Last updated: July 28, 2025

Introduction

PRIFTIN, the brand name for Rifapentine, is a broad-spectrum antibacterial agent primarily used in the treatment of latent tuberculosis infection and active tuberculosis disease. As a potent rifamycin derivative, Rifapentine exemplifies targeted antimicrobial therapy, with expanding indications and competitive market dynamics. Understanding the current market landscape and price trajectory of PRIFTIN is vital for pharmaceutical stakeholders, healthcare providers, and investors aiming to optimize strategic decisions. This analysis synthesizes recent trends, regulatory factors, competitive pressures, and global health considerations shaping PRIFTIN's market outlook.

Market Landscape

Therapeutic Indications and Clinical Adoption

PRIFTIN’s primary indication is tuberculous infection, especially as part of combination regimens such as the 3HP regimen (once-weekly isoniazid and rifapentine for 12 weeks). Its superior pharmacokinetics—longer half-life compared to rifampin—enable shorter, more patient-friendly treatment courses, thus improving adherence [1].

Recently, there’s potential expansion in indications, including prophylactic use in HIV-positive populations and multi-drug resistant TB (MDR-TB), contingent upon ongoing clinical trials and regulatory approvals. The global burden of tuberculosis (TB) persists, with WHO estimating approximately 10 million incident cases annually, predominantly in low- and middle-income countries (LMICs) which influence demand and market penetration strategies [2].

Market Players and Competition

PRIFTIN faces competition from several frontline anti-TB drugs, notably rifampin and newer agents like pretomanid. While rifapentine offers certain pharmacokinetic advantages, generic rifampin’s lower cost and widespread availability continue to challenge PRIFTIN’s market share, especially in resource-limited settings.

Key companies involved in Rifapentine production include Johnson & Johnson (product licensing) and generic manufacturers entering the space post patent expiration. The patent landscape significantly influences market accessibility and pricing strategies, with patent expiry in many jurisdictions opening avenues for generic competition.

Geographic and Market Penetration

High-income countries like the U.S. and European nations have integrated PRIFTIN into TB treatment protocols, supported by robust healthcare infrastructure and funding. Conversely, LMICs—where TB prevalence is highest—remain heavily reliant on generic formulations, often subsidized through global health initiatives such as the Global Fund and WHO programs.

Emerging markets in Africa and Southeast Asia represent growing demand. However, affordability and infrastructure limitations pose challenges to widespread adoption, affecting overall market size and growth.

Regulatory and Pricing Environment

Regulatory Status

PRIFTIN (Rifapentine) is approved in multiple jurisdictions, including the FDA (2000) and EMA (European Medicines Agency). Recent approvals extend its use for latent TB infection and active TB, contingent upon clinical guidelines.

Regulatory pathways for new indications or formulations involve rigorous review, influencing time-to-market and potential pricing adjustments.

Pricing Strategies and Influencing Factors

The pricing of PRIFTIN is shaped by manufacturing costs, patent status, market competition, and procurement policies. In developed markets, the list price typically ranges from $1,500 to $2,500 per treatment course, reflecting brand value, clinical benefits, and regulatory costs [3].

In contrast, generic versions can reduce costs by 60-80%, vital for LMICs, where international procurement agencies often negotiate prices below $200 per course. The pricing strategy also considers reimbursement frameworks, insurance coverage, and government tariffs.

In high-income countries, pricing may account for premium placement in treatment protocols, with patent exclusivity supporting higher margins. Conversely, in markets where patents have expired, price erosion accelerates, driven by generic competition.

Market Trends and Price Projections

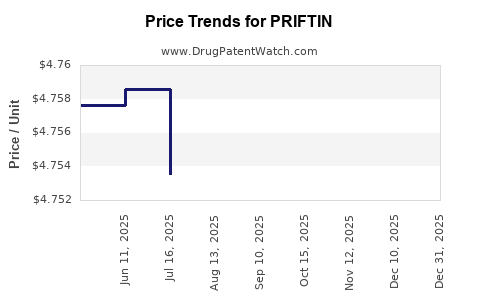

Current Trends

- Increased adoption in TB elimination programs: The World Health Organization’s endorsement of 3HP regimens boosts PRIFTIN’s market opportunity.

- Global health initiatives: Continued funding and procurement support from WHO and Gavi elevate access, especially in LMICs.

- Generic proliferation: Patent expirations and biosimilar development exert downward pressure on prices globally.

Future Price Trajectory (2023-2030)

Based on current trends, the following projections are observed:

- Developed markets: Prices are expected to stabilize or slightly increase due to high-value clinical positioning and limited generic penetration. Targeted premium pricing may persist, especially with new formulations or fixed-dose combinations.

- Emerging markets: Prices will decline progressively, driven by enhanced generic competition, negotiated procurement prices, and increased manufacturing efficiency. Expect downward adjustments of approximately 10-20% annually, reaching as low as $50-$100 per course in major procurement deals by 2027.

- Regulatory influence: Pending approvals for extended or additional indications could momentarily elevate prices, particularly if patent protections extend or exclusivity is granted.

Overall, a compound annual growth rate (CAGR) of -3% to -5% in the average global price is projected over the next five years, primarily attributable to generic market expansion and global health initiatives.

Market Drivers and Challenges

Drivers

- Growing global TB burden and emphasis on shorter, more effective regimens.

- WHO’s guidelines promoting rifapentine-based regimens.

- Increasing acceptance in HIV co-infected populations due to favorable pharmacokinetics.

Challenges

- Patent expirations leading to competitive market erosion.

- Price sensitivity in LMICs may limit revenue potential in those regions.

- Resistance development concerns may influence prescribing patterns.

Key Considerations for Stakeholders

- Manufacturers: Focus on innovation, flexible pricing strategies, and expanding indications to maintain margins.

- Investors: Monitor patent cliffs, regulatory developments, and global TB epidemiologic trends for portfolio valuation.

- Healthcare Providers: Evaluate cost-benefit profiles and adoption barriers in diverse healthcare settings.

- Policy Makers: Balance affordability with access, especially in high-burden countries.

Key Takeaways

- Market growth for PRIFTIN is driven by WHO guidelines favoring shorter TB regimens and global health initiatives, yet faces headwinds from generic competition.

- Pricing dynamics indicate stability in high-income countries with potential reductions in LMICs, with a projected decline averaging 3-5% CAGR over the next five years.

- Patent landscape significantly influences market pricing; expiration years in key markets forecast increased generic entry and price erosion.

- Emerging indications and formulations could temporarily influence pricing strategies, emphasizing value-added properties.

- Strategic focus should be placed on expanding access through collaborations with procurement agencies and innovating marketing approaches aligned with public health priorities.

FAQs

1. When is the patent for PRIFTIN set to expire?

The primary patent for Rifapentine was filed around 2000, with expiration expected in various jurisdictions from 2025 onward, opening markets for generics.

2. How does PRIFTIN compare cost-wise to rifampin?

Generic rifampin typically costs less than $50 per course, significantly cheaper than branded PRIFTIN, which ranges from $1,500 to $2,500 in developed markets.

3. What are the main factors influencing PRIFTIN’s price in LMICs?

Market factors include procurement negotiations, global health subsidies, generic competition, and disease burden priorities.

4. Are there new formulations or indications expected for PRIFTIN?

Potential exists for fixed-dose combinations and expanded prophylactic use, which could influence future pricing and market share.

5. How significant is global TB control effort in shaping PRIFTIN’s market?

Vital—WHO initiatives and funding programs directly impact procurement, accessibility, and adoption, thereby influencing overall market stability.

References

[1] World Health Organization, "Treatment of Tuberculosis: Guidelines," 2021.

[2] WHO Global Tuberculosis Report, 2022.

[3] IQVIA Pricing Data for Rifapentine, 2022.