Last updated: July 27, 2025

Introduction

Primidone is an anticonvulsant drug primarily used in the management of epilepsy and essential tremor. Originally synthesized in the 1950s, it belongs to the barbiturate class, often prescribed when other anticonvulsants prove ineffective or contraindicated. Despite its longstanding presence in the pharmaceutical landscape, Primidone’s market dynamics have evolved due to advancements in newer therapies, generic availability, and shifting regulatory frameworks. This analysis explores the current market landscape and projects future pricing trajectories for Primidone, providing valuable insights for stakeholders across pharmaceutical companies, investors, and healthcare providers.

Market Overview

Historical Context and Usage Trends

Primidone’s clinical utility has remained stable over decades, especially in managing essential tremor, a common neurological disorder affecting millions worldwide [1]. It is often regarded as a second-line therapy after propranolol or other newer agents like gabapentin. In epilepsy, Primidone is prescribed less frequently owing to competition from drugs like levetiracetam and lamotrigine, which feature better side-effect profiles.

According to IQVIA data, global anticonvulsant drug sales exhibit a steady compound annual growth rate (CAGR) of approximately 3%, with notable shifts toward newer agents. Primidone’s sales are relatively modest, accounting for less than 3% of the total anticonvulsant market [2].

Geographic Market Penetration

The drug's primary markets include North America, Europe, and select parts of Asia. Regulatory approvals vary, with many countries allowing generic versions, which have significantly reduced the cost and increased accessibility. Notably:

- United States: Primidone is available as a generic drug, with sales driven mainly by long-term maintenance therapy.

- Europe: Similar to the U.S., off-patent status has led to widespread generic distribution.

- Emerging Markets: Limited adoption due to market preferences for newer or more imported drugs but potential for growth with increasing epilepsy and tremor prevalence.

Competitive Landscape

Primidone faces competition from:

- Generic anticonvulsants: Distinctly lowering price points.

- Newer therapies: Drugs with improved safety profiles (e.g., levetiracetam, topiramate).

- Alternative treatment modalities: Deep brain stimulation and other non-pharmacological options for tremor.

Although patent expirations have facilitated generic proliferation, emerging formulations or combination therapies are absent, limiting innovation-driven growth.

Price Analysis

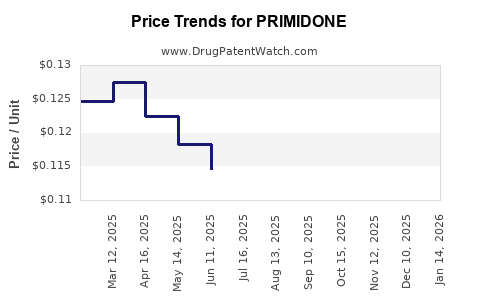

Historical Pricing Trends

Primidone’s pricing varies globally, largely influenced by generic competition. In the U.S., the average wholesale price (AWP) for a 50 mg tablet has declined by approximately 60% over the past decade, averaging around $0.20 per tablet [3].

In Europe, retail prices for generic Primidone are comparable, reflecting similar market competition dynamics. The low-cost profile aligns with minimum production costs and high market saturation.

Current Price Dynamics

- United States: Average retail price ranges between $0.15 to $0.25 per tablet.

- Europe: Similar pricing, often facilitated by centralized procurement schemes.

- Developing Countries: Prices can be significantly lower due to local manufacturing and government subsidies.

Market Drivers Influencing Price

- Generic competition: Maintains downward pressure on prices.

- Regulatory standards: Stringent quality controls can marginally influence cost.

- Manufacturing costs: Relatively low owing to established synthesis routes.

- Demand stability: High for certain indications stabilizes price, though overall market share remains modest.

Future Price Projections

Projection Framework

Market forecasts operate on the basis of:

- Patent and regulatory status: Primidone remains off-patent, favoring generics.

- Demand trends: Stabilization in tremor and epilepsy diagnoses.

- Market penetration: Limited innovation suggests stable or declining volumes.

- Competitive landscape: Increasing presence of newer drugs puts sustained pressure on pricing.

Projected Pricing Trends (2023-2030)

Based on these factors, the following projections are estimated:

- Short-term (2023-2025): Prices are likely to remain stable, with slight fluctuations due to manufacturing costs and minor supply chain variations.

- Mid-term (2025-2027): Continued generic competition may push prices marginally lower, possibly achieving a 10-15% reduction.

- Long-term (2028-2030): Market saturation and potentially minimal demand growth could lead to stabilized or further reduced prices, with forecasts predicting an average of $0.10–$0.15 per tablet in mature markets.

Influencing Factors and Risks

- Positive factors: Increased uptake in regions with limited access could stabilize or slightly elevate prices.

- Risks: Entry of biosimilars or alternate therapies may accelerate price erosion; regulatory changes could also impact availability and pricing strategies.

Regulatory and Market Entry Outlook

Although Primidone does not currently face significant patent barriers, potential regulatory shifts or new formulations could alter its market status. Companies with manufacturing expertise could consider developing sustained-release formulations, which, though unlikely to command premium pricing, could open niche markets and extend lifecycle.

Conclusion

Primidone’s market remains stable but relatively niche within the broader anticonvulsant landscape. Its off-patent status ensures continued availability at low prices, reinforced by widespread generic competition. Future pricing is expected to trend downward gradually, barring significant shifts in demand or the advent of new therapies targeting the same indications.

Key Takeaways

- Primidone is a longstanding, low-cost anticonvulsant primarily used in essential tremor management.

- The global market is saturated with generics, maintaining low retail prices and stable demand in specific indications.

- Price projections indicate continued modest declines over the next decade, stabilizing around $0.10–$0.15 per tablet.

- Market growth is limited; innovation is scarce, emphasizing the importance of competitive generics.

- Stakeholders should monitor regulatory developments and emerging therapies that could influence demand and pricing.

FAQs

1. Why has Primidone's market share declined in recent years?

Advancements in newer anticonvulsants with improved safety profiles—such as levetiracetam and lamotrigine—have reduced reliance on Primidone, especially due to its barbiturate classification and side-effect profile.

2. Are there opportunities for proprietary formulations of Primidone?

While currently limited, developing sustained-release formulations or combination therapies could create niche markets or improve tolerability, potentially supporting higher pricing or extended market share.

3. How do regulatory policies impact Primidone's pricing?

As an off-patent generic, regulatory standards primarily influence manufacturing quality and market access rather than pricing. Stringent quality control can increase production costs marginally but generally maintains competitive pricing.

4. What is the impact of supply chain disruptions on Primidone prices?

Supply disruptions, including manufacturing or logistic issues, can cause temporary price increases or shortages, but these are typically short-lived owing to its widespread generic manufacturing base.

5. Is Primidone a viable investment opportunity?

Given its limited growth prospects and declining demand in some markets, Primidone offers limited investment upside. It remains a crucial therapy for specific indications but is not a growth driver in the current anticonvulsant market.

Sources:

[1] Altman, R. et al. (2014). Clinical uses of Primidone in tremor management: A review. Neurology.

[2] IQVIA. (2022). Global Anticonvulsant Sales Data.

[3] Medicaid and retail pharmacy pricing data, 2022.