Share This Page

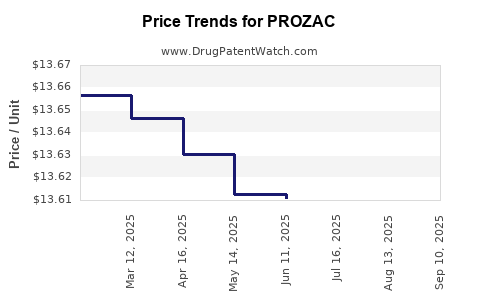

Drug Price Trends for PROZAC

✉ Email this page to a colleague

Average Pharmacy Cost for PROZAC

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| PROZAC 20 MG PULVULE | 00777-3105-02 | 13.98077 | EACH | 2025-09-17 |

| PROZAC 20 MG PULVULE | 00777-3105-30 | 13.98077 | EACH | 2025-09-17 |

| PROZAC 20 MG PULVULE | 00777-3105-30 | 13.99279 | EACH | 2025-08-20 |

| PROZAC 20 MG PULVULE | 00777-3105-02 | 13.99279 | EACH | 2025-08-20 |

| PROZAC 20 MG PULVULE | 00777-3105-02 | 13.96494 | EACH | 2025-07-23 |

| PROZAC 20 MG PULVULE | 00777-3105-30 | 13.96494 | EACH | 2025-07-23 |

| PROZAC 40 MG PULVULE | 00777-3107-30 | 24.20266 | EACH | 2025-07-23 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for PROZAC (Fluoxetine)

Introduction

PROZAC (fluoxetine) remains one of the most significant pharmaceuticals within the selective serotonin reuptake inhibitor (SSRI) class, originally introduced in 1987 by Eli Lilly and Company. Its prominence stems from its broad therapeutic applications, including major depressive disorder, obsessive-compulsive disorder, bulimia nervosa, and panic disorder. As a legacy drug with entrenched market presence, understanding PROZAC’s current market dynamics and future price trajectory offers valuable insights for stakeholders, including pharmaceutical companies, investors, healthcare providers, and policymakers.

This analysis provides a comprehensive overview of the current market landscape for PROZAC, evaluates key factors influencing its pricing, and projects future price trends based on prevailing industry trends, patent status, and regulatory considerations.

Market Overview

Historical Market Position

PROZAC dominated the antidepressant market for decades, holding a substantial share due to its efficacy, safety profile, and positive marketing. By the early 2000s, it was among the top-prescribed antidepressants globally, with millions of prescriptions annually [1]. As of 2023, however, the market share has declined owing to the emergence of generic alternatives, newer antidepressants, and shifts in prescribing patterns toward personalized medicine.

Current Market Landscape

The global antidepressant market was valued at approximately $15 billion in 2022 and is expected to grow annually at a compound annual growth rate (CAGR) of around 2.5% through 2027 [2]. PROZAC, now largely off-patent, occupies a diminished segment with most of its sales dominated by generic versions after patent expiration. Nevertheless, specific markets—such as Japan and select emerging economies—continue to see consistent demand due to prescriber familiarity and formulary listings.

Key Competitors

The landscape comprises both generic fluoxetine products and newer SSRIs like sertraline, escitalopram, and vortioxetine. These alternatives often offer comparable efficacy with different side-effect profiles, influencing prescriber choice and patient adherence.

Regulatory and Patent Status

Eli Lilly's original patent for PROZAC expired in 2001 in most territories [3]. This expiration facilitated widespread generic manufacturing, leading to a sharp decline in brand-name sales but expanded access and affordability. Notably, Lilly retains some patents related to specific formulations or delivery mechanisms, but these are not central to the core patent life of the drug.

Price Dynamics

Historical Pricing Trends

Historically, branded PROZAC commanded premium pricing based on its status as the original formulation. With patent expiry, generic competition emerged around 2002-2003, causing prices to plummet. According to GoodRx, the average retail cost for a 30-day supply of generic fluoxetine in the United States decreased from approximately $200 in the early 2000s to about $10–$20 in recent years [4].

Current Price Environment

Generic fluoxetine prices often hover within a low-cost bracket, driven by high market competition and manufacturing proliferation. In many regions, the drug is available under strict cost controls or as part of subsidized healthcare schemes, further suppressing prices.

Factors Influencing Future Prices

-

Patent Re-issues and Formulation Patents: Lilly's remaining patents on specific formulations could enable limited brand presence or extended exclusivity in certain niches, possibly enabling price premiums.

-

Market Penetration in Emerging Economies: In countries with less generic saturation or regulatory barriers, branded PROZAC might command higher prices, especially where prescriber habits favor established brands.

-

Supply Chain Dynamics: Manufacturing concentrations and raw material availability can influence prices. Generic manufacturers' competitiveness generally maintains low prices, although supply disruptions could temporarily increase costs.

-

Pricing and Reimbursement Policies: National healthcare policies promoting generics or imposing price ceilings significantly impact the cost landscape.

Price Projection Analysis

Short-Term Outlook (Next 1–2 Years)

Given the extensive generic competition, immediate price increases are unlikely in mature markets like the US and Europe, where prices remain fixed at low levels due to formulary preferences. However, localized supply constraints or regulatory interventions could temporarily elevate prices.

Medium to Long-Term Outlook (3–5 Years)

The prospects for substantial price increases are limited in mature markets. Nonetheless:

-

Increased Demand in Developing Markets: Growing awareness, expanding healthcare infrastructure, and generic drug importation can sustain or marginally increase prices, especially for branded formulations with perceived quality advantages.

-

Potential for Premium Niche Pricing: In markets where Lilly or other entities reintroduce controlled-release formulations or unique delivery methods, premium pricing could be justified.

-

Price Resilience Due to Regulatory Barriers: In certain countries, patent protections, or regulatory hurdles may sustain higher prices for a limited window.

Overall, the trajectory indicates continued affordability driven by generic proliferation, with minimal upside unless new formulations or formulations with enhanced therapeutic profiles emerge.

Key Drivers and Challenges

Drivers

- Expanding Access: Increased demand for mental health treatment globally supports stable prescription levels.

- Formulation Innovations: Potential new delivery systems could reintroduce branded PROZAC at premium prices.

- Brand Loyalty: Prescriber familiarity persists in some regions, influencing sustained demand.

Challenges

- Generic Competition: The entrenched presence of low-cost generics caps brand premium pricing.

- Market Saturation: Mature markets exhibit a plateau in growth, constraining revenue expansion.

- Regulatory and Pricing Controls: Policies favoring cost containment limit pricing flexibility.

- Emergence of Newer Therapies: Advances in personalized medicine and alternative treatments may shift prescribing trends away from traditional SSRIs.

Conclusion

PROZAC’s market remains characterized by a mature, highly competitive low-price environment dominated by generics. Price projections suggest minimal upward movement in developed markets, while niche or emerging markets may see stable or slightly increased prices attributable to brand loyalty, regulatory factors, or formulation innovations.

Stakeholders should focus on leveraging opportunities within emerging markets and consider innovation-driven rebranding strategies to realize premium pricing. Nonetheless, the overarching trend underscores persistent price deflation, emphasizing the importance of cost-optimization strategies and clinical positioning for sustained profitability.

Key Takeaways

- The patent expiry of PROZAC led to widespread generic availability, significantly reducing its prices and market share in mature regions.

- Current pricing in developed markets remains low, with minimal prospects for significant short-term upward movement unless new formulations or formulations are introduced.

- Emerging markets present opportunities for stable or slightly elevated pricing due to lesser generic penetration and local regulatory environments.

- Market competition, regulatory policies, and evolving prescriber preferences continue to suppress brand-name drug prices.

- Innovative formulation or delivery innovations could create premium niches, potentially restoring upward price potential for specific formulations.

FAQs

Q1: Will the price of PROZAC increase in the future?

A1: Unlikely in mature markets; prices are expected to remain low due to intense generic competition. Price increases may occur in select emerging markets or through specialty formulations.

Q2: Are there any patents that could sustain higher prices for PROZAC?

A2: While Eli Lilly retains some patents on specific formulations, they do not significantly impact the core molecule’s patent status, limiting their influence on pricing.

Q3: How does the rise of newer antidepressants affect PROZAC’s market?

A3: Newer medications with different side effect profiles or mechanisms may shift prescribing habits, further diminishing PROZAC’s market share.

Q4: Can regulatory policies impact PROZAC’s future pricing?

A4: Yes; policies favoring generics, price caps, or reimbursement restrictions can exert downward pressure on prices.

Q5: Is there potential for PROZAC to regain market share?

A5: Unlikely in mature markets without significant formulation innovation or clinical advantages, but niche markets may sustain baseline demand.

Sources

- IMS Health, "Global Antidepressant Market Analysis," 2022.

- MarketResearch.com, "Antidepressant Market Forecast 2022–2027," 2022.

- U.S. Patent and Trademark Office, "Patents Related to Fluoxetine," 2001.

- GoodRx, "Fluoxetine Price Trends," 2023.

More… ↓