Share This Page

Drug Price Trends for PSEUDOEPHEDRINE

✉ Email this page to a colleague

Average Pharmacy Cost for PSEUDOEPHEDRINE

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| PSEUDOEPHEDRINE ER 120 MG TAB | 70000-0601-01 | 0.26341 | EACH | 2025-12-17 |

| PSEUDOEPHEDRINE 30 MG TABLET | 00904-6990-61 | 0.05977 | EACH | 2025-12-17 |

| PSEUDOEPHEDRINE 30 MG TABLET | 45802-0432-62 | 0.05977 | EACH | 2025-12-17 |

| PSEUDOEPHEDRINE ER 120 MG TAB | 00904-7409-15 | 0.26341 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Pseudoephedrine

Introduction

Pseudoephedrine, a sympathomimetic amine, is primarily used as a decongestant for respiratory illnesses. Despite its medical utility, pseudoephedrine is also a precursor in the illicit manufacture of methamphetamine, subjecting it to strict regulatory controls worldwide. These dual roles influence its market dynamics and pricing. This report provides a comprehensive analysis of the current market landscape, regulatory environment, supply-demand factors, and future price trajectories.

Market Overview

Pharmaceutical Demand and Therapeutic Applications

In the legitimate healthcare sector, pseudoephedrine is incorporated into over-the-counter (OTC) cold and allergy medications. Its efficacy as a nasal decongestant has maintained steady demand, particularly in markets with high prevalence of respiratory illnesses. The global OTC decongestant market is projected to grow at a Compound Annual Growth Rate (CAGR) of approximately 4% over the next five years, bolstered by increasing awareness and self-medication trends. The demand is largely stable in North America and Europe, with emerging markets such as Asia-Pacific witnessing rapid expansion.

Illicit Use and Regulatory Constraints

A significant proportion of pseudoephedrine's market influence stems from its role as a methamphetamine precursor. Authorities impose tight controls, including purchase limits, mandatory licensing, and record-keeping, primarily in the United States, Australia, and Europe. In the U.S., the Combat Methamphetamine Epidemic Act (CMEA) restricts sales of pseudoephedrine products, significantly impacting supply chains and retail availability.

Manufacturing and Supply Chain Considerations

Major producers of pseudoephedrine include chemical supply giants in India and China. These regions benefit from established pharmaceutical manufacturing infrastructure, competitive costs, and proximity to growing markets. However, synthetic supply chains often face disruptions due to regulatory crackdowns and enforcement actions targeting illicit diversion.

Regulatory and Political Landscape

Global Regulatory Environment

The global regulation of pseudoephedrine varies significantly. Countries like the United States classify it as a List I chemical under the Combat Methamphetamine Epidemic Act, requiring stringent record-keeping. Conversely, other jurisdictions have more relaxed controls, influencing regional market prices and availability.

Impact on Price Formation

Regulatory restrictions tend to inflate costs due to compliance requirements, limited supply, and increased logistical complexity. Conversely, in semi-regulated or unregulated markets, pseudoephedrine prices remain comparatively lower but are susceptible to volatility owing to illicit trade, enforcement actions, and supply chain disruptions.

Supply-Demand Dynamics and Market Drivers

Legal Market Dynamics

The persistent demand for OTC decongestants sustains a baseline market volume. Manufacturing costs, including raw material prices and compliance expenses, influence wholesale prices. As demand stabilizes, pricing is primarily driven by production efficiency and regulatory overheads.

Illicit Market Influence

Illicit diversion acts as a double-edged sword—reducing legal supply and inflating illicit market prices, which in turn feedback into legitimate markets through increased regulatory costs and supply chain safeguards. The clandestine market for pseudoephedrine or methamphetamine production continuously exerts upward pressure on the legal price points.

Raw Material and Currency Fluctuations

Precursor chemicals for pseudoephedrine production have experienced price volatility due to geopolitical tensions, trade restrictions, and environmental regulations. Fluctuations in USD and local currencies impact manufacturing costs, influencing market prices globally.

Market Size and Competitive Landscape

Market Valuation

Estimated global pseudoephedrine market size stands in the range of US$1.8 billion as of 2023, with a projected CAGR of 4% through 2028, driven predominantly by legitimate pharmaceutical use. The supply chain is dominated by a handful of multinational chemical companies and regional producers.

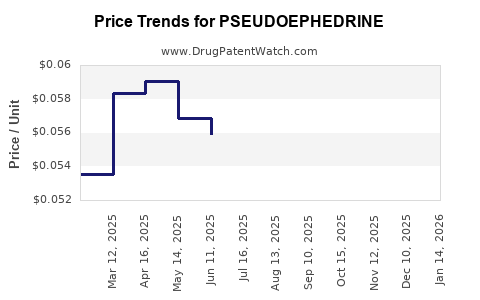

Pricing Trends

Wholesale prices for pseudoephedrine hydrochloride powder vary regionally, with North America averaging around US$15–20 per kilogram, while prices escalate in markets with strict regulatory controls to US$50 or more per kilogram. Retail prices for OTC products containing pseudoephedrine typically range from US$6 to US$12 per package, depending on brand and formulation.

Price Projections

Short to Medium-Term Outlook (Next 3–5 Years)

- Legitimate Pharmaceutical Market: Prices are expected to stabilize amid increased manufacturing efficiencies and generic competition, with marginal upward pressure due to regulatory compliance costs.

- Regulatory Impacts: Stricter controls and supply chain safeguards could elevate wholesale prices by approximately 5–10%.

- Illicit Market Influence: Enforcement actions and international cooperation aim to curb diversion, potentially reducing illicit supply and tightening legal markets, which could lead to price premiums in regions with high interdiction success rates.

- Raw Material Costs: Fluctuations in precursor chemical prices may introduce volatility, with potential upward movements of 3–7%.

Long-Term Projections (Beyond 5 Years)

- Potential technological innovations or alternative formulations for decongestion therapy could alter demand dynamics.

- Continued regulatory tightening is likely, especially in major markets, imposing higher compliance costs and maintaining elevated prices.

- Market adaption towards bulk purchasing, regional manufacturing, and supply chain diversification may stabilize prices ultimately but could sustain a band of increased costs relative to pre-regulation levels.

Risks and Opportunities

Risks

- Regulatory policy shifts could either ease or tighten controls, impacting supply and price stability.

- Proliferation of illicit markets could influence legal market prices and supply security.

- Supply chain disruptions due to geopolitical tensions or environmental regulations.

Opportunities

- Emerging markets present growth prospects for both legitimate and illicit demand.

- Development of alternative decongestants could reduce reliance on pseudoephedrine, impacting future demand and pricing.

Key Takeaways

- The pseudoephedrine market remains relatively stable in legitimate medical usage but is heavily influenced by regulatory environments and illicit diversion concerns.

- Prices are expected to moderate in the legitimate sector but may remain elevated due to compliance expenses, regional restrictions, and supply chain constraints.

- Monitoring regulatory trends, enforcement efficacy, and raw material costs will be crucial for accurate short- and long-term price projections.

- Regional differences significantly impact prices, with stricter markets exhibiting higher costs and limited supply.

- Opportunity exists for businesses to explore alternative decongestant therapies and supply chain innovations to mitigate risks associated with pseudoephedrine market fluctuations.

FAQs

-

What factors primarily influence pseudoephedrine pricing?

Regulatory controls, supply chain costs, raw material prices, and illicit diversion significantly impact prices. -

How do regulations differ globally regarding pseudoephedrine?

Countries like the United States enforce strict purchase limits and record-keeping, whereas others may have more relaxed controls, affecting regional market dynamics. -

What is the expected trend for pseudoephedrine prices over the next five years?

Prices are likely to stabilize broadly, with modest increases stemming from regulatory compliance and supply constraints, though regional variability will apply. -

How does illicit diversion impact the legitimate pseudoephedrine market?

Diversion elevates illicit prices, prompts stricter regulations, and increases compliance costs, which in turn can elevate legitimate market prices. -

Are there alternatives to pseudoephedrine that are less regulated?

Yes, other decongestants like loratadine or phenylephrine exist but vary in effectiveness and market acceptance; ongoing innovation may yield new options.

References

[1] Market Research Future. "Global OTC Decongestant Market." 2022.

[2] U.S. Drug Enforcement Administration. "Controlled Substance Act and Pseudoephedrine Regulations." 2023.

[3] International Narcotics Control Board. "Precursor Chemicals and Control Measures." 2022.

[4] Global Industry Analysts. "Pharmaceutical Solvents Market." 2023.

[5] Statista. "Global Market Size of Pseudoephedrine." 2023.

More… ↓