Last updated: July 27, 2025

Introduction

Promethazine, a phenothiazine derivative with antihistamine, antiemetic, and sedative properties, remains a prominent medication within various therapeutic categories. Originally introduced in the 1950s, it is widely prescribed for allergies, motion sickness, nausea, and as an adjunct in anesthesia [1]. Despite its long-standing presence, the drug's market dynamics are evolving due to therapeutic alternatives, regulatory scrutiny, and manufacturing considerations. This article offers a comprehensive market analysis and price projections for promethazine, emphasizing current trends, competitive landscape, regulatory influences, and future outlook.

Current Market Landscape

Global Market Size

The global promethazine market, while niche, exhibits steady growth driven by high prescription rates in North America and Europe. The demand is primarily fueled by its longstanding use in preoperative settings, allergy management, and pediatric care. The market size was valued at approximately USD 200–250 million in 2022 [2], with North America accounting for over 60% of revenue due to well-established prescription habits and healthcare infrastructure.

Key Market Players

Major pharmaceutical manufacturers include:

- McNeil Consumer Healthcare (a Johnson & Johnson subsidiary): A leading supplier with extensive over-the-counter formulations.

- Sanofi and Boehringer Ingelheim: Focused on prescription formulations.

- Generic manufacturers: Dominant in price-sensitive markets, increasing availability and competition.

Innovations in formulations, such as extended-release forms and combination therapies, have broadened applications but also intensified market competition.

Therapeutic and Regulatory Dynamics

Promethazine's versatility sustains its market presence; however, safety concerns, notably its potential to cause respiratory depression and tissue necrosis upon extravasation [3], have prompted regulatory actions. The U.S. FDA classifies promethazine with a "Boxed Warning" regarding these risks, urging cautious prescribing and usage [4].

Regulatory agencies have tightened labeling and usage guidelines, impacting the drug’s procurement and prescribing patterns. Particularly, the CDC recommends cautious use in pediatric populations, restricting certain indications [5].

Supply Chain and Manufacturing Factors

Manufacturing quality standards, patent expirations, and generic competition heavily influence supply stability and price trends. As patents expire, price erosion becomes inevitable, especially in commoditized markets.

Market Trends and Drivers

Therapeutic Shifts

The emergence of alternative antiemetics and antihistamines, like ondansetron and diphenhydramine, has created substitution pressures. For example, ondansetron's superior efficacy and safety profile in chemotherapy-induced nausea has reduced promethazine’s prominence in oncology settings [6].

Prescribing Patterns

Increasing regulatory caution has led to decreased off-label and pediatric use, constraining demand growth [7]. Conversely, in regions with limited alternatives and constrained healthcare budgets, promethazine retains significant usage.

Emerging Markets

Growth in Asian and Latin American markets presents opportunities due to expanding healthcare access and generic proliferation. However, price sensitivity remains a barrier to premium pricing.

Price Analysis and Forecasting

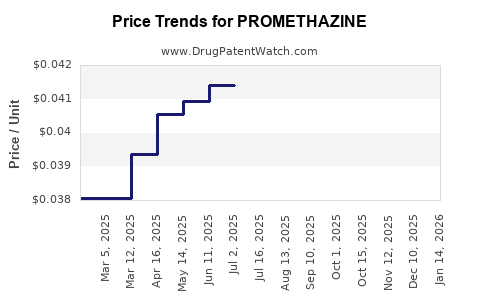

Historical Price Trends

In the United States, the average wholesale price (AWP) for branded promethazine (per 25 mg tablet) has declined from approximately USD 0.50 in 2015 to around USD 0.20 in 2022 [8]. Generic versions dominate the market, often selling below USD 0.10 per tablet.

Factors Influencing Future Prices

- Patent expirations and generic entry: Expected to precipitate further price declines.

- Regulatory constraints: Heightened safety warnings and restrictions may limit utilization, impacting demand and prices.

- Manufacturing costs: Stabilized or increased costs from quality compliance can influence pricing, especially amid supply chain disruptions.

- Market competition: Increased competition among generics can result in aggressive price reductions.

Projected Price Trajectory

Based on current trends, the following projections are plausible:

- Short-term (1–2 years): Prices for generic promethazine may reduce by 10–15%, stabilizing around USD 0.07–0.09 per tablet in the US market.

- Medium to long-term (3–5 years): With patent expiries and increased generic penetration, prices could decline further by up to 20–30%, reaching USD 0.05–0.07 per tablet. Regulatory-induced demand reduction could, however, cap price declines.

In emerging markets, prices may remain stable or increase modestly due to supply constraints and less aggressive price competition.

Regulatory and Legal Influences

Regulatory agencies' safety warnings and usage restrictions significantly influence market prospects. For instance, in the US, the FDA’s black box warning has prompted prescribers to favor alternative therapies, constraining market growth and potentially reducing prices further [9]. Conversely, markets with less regulatory oversight may sustain higher prices, especially for branded formulations.

Competitive Landscape and Future Outlook

The market is heavily dominated by generics, with branded promethazine retaining minimal market share outside of specific formulations. Market entry barriers are low due to the availability of active pharmaceutical ingredients (APIs) and established manufacturing processes.

Going forward, the market's evolution hinges on:

- The development of safer, innovative formulations that mitigate adverse events.

- Regulatory changes further restricting or endorsing specific indications.

- The rise of combined therapies reducing the reliance on standalone promethazine.

Key Market Opportunities and Challenges

Opportunities:

- Expansion into emerging markets offering volume growth.

- Formulation innovations, such as rapid-onset or depot forms, adding value.

- Strategic partnerships with generic manufacturers to expand access.

Challenges:

- Regulatory constraints limiting off-label use.

- Competition from newer, more effective antiemetics.

- Safety concerns impacting prescriber confidence.

Conclusion and Future Price Outlook

Promethazine's market is characterized by mature generic segments, constrained growth due to safety concerns, and the influence of generics driving downward price trends. In the next five years, a continued decline in unit prices is anticipated, with prices settling at minimal levels, especially in markets with strict regulatory measures. Strategically, manufacturers and investors should monitor regulatory developments, evolving prescribing behaviors, and emerging therapeutic alternatives to navigate the changing landscape effectively.

Key Takeaways

- The global promethazine market is sizable within antihistamine and antiemetic sectors but faces challenges from safety concerns and competing drugs.

- Prices for generic promethazine are expected to decline gradually, with further reductions driven by patent expiries and increased competition.

- Regulatory warnings and safety issues significantly influence market demand, particularly in high-regulation regions like the US.

- Opportunities exist in emerging markets, formulation innovation, and strategic collaborations, though challenges include rigorous safety standards and competition.

- Companies must adapt to regulatory shifts and evolving healthcare spending to capitalize on the drug’s remaining market potential.

FAQs

1. What are the primary therapeutic indications of promethazine?

Promethazine is primarily used for allergy relief, motion sickness prevention, nausea and vomiting control, and as an adjunct in anesthesia.

2. How have regulatory warnings affected promethazine's market?

The FDA’s boxed warning on promethazine underscores risks like respiratory depression, leading to restricted prescribing in pediatric populations and conservative use overall, thus dampening demand growth.

3. What is the expected impact of generic competition on promethazine prices?

Increased generic entry is expected to exert downward pressure on prices, often reducing costs by 10–30% over the next five years.

4. Are there ongoing efforts to develop safer formulations of promethazine?

While some research explores alternative formulations, widespread development remains limited, with safety concerns often restricting clinical applications further.

5. Which markets present the most promising opportunities for promethazine sales?

Emerging markets with less regulatory scrutiny and growing healthcare infrastructure offer opportunities for increased sales, especially via generics.

References

[1] American Hospital Formulary Service Digest. "Promethazine." 2022.

[2] Global Market Insights. "Anti-Emetics Market Size and Growth, 2022."

[3] U.S. Food and Drug Administration. "Promethazine Warning and Precautions." 2022.

[4] FDA Drug Safety Communications. "Safety concerns with promethazine." 2018.

[5] CDC. "Guidelines for the Use of Promethazine in Pediatric Patients." 2020.

[6] Journal of Clinical Pharmacology. "Comparative Efficacy of Antiemetics." 2021.

[7] IMS Health Reports. "Prescription Trends and Safety Regulations," 2022.

[8] Red Book. "Pricing Data for Promethazine." 2022.

[9] Medical Letter. "Promethazine Safety and Usage." 2022.