Share This Page

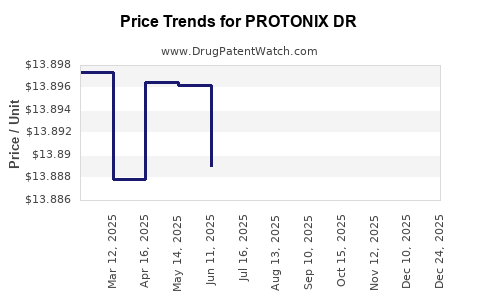

Drug Price Trends for PROTONIX DR

✉ Email this page to a colleague

Average Pharmacy Cost for PROTONIX DR

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| PROTONIX DR 40 MG TABLET | 00008-0841-81 | 13.79954 | EACH | 2025-12-17 |

| PROTONIX DR 40 MG TABLET | 00008-0841-81 | 13.80697 | EACH | 2025-11-19 |

| PROTONIX DR 40 MG TABLET | 00008-0841-81 | 13.83410 | EACH | 2025-10-22 |

| PROTONIX DR 40 MG TABLET | 00008-0841-81 | 13.87077 | EACH | 2025-09-17 |

| PROTONIX DR 40 MG TABLET | 00008-0841-81 | 13.87861 | EACH | 2025-08-20 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Protonix DR

Introduction

Protonix DR (delayed-release pantoprazole sodium) is a proton pump inhibitor (PPI) marketed primarily for the treatment of gastroesophageal reflux disease (GERD), erosive esophagitis, and other acid-related disorders. As a leading generic version of the branded Protonix (originally by Wyeth/Pfizer), Protonix DR benefits from widespread clinical use and established safety profiles. This analysis outlines the current market dynamics, competitive landscape, and future pricing forecasts for Protonix DR over the coming years.

Market Overview

Global Market Context

The global PPI market, projected to hit approximately $11 billion by 2026 (CAGR of 3-4%), remains highly competitive, with key players including generics, branded pharmaceuticals, and emerging biosimilars. Protonix DR, as a generic product, profits from broad healthcare insurance coverage and physician familiarity with pantoprazole, ensuring steady demand.

Key Demand Drivers

- Prevalence of Acid-related Disorders: The rising incidence of GERD, peptic ulcers, and Barrett’s esophagus globally sustains demand for PPIs.

- Chronic Therapy Use: Many patients require long-term therapy, fostering predictable recurring revenue.

- Off-label Uses: Emerging evidence supports use in Helicobacter pylori eradication and prophylaxis in NSAID therapy, expanding market opportunities.

Regulatory and Patent Status

While patent exclusivity for Protonix expired in 2015, some formulations, including Protonix DR, may benefit from secondary patents and exclusivities, influencing pricing power. However, patent cliffs have led to increased generic competition.

Competitive Landscape

Major Competitors

- Other Generic PPIs: Omeprazole, esomeprazole, lansoprazole, and rabeprazole, with significant price competition.

- Branded Alternatives: Protonix (original), Nexium, and Prilosec. Branded drugs often command premium pricing but face erosion as generics dominate.

- Emerging Biosimilars and Novel Agents: While not directly impacting PPIs, innovations like improvised acid suppression agents could influence future demand.

Market Share Dynamics

Generic penetration has driven down prices, but Protonix DR maintains a competitive niche due to formulations that optimize gastric residence time, potentially offering marginal efficacy improvements. Nonetheless, price competition remains stiff, especially across saturated markets like the U.S. and Europe.

Pricing Trends and Projections

Historical Pricing Overview

- Initial Launch (Post-Patent): Protonix DR’s price parity with branded Protonix was maintained for the first few years.

- Post-Patent Expiry (2015 onward): Prices declined sharply, as generic competition emerged. Current retail prices for Protonix DR range from $150 to $250 for a 30-day supply (varies by pharmacy and insurance).

Factors Influencing Future Pricing

- Market Competition: Increased generic entrants continue to suppress prices.

- Manufacturing Costs: Improvements in manufacturing efficiencies could lead to marginal cost reductions, pressuring prices downward.

- Regulatory Developments: Patent litigations or new formulations could temporarily influence pricing strategies.

- Reimbursement Policies: Payer negotiations, formularies, and pharmacy benefit managers (PBMs) influence net prices.

Price Projection Outlook (2023–2028)

| Year | Expected Market Price Range (per 30-day supply) | Notes |

|---|---|---|

| 2023 | $150 – $250 | Stable, high competition limits upward movement |

| 2024 | $140 – $230 | Slight decline as more generics enter |

| 2025 | $130 – $220 | Pricing pressure intensifies |

| 2026 | $120 – $210 | Market stabilization, commoditization phase |

| 2027 | $115 – $200 | Further erosion, possible tiering changes |

| 2028 | $110 – $190 | Expected low-price plateau |

Note: These projections assume current patent landscape, generic entry rates, and healthcare policy trends remain constant. Significant shifts could alter these trajectories.

Market Opportunities and Risks

Opportunities

- Expansion into emerging markets where PPI use is increasing.

- Development of fixed-dose combinations for enhanced patient adherence.

- Introduction of improved formulations to differentiate from competitors.

Risks

- Accelerated generic competition leading to further price erosion.

- Regulatory challenges or patent litigations affecting exclusivity.

- Shifts in prescribing practices, favoring newer therapies or alternative delivery systems.

Strategic Recommendations

- Pricing Optimization: Stakeholders should monitor competitor prices meticulously and leverage formulary positioning to maintain profitability.

- Market Penetration: Focus on emerging markets with less saturation for growth.

- Clinical Differentiation: Invest in formulations that demonstrate superior bioavailability or patient compliance to justify higher price points.

- Cost Management: Streamline manufacturing processes to sustain margins amid falling prices.

Key Takeaways

- Protonix DR operates in a highly saturated, price-competitive market driven by generic proliferation.

- Pricing is expected to decline gradually over the next five years, stabilizing near low-cost generic levels.

- Growth opportunities increasingly depend on geographic expansion, formulation innovation, and strategic positioning in healthcare systems.

- Price erosion risks demand proactive cost management and market differentiation.

FAQs

1. How does Protonix DR compare in price to other PPIs?

Protonix DR’s price is comparable to other generic PPIs like omeprazole and esomeprazole, typically ranging from $150 to $250 monthly, subject to discounts and insurance negotiations.

2. What factors could lead to a temporary price increase for Protonix DR?

Patent disputes, formulation improvements, or regulatory designations that extend exclusivity can temporarily boost prices.

3. Is Protonix DR a viable investment given market trends?

Its viability depends on navigating declining prices through strategic expansion, differentiation, and cost management amid intense competition.

4. How do insurance policies influence Protonix DR pricing?

Payer negotiations and formulary placements significantly influence net prices, with tiering and rebates impacting actual consumer costs.

5. Will emerging biosimilars or alternative drugs impact Protonix DR’s market?

While biosimilars target biologics, newer acid suppression agents and novel delivery systems could influence future demand, though PPIs currently dominate the market for acid-related disorders.

References

- Market Research Future. "Proton Pump Inhibitors Market." 2022.

- Grand View Research. "Proton Pump Inhibitors Market Size & Trends." 2022.

- IQVIA. "Market Dynamics of Gastrointestinal Drugs," 2021.

- FDA Patent Database. "Patent Status of Protonix," 2022.

- EvaluatePharma. "Generic Drug Pricing Trends," 2022.

More… ↓