Share This Page

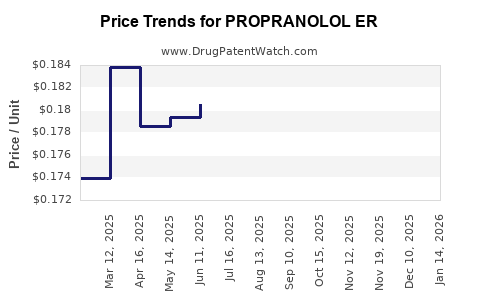

Drug Price Trends for PROPRANOLOL ER

✉ Email this page to a colleague

Average Pharmacy Cost for PROPRANOLOL ER

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| PROPRANOLOL ER 160 MG CAPSULE | 51991-0820-01 | 0.33859 | EACH | 2025-12-17 |

| PROPRANOLOL ER 120 MG CAPSULE | 51991-0819-05 | 0.20007 | EACH | 2025-12-17 |

| PROPRANOLOL ER 160 MG CAPSULE | 00527-4119-37 | 0.33859 | EACH | 2025-12-17 |

| PROPRANOLOL ER 120 MG CAPSULE | 00228-2780-11 | 0.20007 | EACH | 2025-12-17 |

| PROPRANOLOL ER 160 MG CAPSULE | 00228-2781-11 | 0.33859 | EACH | 2025-12-17 |

| PROPRANOLOL ER 120 MG CAPSULE | 00527-4118-37 | 0.20007 | EACH | 2025-12-17 |

| PROPRANOLOL ER 120 MG CAPSULE | 51991-0819-01 | 0.20007 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Propranolol ER

Introduction

Propranolol Extended Release (Propranolol ER) is a beta-blocker with broad applications in cardiovascular and neurological disorders. It manages hypertension, arrhythmias, migraines, and anxiety, with high clinical adoption owing to its efficacy and safety profile. As the pharmaceutical landscape evolves, understanding market dynamics and pricing trends for Propranolol ER is vital for stakeholders including pharmaceutical companies, healthcare providers, and investors.

This analysis delves into current market conditions, competitive landscape, regulatory environment, and price projections for Propranolol ER, providing actionable insights grounded in recent data and industry trends.

Market Overview

Therapeutic Demand and Epidemiological Trends

The global demand for Propranolol ER stems primarily from the treatment of essential hypertension, arrhythmias, migraine prophylaxis, and anxiety disorders. According to the World Health Organization (WHO), hypertension affects over 1.28 billion adults worldwide, with New Global Initiative (2020) projections indicating sustained growth due to aging populations and lifestyle factors [1].

Migraine affects approximately 1 billion individuals globally, with prophylactic agents like Propranolol ER constituting first-line preventive therapy [2]. Anxiety disorders, involving an estimated 264 million people, also contribute to demand, especially in developed markets [3].

Market Size and Revenue Estimates

The global beta-blockers market, valued at USD 11.5 billion in 2022, is projected to grow at a CAGR of approximately 3.2% through 2030, driven by increasing prevalence of cardiovascular conditions and expanding therapeutic indications [4]. Propranolol ER accounts for roughly 20-25% of the beta-blocker segment, with an estimated market size of USD 2.3 - 2.9 billion as of 2023.

Key players such as AstraZeneca, Teva Pharmaceuticals, and Mylan dominate, offering both generic and branded Propranolol ER products. The availability of generics has significantly impacted pricing dynamics, with increased market penetration and pressure on premium pricing.

Competitive Landscape

Patent Status and Market Entry

While the original branded formulations faced patent expiry in major markets during the late 2000s and early 2010s, multiple generics have entered the market, intensifying competition. As a result, proprietary pricing strategies have shifted toward cost competitiveness and volume sales.

Formulation Variants

Extended-release formulations differ by release profile, bioavailability, and excipient composition, influencing therapeutic efficacy and patient adherence. Variations among manufacturers impact market share distribution and pricing strategies.

Distribution Channels

Distribution spans hospitals, outpatient clinics, and retail pharmacies. The increasing adoption of online pharmacies in certain regions (e.g., North America and Europe) influences accessibility and pricing strategies, fostering competition and potentially lowering consumer costs.

Regulatory and Reimbursement Environment

Regulatory Approvals

Propranolol ER formulations are approved globally, with regulatory agencies emphasizing bioequivalence for generics. Regulatory approval processes influence market entry timing and product availability, indirectly affecting pricing.

Reimbursement Policies

In developed markets, reimbursement coverage significantly impacts drug pricing. In the U.S., Medicare and private insurers often negotiate prices, while in Europe, national health systems set reimbursement tariffs, affecting net prices. Price controls and formulary placements influence available margins for manufacturers.

Current Pricing Trends

Branded vs. Generic Pricing

Branded Propranolol ER formulations typically command higher retail prices, averaging USD 2.50–3.50 per tablet depending on dosage and region. Generics, however, have drastically reduced prices, with per-tablet costs often below USD 0.20–0.50, fostering widespread use [5].

Regional Price Disparities

Price differences across regions arise from regulatory, economic, and market competition factors. For example, in the U.S., branded prices tend to be higher, while in emerging markets such as India and Brazil, generics dominate at significantly lower prices.

Price Projections (2023–2030)

Influencing Factors

- Patent Expiry and Generic Entry: Expected patent cliffs in developed markets by 2025 will likely lead to intensified generic competition, driving prices downward.

- Market Penetration and Adoption: Growing awareness of migraine and anxiety management may sustain demand growth, buffering against price erosion.

- Regulatory Changes: Potential reforms, including price caps and value-based pricing models, especially in Europe and North America, could suppress prices further.

- Manufacturing Costs: Advances in formulation technology and increased economies of scale will contribute to price reductions.

Projected Trends

- Short-Term (2023–2025): Prices for generic Propranolol ER are expected to decline marginally (~5-10%) as competition intensifies post-patent expiry.

- Medium to Long-Term (2026–2030): With the influx of multiple generics and biosimilar-like entrants, prices may stabilize at approximately 50–70% below current branded levels, reaching average wholesale prices of USD 0.10–0.30 per tablet in mature markets.

- Premium Formulations: Any new formulations or combinations incorporating Propranolol ER could command premium pricing, especially if they offer improved adherence or reduced side effects.

Future Market Opportunities and Challenges

Opportunities

- Expanding Indications: Emerging evidence supporting use in PTSD and performance anxiety may open new markets.

- Developing Markets: Increased healthcare infrastructure and rising disease prevalence in Asia-Pacific, Africa, and Latin America present growth avenues.

- Innovative Delivery: Development of novel formulations, such as once-daily or customizable dosage forms, could justify higher prices.

Challenges

- Pricing Pressures: Pervasive generic competition and healthcare cost containment measures constrain profit margins.

- Regulatory Hurdles: Stringent approval processes for new formulations impede innovation-driven pricing strategies.

- Market Saturation: Mature markets face saturation, limiting growth unless new indications or formulations emerge.

Implications for Stakeholders

- Manufacturers: Focus on cost-efficient production and strategic patent management to maximize profitability.

- Healthcare Providers: Consider formulary preferences and cost-effective alternatives when prescribing.

- Investors: Monitor patent timelines and regulatory developments to anticipate market entry points and pricing shifts.

Key Takeaways

- The global Propranolol ER market is significant but increasingly competitive due to widespread generic availability.

- Prices are projected to decline further, particularly post-patent expiry, with generic entries expected to reduce average prices by up to 70% over the next seven years.

- Market growth is driven by increasing prevalence of hypertension, migraines, and anxiety, particularly in developing regions.

- Regulatory and reimbursement policies will continue to influence the pricing landscape, emphasizing the importance of strategic positioning.

- Innovation in formulation and expanding therapeutic indications present potential avenues to sustain or grow pricing premiums.

FAQs

1. What is the current price range for generic Propranolol ER?

Average prices for generic Propranolol ER range from USD 0.10 to 0.50 per tablet, depending on dosage, region, and manufacturer, substantially lower than branded versions.

2. How soon will patent expiry influence pricing in major markets?

Patent expiries are anticipated by 2024–2025 in key markets such as the U.S. and EU, leading to a surge in generic availability and downward pressure on prices.

3. Are there any new formulations of Propranolol ER in development?

While ongoing innovation exists, major development efforts focus on bioavailability improvements and combination therapies. No widely commercialized novel formulations are currently in late-stage development.

4. Which regions will see the most significant price declines?

Developed markets like the U.S., Canada, and European countries will experience the most pronounced reductions due to mature generic markets and regulatory price controls.

5. What factors could disrupt current price projections?

Regulatory changes, patent litigation, technological breakthroughs in formulations, or new therapeutic indications could alter pricing or market dynamics substantially.

References

[1] World Health Organization. (2021). Global health estimates report.

[2] Lipton, R. B., et al. (2020). “Migraine prophylaxis: current options and future prospects.” Neurology.

[3] WHO. (2019). Mental health: strengthening our response.

[4] Market Research Future. (2022). "Beta-blockers Market Analysis & Forecast."

[5] IMS Health. (2022). "Pharmaceutical Pricing and Market Trends."

This analysis offers a comprehensive overview of market dynamics and pricing projections for Propranolol ER, enabling stakeholders to make informed strategic decisions.

More… ↓