Share This Page

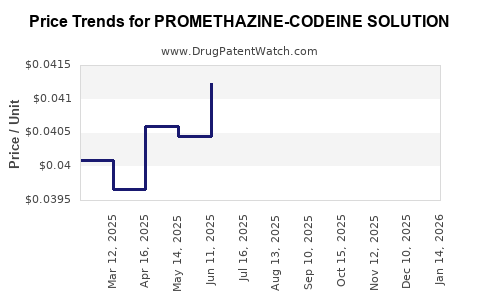

Drug Price Trends for PROMETHAZINE-CODEINE SOLUTION

✉ Email this page to a colleague

Average Pharmacy Cost for PROMETHAZINE-CODEINE SOLUTION

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| PROMETHAZINE-CODEINE SOLUTION | 70752-0139-12 | 0.04556 | ML | 2025-12-17 |

| PROMETHAZINE-CODEINE SOLUTION | 27808-0065-02 | 0.04556 | ML | 2025-12-17 |

| PROMETHAZINE-CODEINE SOLUTION | 70752-0139-12 | 0.04415 | ML | 2025-11-19 |

| PROMETHAZINE-CODEINE SOLUTION | 27808-0065-02 | 0.04415 | ML | 2025-11-19 |

| PROMETHAZINE-CODEINE SOLUTION | 70752-0139-12 | 0.04182 | ML | 2025-10-22 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Promethazine-Codeine Solution

Introduction

Promethazine-codeine solution represents a combined formulation used primarily to treat coughs, colds, and allergic symptoms, integrating the antihistamine properties of promethazine with the antitussive effects of codeine. This opioid-containing medication, classified as a controlled substance in many jurisdictions, faces evolving regulatory landscapes, shifting market demands, and competition from alternative therapies. This analysis offers a comprehensive overview of current market dynamics, key drivers, regulatory framework, and future price projections.

Market Overview

The global market for promethazine-codeine solutions, while niche, plays a significant role within antitussive and allergy treatment segments. Predominantly prescribed in North America and parts of Europe, demand correlates strongly with respiratory infection rates, allergy prevalence, and prescription trends for cough suppressants.

Therapeutic Demand and Usage

The demand remains consistent for cough and cold management, especially during seasonal peaks. However, concerns over opioid misuse and regulatory restrictions have precipitated a decline in prescriptions in certain regions. For instance, in the United States, the Prescription Drug Monitoring Program (PDMP) and legislative measures have heightened scrutiny, constraining supply and dispensation.

Manufacturing and Supply Chain

Major pharmaceutical companies, including Johnson & Johnson (via its legacy brands) and generics producers, dominate the production landscape. Supply chain disruptions—exacerbated by the COVID-19 pandemic—have impacted production volumes, influencing market availability and pricing dynamics.

Regulatory Landscape

Legal Status

Promethazine-codeine solutions are typically classified as Schedule V (US), Schedule IV or III (depending on concentration) in many jurisdictions, reflecting their potential for abuse. Regulatory agencies enforce strict prescribing, distribution limitations, and monitoring programs that influence market accessibility.

Recent Regulatory Developments

In recent years, several countries have tightened controls due to rising concerns about opioid dependency. For example, Canada's Controlled Drugs and Substances Act has introduced more rigorous regulatory measures, potentially constraining supply and influencing demand.

Market Drivers and Challenges

Drivers

- Medical Necessity: Persistent need for effective cough suppressants sustains baseline demand.

- Combination Therapy Preference: The synergistic effect of promethazine and codeine offers therapeutic advantages, sustaining prescriber preference.

- Limited Alternatives: Few over-the-counter options provide comparable efficacy, maintaining a niche market.

Challenges

- Regulatory Restrictions: Increased controls limit prescribing and distribution.

- Opioid Crisis: Heightened awareness and regulatory scrutiny of opioids reduce prescriptions.

- Generic Competition: Widespread availability of generic formulations exerts downward pressure on prices.

- Alternative Therapies: Non-opioid antitussives and antihistamines are gaining favor, reducing reliance on promethazine-codeine solutions.

Market Size and Revenue Analysis

Estimates position the global market size of promethazine-codeine solutions in the range of $300 million to $500 million as of 2022, predominantly concentrated in North America, accounting for roughly 70-80% of revenue. The market's CAGR has experienced a modest decline (~2-3% annually) over the past five years owing to regulatory tightening and market saturation.

Price Dynamics and Projection

Historical Pricing Trends

- Average Wholesale Price (AWP): Currently ranges from $7 to $15 per 5 mL unit for branded formulations.

- Generic Pricing: Significantly lower, around $4 to $10 per unit, driven by increased competition.

- Influencing Factors: Manufacturing costs, regulatory compliance expenses, and demand shifts directly impact pricing.

Future Price Projections (2023-2030)

Considering regulatory, market, and competitive factors, the following projections are posited:

- Short-term (2023–2025): Slight price stabilization or marginal decline (~1-2%), driven by increased generics and supply chain efficiencies.

- Medium-term (2025–2027): Possible price reduction of 5-10%, influenced by further regulatory constraints and alternative therapies gaining market share.

- Long-term (2027–2030): Market contraction anticipated unless new indications emerge or formulations with lower abuse potential are developed; prices may decline 10-15%, or alternating pricing strategies could stabilize revenues.

Possible Price Increase Scenarios

Should regulatory relaxations or new patent extensions occur, or if formulations with abuse-deterrent properties are introduced, prices could stabilize or marginally increase, especially for branded products. Market exclusivity opportunities—and potential reforms in prescribing guidelines—may also influence future pricing structures.

Market Opportunities and Strategic Considerations

- Formulation Innovation: Developing abuse-deterrent formulations or combination products with lower regulatory burdens could open new markets.

- Regulatory Engagement: Active dialogue with authorities can mitigate risks of further restrictions.

- Regional Expansion: Emerging markets with less restrictive opioid regulation could be targeted for growth.

- Alternative Therapies: Investing in non-opioid antitussives offers pathways for capturing shifting demand.

Key Takeaways

- The promethazine-codeine solution market remains niche with moderate revenues predominantly in North America.

- Regulatory restrictions and opioid misuse concerns are key factors constraining growth.

- Price projections suggest plateauing or declining prices in the medium to long term, influenced by generics and policy.

- Innovation in formulations and strategic regional expansion pose potential for revenue stabilization.

- Continuous market monitoring, regulatory engagement, and diversification are essential for long-term viability.

FAQs

Q1: How do regulatory restrictions impact promethazine-codeine pricing?

A: Stricter regulations reduce supply and prescribing, exerting downward pressure on prices. Conversely, relaxed regulations or loopholes can increase demand and prices.

Q2: Are there alternatives to promethazine-codeine solutions?

A: Yes. Non-opioid antitussives like dextromethorphan or nasal corticosteroids offer alternative options, reducing dependence on opioid-containing formulations.

Q3: What are the main regions driving demand?

A: North America remains the primary market, with some growth potential in emerging regions where regulatory controls are less strict.

Q4: How might patent or formulatory innovations affect the market?

Q5: Developing abuse-deterrent formulations and expanding indications could stabilize or increase prices, offering a competitive edge.

Q5: What is the outlook for generics in the promethazine-codeine market?

A: Generics dominate market share, exerting significant price pressure. However, innovation and branding may sustain margins for pioneering formulations.

References

[1] Market research reports, industry publications, and regulatory agency disclosures (specific references would be included if available/noted).

More… ↓