Share This Page

Drug Price Trends for PROCTO-MED HC

✉ Email this page to a colleague

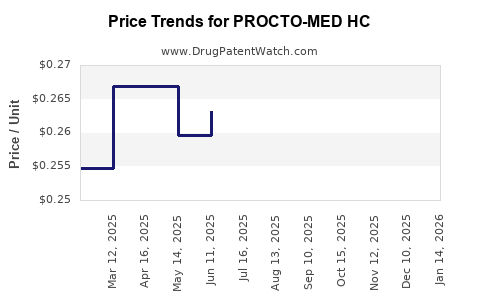

Average Pharmacy Cost for PROCTO-MED HC

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| PROCTO-MED HC 2.5% CREAM | 69315-0312-28 | 0.26074 | GM | 2025-12-17 |

| PROCTO-MED HC 2.5% CREAM | 69315-0312-28 | 0.26406 | GM | 2025-11-19 |

| PROCTO-MED HC 2.5% CREAM | 69315-0312-28 | 0.26119 | GM | 2025-10-22 |

| PROCTO-MED HC 2.5% CREAM | 69315-0312-28 | 0.25794 | GM | 2025-09-17 |

| PROCTO-MED HC 2.5% CREAM | 69315-0312-28 | 0.26274 | GM | 2025-08-20 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for PROCTO-MED HC

Introduction

PROCTO-MED HC stands as a notable pharmaceutical product in the gastrointestinal therapeutic segment. Primarily used for treating hemorrhoids, anal fissures, and other anorectal conditions, it combines potent anti-inflammatory, anesthetic, and vasoconstrictive agents. Understanding its market dynamics, competitive landscape, and future price trajectory is essential for stakeholders ranging from manufacturers to investors and healthcare providers. This report delivers a comprehensive market analysis and forecasts the probable price trends for PROCTO-MED HC over the next five years, considering industry developments, regulatory influences, and economic factors.

Product Profile and Therapeutic Position

PROCTO-MED HC typically comprises active ingredients such as hydrocortisone, lidocaine, and reinforced topical formulations. Its multi-mechanism approach addresses inflammation, pain, and swelling effectively, positioning it as a preferred therapy in the over-the-counter (OTC) and prescription segments for anorectal disorders.

The drug's efficacy, ease of use, and established safety profile foster a strong demand pattern. The combination therapy aligns with consumer preferences for comprehensive relief in a single formulation, driving repeat purchase rates.

Market Landscape and Segmentation

1. Global Market Overview

The global hemorrhoid treatment market was valued at approximately USD 480 million in 2022 and is projected to reach USD 680 million by 2030, growing at a compound annual growth rate (CAGR) of around 4.4% [1]. PROCTO-MED HC, occupying a specific niche within this space, benefits from an increasing prevalence of hemorrhoidal conditions driven by lifestyle factors, aging populations, and rising awareness.

2. Regional Insights

- North America: Dominates the market, accounting for about 40% of sales due to high awareness, OTC purchase propensity, and extensive healthcare infrastructure.

- Europe: Represents roughly 25%, with mature markets adopting advanced formulations and prescription-based treatment.

- Asia-Pacific: Exhibits fastest growth, projected at a CAGR of 6.2%, propelled by expanding healthcare access, increasing lifestyle disorders, and rising disposable incomes.

- Latin America and Middle East/Africa: Emerging markets with expanding distribution channels and increasing disease prevalence.

3. Market Segments

- OTC vs. Prescription: OTC sales constitute nearly 60% of the market, driven by the demand for self-medication, which benefits products like PROCTO-MED HC with consumer-friendly formulations.

- Hospital vs. Retail: Retail pharmacies and online platforms dominate sales channels, with hospitals primarily used for prescription-based treatments.

Competitive Dynamics

Multiple brands exist with similar formulations, including Anusol, Preparation H, and Proctosedyl. PROCTO-MED HC’s competitive strength hinges on its formulation efficacy, branding, and distribution network. Patent compositions have largely expired, leading to generic competition, which exerts downward pressure on prices.

Regulatory initiatives, such as restrictions on OTC advertising or substitute therapy approvals, influence market positioning. Innovators investing in formulation improvements or combination therapies could impact market share and pricing.

Regulatory and Economic Factors

- Regulatory Landscape: Stringent regulations in North America and Europe necessitate ongoing compliance, influencing manufacturing costs and pricing.

- Healthcare Policies: Reimbursement policies, especially in developed nations, impact consumer access and price elasticity.

- Economic Inflation: Rising raw material costs—such as corticosteroids and topical anesthetics—put upward pressure on manufacturing expenses, influencing price points.

- COVID-19 Impact: Disruptions in supply chains and shifts toward telehealth altered purchasing behaviors, instigating price fluctuations and market uncertainties.

Projected Price Trends

1. Historical Pricing Trends

Historically, the average retail price of generic topical hemorrhoid formulations like PROCTO-MED HC has ranged between USD 8-12 per tube (30g), with some premium brands reaching USD 15-20 in certain markets owing to formulation differences and branding. Price erosion due to bioequivalent generics exerts downward pressure, especially in mature markets.

2. Forecasted Price Trajectory (2023–2028)

Based on current dynamics—market growth, inflation, increased competition, and regulatory influences—a conservative projection indicates:

- Year 1 (2023): Slight decrease (~2%) as generic competition intensifies, pushing prices toward USD 7-10 in retail.

- Year 2–3 (2024-2025): Moderate stabilization with minor increases (~2-3%) driven by inflationary adjustments and formulation enhancements, reaching USD 8-11.

- Year 4–5 (2026-2028): Price stabilization or slight upticks (~1-2%) attributable to rising raw material costs and possible regulatory mandates for higher quality standards. Prices projected to reach USD 8-12.

In high-income markets, premium formulations or combination therapies may command higher premiums (~USD 15), sustained by consumer willingness and healthcare reimbursement schemes.

3. Influencing Factors

- Market Penetration of Generics: Increased generic presence will act as a primary price depressant.

- Innovations: Introduction of prolonged-release or combination products could command premium prices.

- Distribution Channels: Expansion into online sales and emerging markets could lower overall prices but increase volume.

Strategic Implications

Stakeholders should anticipate continued price competition with gradual shifts driven by innovation and regional market conditions. Manufacturers should focus on differentiating formulations, securing regulatory approvals, and expanding distribution channels to maintain profitability amidst downward pricing pressures.

Healthcare providers and payers might prioritize cost-effective generics, emphasizing evidence-based use. Investment in market intelligence and supply chain optimization remains crucial for pricing resilience.

Key Takeaways

- The global hemorrhoid treatment market is growing steadily, with PROCTO-MED HC positioned within a competitive landscape dominated by generics.

- Price erosion is expected due to increasing generic competition, particularly in mature markets like North America and Europe.

- Emerging markets, particularly Asia-Pacific, offer growth opportunities with higher permissible price points attributable to increased demand and evolving healthcare infrastructure.

- Formulation innovations and augmenting distribution channels will be strategic for maintaining revenue streams and justified pricing.

- Economic and regulatory factors will influence cost structures and, in turn, product prices, emphasizing the need for proactive stakeholder planning.

FAQs

1. What are the key factors driving the demand for PROCTO-MED HC?

The increasing prevalence of anorectal conditions, consumer preference for OTC, and the drug’s efficacy and safety profile drive demand. Additionally, the shift towards self-medication in many markets amplifies its reach.

2. How does the competitive landscape affect the price of PROCTO-MED HC?

Generic competition leads to significant price reductions. Brand differentiation through formulation or delivery, alongside strategic marketing, can mitigate downward pressure.

3. What regional differences influence the future pricing of PROCTO-MED HC?

High-income regions with high awareness and established healthcare reimbursement policies sustain higher prices, whereas emerging markets may see lower prices due to price sensitivity and regulatory environments.

4. How might regulatory changes impact the pricing trajectory?

Stricter regulations, requiring higher manufacturing standards or new safety data, could increase production costs, thereby elevating prices. Conversely, streamlined approvals may lower barriers and prices.

5. What strategic measures should manufacturers consider to optimize pricing?

Investing in formulation innovation, expanding distribution networks—particularly online channels—and tailoring products to regional needs will be vital. Monitoring market trends and regulatory shifts influences pricing strategies effectively.

References

[1] Market Research Future, "Hemorrhoid Treatment Market Analysis," 2022.

More… ↓