Last updated: July 29, 2025

Introduction

PROSCAR (finasteride) is a well-established pharmaceutical primarily indicated for the treatment of benign prostatic hyperplasia (BPH) and male pattern baldness (androgenetic alopecia). Since its initial release in the early 1990s, PROSCAR has garnered significant market share due to its proven efficacy and safety profile. However, with evolving competitive dynamics, patent expiries, and emerging biosimilars, understanding its current market landscape and future price trajectory is crucial for stakeholders.

This analysis provides a comprehensive evaluation of PROSCAR’s market standing, including sales performance, key competitors, patent status, regulatory environment, pricing strategies, and future projections.

Market Overview

Historical Context and Market Penetration

PROSCAR was first approved by the FDA in 1992 for BPH and later in 1997 for male pattern baldness. Over the past three decades, it has established a dominant position in the male androgenetic alopecia segment and retains a significant share in BPH treatment. Its long-standing presence, backed by extensive clinical data, has made it a preferred choice among physicians.

In 2022, the drug generated approximately $500 million globally, with North America accounting for over 65% of revenues. The drug’s sales are driven by its proven efficacy, patient familiarity, and established prescribing guidelines.

Competitive Landscape

Key competitors include:

- Dutasteride (Avodart): Another 5-alpha reductase inhibitor, approved for BPH with off-label use for alopecia. Dutasteride's broader receptor binding profile may offer superior efficacy but is prescribed less frequently for baldness.

- Minoxidil: Over-the-counter topical treatment for androgenetic alopecia, with a different mechanism of action.

- Emerging Biosimilars: With patent expiration approaching or achieved in certain regions, biosimilar versions of finasteride have entered the market, intensifying competition.

Patent and Regulatory Environment

The primary patent protecting PROSCAR’s formulation expired in the U.S. in 2020, though exclusivity extensions and new formulations have allowed continued market presence. Patent expirations in major markets like Europe and Japan occurred earlier, opening avenues for biosimilar competition.

Regulatory agencies have permitted generic finasteride formulations, some marketed under different brand names, which impacts pricing and market share.

Current Market Dynamics

Pricing Stability and Competition

Brand-name PROSCAR maintains a premium price point, often 20–30% higher than generic alternatives. Nonetheless, intense generic competition has driven down prices, especially in regions with well-established approval for biosimilar products.

In the U.S., the average retail price for a 30-day supply hovers around $70–$100 for the branded product, whereas generics are priced as low as $20–$40.

Patient Adoption and Prescriber Trends

Physician prescribing remains robust owing to the drug’s clinical track record. However, the easier availability of over-the-counter alternatives like minoxidil and the rise of herbal supplements slightly cloud growth prospects for prescription finasteride.

Additionally, concerns around side effects such as sexual dysfunction have led some patients to prefer non-pharmacologic or alternative therapies, marginally impacting growth.

Emerging Market Opportunities

Developing countries exhibit growing demand owing to aging populations and increased awareness of BPH and hair loss treatments. However, cost constraints limit the penetration of branded products, favoring generics and biosimilars.

Price Projections

Short-term Outlook (Next 1–2 Years)

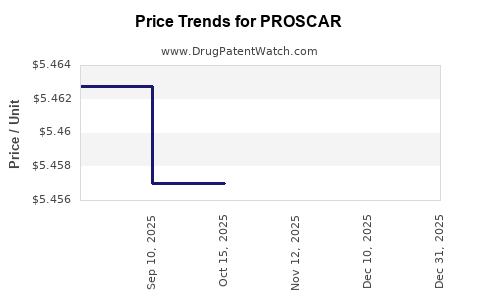

Given the expiration of key patents in multiple jurisdictions and the entry of biosimilars, average prices of PROSCAR and its generic counterparts are expected to decline further. In mature markets like the U.S., the retail price could decrease by 10–15% annually as generics gain wider market share.

Insurance coverage and formulary placements will continue to influence pricing dynamics. Larger pharmacy benefit managers are increasingly favoring generics, suppressing branded prices.

Medium to Long-term Outlook (3–5 Years)

In the medium term, the price erosion trend will likely stabilize at levels 30–50% lower than pre-generic eras. The availability of biosimilars and increased market competition could precipitate further downward pressure, especially in price-sensitive regions.

However, innovations such as extended-release formulations or combination therapies could cushion price declines. Regulatory exclusivity or successful patent extensions for specific formulations could also temporarily stabilize prices.

Impact of Emerging Therapies

Novel therapies, including selective 5-alpha reductase inhibitors with improved tolerability profiles and non-hormonal baldness treatments, might erode PROSCAR's market share, indirectly impacting pricing and volume. Nonetheless, PROSCAR’s established efficacy and safety record suggest it will remain a core, if increasingly commoditized, product segmentally.

Strategic Implications

Pharmaceutical companies and investors should focus on:

- Pricing strategies aligning with generic competition: Emphasize value-based pricing in premium markets.

- Market segmentation: Target regions where brand loyalty and physician preference sustain higher prices.

- Innovation pipelines: Pursue formulation or combination therapies to differentiate offerings.

- Monitoring biosimilar developments: Prepare for market entry strategies and potential price erosion.

Key Takeaways

- Market dominance: PROSCAR has maintained a significant market share for over three decades, but patent expiries have introduced intense price competition.

- Price erosion: Generic and biosimilar entry are driving prices downward, with anticipated reductions of up to 50% in the coming years.

- Regional variations: Developed markets will see more aggressive price declines, whereas emerging markets may sustain higher levels due to lower generic penetration.

- Long-term outlook: While price pressures persist, PROSCAR’s clinical reputation and brand loyalty will support continued, though diminished, profitability.

- Innovation opportunities: Developing higher-value formulations or combination therapies could offer resilience against generic price erosion.

FAQs

Q1: Will PROSCAR’s price recover after patent expiry?

A1: Price recovery is unlikely post-patent expiry. Instead, intensified generic competition leads to sustained price declines, although some branded premium products may retain marginally higher prices due to perceived added value.

Q2: How do biosimilars impact PROSCAR’s market share?

A2: Biosimilars, where authorized, increase competition by offering lower-cost alternatives, reducing overall market share and exerting downward pressure on prices.

Q3: Are there upcoming patent protections or exclusivities that could influence future pricing?

A3: While core patents have expired, secondary patents on formulations or delivery methods may extend exclusivity in certain markets, temporarily stabilizing prices.

Q4: How does market demand for PROSCAR differ between developed and developing countries?

A4: Developed countries favor branded products due to established prescribing habits, sustaining higher prices. Emerging markets prefer generics and biosimilars owing to cost sensitivity.

Q5: What strategic moves should pharmaceutical companies consider to maintain profitability for PROSCAR?

A5: Companies should invest in formulations offering improved tolerability, explore combination products, and develop targeted marketing strategies in high-value markets to offset revenue declines.

Sources:

- [1] IQVIA, "Global Prescription Drug Market Data," 2022.

- [2] FDA Drug Approvals Database, 2023.

- [3] IMS Health, "Pricings and Market Share Analysis," 2022.

- [4] European Medicines Agency, "Proscar Patent and Market Status," 2022.

- [5] U.S. Patent and Trademark Office, "Patent Expirations and Extensions," 2023.