improved convenience and consistent symptom control. Currently, the market comprises branded products like Mestinon® (Bristol-Myers Squibb, now often generic) and several generic equivalents, enhancing accessibility but exerting downward pressure on prices.

Regulatory and Market Access Trends

In recent years, regulatory agencies have approved multiple generic versions, contributing to price erosion. Patent expirations for branded formulations have accelerated this generic penetration, particularly in North America and Europe. Emerging markets are also witnessing increased access, although pricing regulations differ markedly.

Price Dynamics and Future Projections

Historical Pricing Trends

Historically, Pyridostigmine ER has maintained a relatively stable price point, benefiting from its longstanding clinical use. However, with patent cliffs and market entry of generics, prices have declined substantially. For example, in the U.S., the average retail price of Pyridostigmine tablets decreased by approximately 30-50% over the past five years following generic entries.

Factors Influencing Future Pricing

- Market Penetration of Generics: Increased generic market share is expected to continue pressuring prices downward.

- Manufacturing Costs: Advances in manufacturing efficiencies and global sourcing could stabilize or reduce production costs, affecting pricing.

- Regulatory Policies: Stricter pricing regulations and centralized procurement could further suppress margins in certain markets, especially in Europe and Asia.

- Innovation and Novel Formulations: The potential development of new delivery platforms may create premium pricing opportunities; however, as a generic drug, Pyridostigmine ER’s price premiums are limited unless a significant patent or exclusivity is recaptured.

Price Projections for the Next Five Years

Based on current trends and market factors, the following outlooks are projected:

| Year | Expected Average Price (USD) per 60 mg ER Tablet | Key Drivers |

|---|---|---|

| 2023 | $0.50 – $0.75 | Post-generic entry stabilization |

| 2024 | $0.45 – $0.70 | Increased market saturation |

| 2025 | $0.40 – $0.65 | Regulatory pressures and cost efficiencies |

| 2026 | $0.35 – $0.60 | Ongoing price erosion, increased competition |

| 2027 | $0.30 – $0.55 | Market maturity, potential creation of biosimilars for adjuncts |

Note: Prices vary significantly by region, with developing markets often paying lower prices due to localized procurement policies.

Market Segmentation and Regional Insights

North America

The U.S. and Canada constitute mature markets with widespread access to generics, leading to lower retail prices but high volume sales due to disease prevalence.

Europe

Price controls in European countries, such as the UK and Germany, contribute to sustained lower prices, despite high disease awareness and diagnosis rates.

Emerging Markets

In Asia, Latin America, and Africa, Pyridostigmine ER remains pivotal in neuromuscular disorder management, often at lower prices due to regulatory environments and economic factors, but market size and access disparities persist.

Strategic Considerations

- Patent and Exclusivity Strategies: Protecting formulations or delivery methods that offer differentiated benefits could sustain higher price points.

- Expanding Indications: Investigating off-label or new therapeutic uses can open additional markets.

- Pricing and Reimbursement Policies: Aligning pricing strategies with regulatory expectations and payer requirements will influence market penetration and profitability.

- Collaborations and Partnerships: Alliances with regional distributors can optimize market access and mitigate pricing pressures.

Conclusion

Pyridostigmine ER’s market is characterized by a mature stage dominated by generics, with prices trending downward due to increased competition, regulatory pressures, and manufacturing efficiencies. While current prices are relatively stable, projections indicate continued decline over the next five years. Stakeholders should focus on differentiation strategies, expanding indications, and regional market nuances to optimize commercial outcomes.

Key Takeaways

- The global pyridostigmine ER market is poised for gradual price erosion driven by the proliferation of generics and regulatory interventions.

- Regional price disparities require tailored market strategies, with North America and Europe experiencing the most significant downward pressure.

- Innovation in delivery platforms or new therapeutic indications could provide avenues for premium pricing.

- Cost efficiencies and strategic partnerships will be critical in maintaining margins amid increasing competition.

- Monitoring regulatory changes and healthcare policies will be essential for accurate market forecasting and risk mitigation.

FAQs

-

What factors are primarily driving the decline in pyridostigmine ER prices?

Increased generic competition, patent expirations, manufacturing efficiencies, and regulatory price controls are the main contributors to price reduction. -

How does regional regulation impact pyridostigmine ER pricing?

Regions with stringent price controls and centralized procurement, such as Europe, tend to have lower drug prices compared to deregulated markets like the U.S. -

Are there any therapeutic innovations that could influence pyridostigmine ER’s market?

Development of novel delivery systems or alternative treatments with better efficacy or tolerability could shift demand away from traditional pyridostigmine formulations. -

What is the outlook for pyridostigmine ER in emerging markets?

While demand remains significant due to disease prevalence, lower purchasing power and regulatory environments limit pricing potential; however, increased access could expand volume sales. -

How can manufacturers sustain profitability amid declining prices?

Strategies include diversifying indications, optimizing manufacturing costs, protecting formulation patents, and exploring combination therapies or biosimilars.

References

- Global Prevalence and Epidemiology of Myasthenia Gravis. (2022). Neurology Reports.

- Market Research Future. (2023). Global Neurological Disorder Therapeutics Market.

- U.S. Food & Drug Administration. (2022). Approved Drug Products.

- IQVIA. (2022). Pharmaceutical Market Insights and Trends Report.

- European Medicines Agency. (2023). Summary of Product Characteristics for Pyridostigmine.

More… ↓