Last updated: July 28, 2025

Introduction

Pyrazinamide (PZA) is a cornerstone drug in the treatment of tuberculosis (TB), specifically in first-line combination therapies. As global TB eradication efforts intensify, the demand for PZA continues to grow, driven by increased screening, improved diagnostic testing, and widespread adoption of treatment regimens aligned with World Health Organization (WHO) standards. This report provides a comprehensive market analysis and price projection for pyrazinamide, considering factors such as supply chain dynamics, manufacturing trends, regulatory landscape, and regional market demand.

Market Overview

Global TB Burden and Demand for Pyrazinamide

The World Health Organization (WHO) estimates approximately 10 million new TB cases globally in 2021, with resistance concerns intensifying the reliance on effective pharmacological regimens (WHO, 2022). PZA is essential for its sterilizing activity, reducing therapy duration from 9 to 6 months in drug-sensitive TB cases. Consequently, the global demand for PZA mirrors TB prevalence and treatment guidelines adherence.

Manufacturing Landscape

Major pharmaceutical manufacturers, primarily in India, China, and other emerging markets, dominate PZA supply due to lower production costs and established production infrastructure. Notable players include Sun Pharmaceutical Industries, Lupin Ltd, and Zhejiang Hisun Pharmaceutical Co., Ltd, alongside some smaller generic firms (GlobalData, 2021). Patent status for PZA is generally expired, fostering generic manufacturing and price competition.

Regulatory Environment

PZA is classified as a critical medicine by WHO, with stringent quality standards. Regulatory approval processes vary by country, influencing market entry and expansion. Most regions have accepted WHO prequalification standards, facilitating procurement by international agencies and national health systems.

Current Market Dynamics

Supply and Demand Factors

- Supply Chain Stability: The COVID-19 pandemic strained pharmaceutical supply chains but also underlined the importance of resilient manufacturing and distribution, especially for TB endemic regions.

- Pricing Pressures: Open generic markets exert downward pressure on prices. International procurement agencies, such as the Global Fund and UNICEF, leverage volume-based discounts.

- Market Segmentation: While high-income countries have minimal PZA use due to low TB prevalence, low- to middle-income countries in Africa, Asia, and Eastern Europe constitute the primary markets.

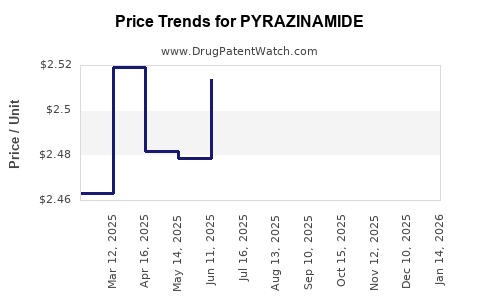

Pricing Trends

Historically, PZA prices in the generic market range between $0.02 and $0.10 per tablet, varying by formulation quality, dose, and procurement quantity (WHO-Prequalification, 2021). These prices have stabilized but remain susceptible to competitive pressures and policy changes.

Future Price Projections

The outlook for PZA prices over the next five years hinges on multiple factors:

- Ongoing Demand: The global TB treatment market is expected to grow marginally, driven by expanding access to diagnostics and treatment programs.

- Market Competition: Increased competition among generic manufacturers will likely sustain downward price pressure.

- Regulatory and Procurement Policies: International aid agencies will continue enforcing strict quality standards, impacting market entry costs and pricing.

- Supply Chain Innovations: Adoption of more efficient manufacturing processes, including continuous flow synthesis, could reduce production costs and thus prices.

Based on these factors, the average price of PZA is projected to decline gradually by approximately 2-4% annually. By 2028, the price per tablet could range from $0.015 to $0.05, depending on regional market conditions and procurement arrangements.

Regional Market Perspectives

Low-Income Countries

In high TB-burden nations, procurement costs are often heavily subsidized through global health initiatives. Prices typically hover at the lower end of the global range, with some countries securing PZA at as low as $0.01 per tablet. Future price reductions are plausible with increased local manufacturing and pooled procurement strategies.

Middle-Income Countries

Pricing remains competitive, often facilitated by local generics firms. Price points stabilize around $0.02 to $0.04 per tablet, with potential for further decreases as market consolidation occurs.

High-Income Countries

Market presence is limited here due to low TB prevalence but accessible through importation of generics at premium prices, often exceeding $0.10 per tablet.

Strategic Market Considerations

- Intellectual Property Landscape: Patent expirations smooth the pathway for generics, reducing prices and expanding access.

- Quality Assurance: Manufacturers adhering to WHO standards will retain eligibility for global procurement programs, influencing their market share.

- Innovation and Formulation: The potential development of fixed-dose combinations (FDCs) or novel formulations could impact pricing and market structure.

Impact of COVID-19 and Future Uncertainties

The pandemic's disruption has temporarily affected procurement cycles but also emphasized the necessity of resilient, localized manufacturing capabilities. Future risk factors include supply chain consolidation, geopolitical considerations, and evolving TB epidemiology, all influencing PZA market dynamics and pricing.

Key Takeaways

- The global demand for pyrazinamide correlates strongly with TB prevalence, with significant markets concentrated in low- to middle-income countries.

- The current pricing landscape is characterized by low, highly competitive generic prices, with anticipated incremental decreases driven by supply chain efficiencies and increased competition.

- Over the next five years, prices are projected to decline modestly by 2-4% annually, stabilizing at around $0.015 to $0.05 per tablet in the most competitive markets.

- Manufacturers that adhere to WHO standards and leverage local manufacturing advantages will sustain market competitiveness.

- International aid and procurement agencies will continue to facilitate access through pooled procurement and funding programs, influencing price stability and downward trends.

Conclusion

Pyrazinamide remains a cost-effective cornerstone in TB treatment regimens. Advancements in manufacturing processes, consistent supply chain management, and global health initiatives are expected to sustain downward price pressures, enhancing access in high-burden regions. Market stakeholders must monitor regulatory developments, regional procurement policies, and innovative formulation strategies to capitalize on this expanding opportunity.

FAQs

-

What are the primary drivers of Pyrazinamide market growth?

The main factors include increasing TB case notifications, expanded treatment coverage, and reliance on generic manufacturing in emerging markets.

-

Will patent protections influence future Pyrazinamide prices?

Since most PZA patents have expired, generic competition dominates, reducing prices and decreasing the likelihood of patent-related price hikes.

-

Which regions will see the highest demand for Pyrazinamide?

Low- and middle-income countries in Africa, Southeast Asia, and Eastern Europe will continue to drive the bulk of demand due to higher TB prevalence.

-

How might new formulations or fixed-dose combinations impact the market?

They could simplify treatment regimens, improve compliance, and potentially influence manufacturing costs and pricing strategies.

-

What risks could disrupt future price stability?

Supply chain disruptions, regulatory delays, geopolitical tensions, or shifts in TB epidemiology could influence supply and prices unpredictably.

References

[1] World Health Organization (WHO). Global Tuberculosis Report 2022.

[2] GlobalData. Pharmaceutical Industry Analysis, 2021.

[3] WHO Prequalification Programme, 2021.