Share This Page

Drug Price Trends for PREZISTA

✉ Email this page to a colleague

Average Pharmacy Cost for PREZISTA

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| PREZISTA 600 MG TABLET | 59676-0562-01 | 35.01006 | EACH | 2025-11-19 |

| PREZISTA 800 MG TABLET | 59676-0566-30 | 70.08562 | EACH | 2025-11-19 |

| PREZISTA 600 MG TABLET | 59676-0562-01 | 34.99375 | EACH | 2025-10-22 |

| PREZISTA 800 MG TABLET | 59676-0566-30 | 69.99644 | EACH | 2025-10-22 |

| PREZISTA 600 MG TABLET | 59676-0562-01 | 34.98528 | EACH | 2025-09-17 |

| PREZISTA 800 MG TABLET | 59676-0566-30 | 69.99090 | EACH | 2025-09-17 |

| PREZISTA 800 MG TABLET | 59676-0566-30 | 69.94896 | EACH | 2025-08-20 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for PREZISTA (Darunavir)

Introduction

PREZISTA (darunavir), developed by Johnson & Johnson, is an antiretroviral drug classified as a protease inhibitor (PI) used predominantly to treat HIV-1 infections. Approved by the U.S. Food and Drug Administration (FDA) in 2006, PREZISTA plays a pivotal role in combination antiretroviral therapy (cART). Its unique mechanism—targeting the viral protease essential for HIV replication—positions it as a cornerstone in HIV treatment regimens. As the global HIV/AIDS landscape evolves, understanding PREZISTA's market dynamics and price trajectory is critical for stakeholders spanning pharmaceutical companies, healthcare providers, payers, and investors.

Market Landscape for HIV Antiretroviral Drugs

The HIV therapeutics market is characterized by high growth, driven by increasing global prevalence and advancements in drug formulations that improve adherence and reduce toxicity. The dominant players include Gilead Sciences, Merck, Johnson & Johnson, and several generics manufacturers.

The market predominantly comprises combination therapies, with most patients on multi-drug regimens to suppress viral loads effectively. Protease inhibitors like PREZISTA maintain relevance, particularly for treatment-experienced patients, drug-resistant strains, or those with contraindications to other agents.

Key Market Segments and Trends

-

Global HIV Prevalence and Treatment Penetration: According to UNAIDS, approximately 38 million people worldwide live with HIV/AIDS, with a significant proportion on antiretroviral treatment (ART). The World Health Organization (WHO) advocates universal access to ART, fueling demand for a range of antiretroviral agents, including protease inhibitors.

-

Adoption of Protease Inhibitors: While integrase inhibitors have gained preference due to their favorable side effect profiles, PI-based regimens remain vital, especially in cases of resistance or intolerability. PREZISTA's high genetic barrier to resistance continues to make it a preferred option for specific patient subsets.

-

Market Competition: Several newer PIs, such as Darunavir (PREZISTA), have been complemented or replaced by integrase inhibitors like Dolutegravir, which offer fewer dosing complexities and reduced side effects. However, PREZISTA remains competitively positioned owing to its efficacy and resistance profile.

Impacts of Patent Status and Generic Entry

PREZISTA’s patent protection was expected to last until approximately 2026-2027, with U.S. patent expiration influencing generic entry plans. Patent cliff dynamics directly impact pricing, market share, and profitability:

-

Patent Expiry and Generic Competition: As patents expire, biosimilars and generics are poised to enter, exerting downward pressure on prices. The potential for early patent challenges or settlement agreements could accelerate generic availability.

-

Brand Premiums and Market Share: In the short-term, Johnson & Johnson leverages its brand, clinical data, and formulary positioning to retain market share.

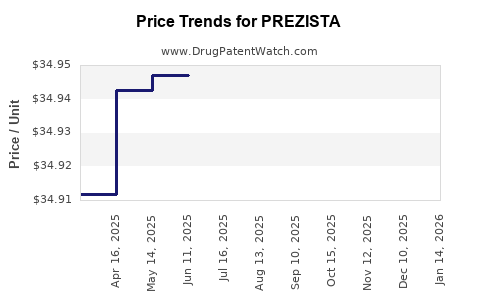

Pricing Dynamics and Historical Trends

-

Pricing Benchmarks: As of 2023, the wholesale acquisition cost (WAC) for PREZISTA is approximately $3,300–$3,600 per month per patient. Pricing varies based on dosage form, adherence programs, and geographic regions.

-

Pricing Trends: Over the past decade, PREZISTA’s prices have remained relatively stable but face downward pressure due to increased competition, patent expiry, and broader healthcare policies aimed at cost containment.

-

Reimbursement and Formularies: Insurance coverage significantly influences actual patient costs. In key markets like the U.S., commercial payers have begun favoring integrase inhibitors, impacting PREZISTA’s formulary access and pricing strategies.

Forecasting Price Trajectories

Short-Term Outlook (1-3 Years):

-

Stability with Slight Decline: Pending patent expiry, prices are expected to decline modestly (~10–20%). J&J might employ rebates, copay assistance, and formulary negotiations to sustain revenue streams.

-

Market Share Stabilization: J&J’s investments in clinical trials, especially for drug combinations, and patient support programs will likely mitigate immediate erosion.

Medium to Long-Term Outlook (3-7 Years):

-

Significant Price Erosion Post-Patent Expiry: Once generics or biosimilars enter, prices could drop by over 50%, aligning with trends observed for other PIs. For example, a study on generic HIV drugs indicated potential price reductions between 50-70% (see [1]).

-

Potential for Pricing Restructuring: J&J might pivot towards value-based pricing models, co-pay assistance, or focus on niche markets (e.g., salvage therapy).

-

Region-Specific Variations: In low- and middle-income countries, price reductions are often influenced by global health initiatives, generic manufacturing, and government negotiations, potentially leading to prices below $1,000 per year.

Innovative Formulations and Combination Products:

- Advances that reduce pill burden and dosing frequency could sustain premium pricing, even amid generic competition.

Factors Influencing Future Pricing and Market Penetration

-

Regulatory Approvals and Patent Litigation: Delays or successful patent challenges can accelerate generic entry, depressing prices.

-

Market Acceptance of Alternatives: Increasing preference for integrase inhibitors like Dolutegravir, which have evolved with fewer side effects and dosing convenience, may further displace PREZISTA as first-line therapy but sustain demand in resistant or salvage settings.

-

Pricing and Access Strategies: The ongoing emphasis on affordable HIV treatment, especially in Africa and Asia, will influence overall profitability, with tiered pricing models and donation programs being prevalent.

Conclusion

PREZISTA remains a critical therapeutic agent within the HIV treatment landscape, primarily due to its robust resistance profile and efficacy in complex cases. However, looming patent expirations and evolving treatment guidelines predict a gradual decline in market dominance and price levels. While short-term prices are stable with minor reductions, the long-term outlook anticipates substantial price erosion driven by generic competition, regional price adjustments, and shifts to newer molecular classes with improved safety and adherence profiles. Strategic positioning through innovation, combination therapies, and access initiatives will be vital for Johnson & Johnson to sustain value.

Key Takeaways

-

Market Position: PREZISTA maintains market relevance due to its resistance profile, especially in treatment-experienced patients, but faces stiff competition from integrase inhibitors.

-

Pricing Trends: Current prices hover around $3,300–$3,600/month in the U.S., with stable short-term outlooks but significant declines expected post-patent expiry.

-

Patent and Competition Impact: Patents ending around 2026–2027 will open gates for generics, likely leading to a 50–70% price reduction in the medium term.

-

Regional Variations: African and Asian markets may see prices drop below $1,000 annually, driven by global health initiatives and generic manufacturers.

-

Innovation as a Buffer: Development of combination products and formulations that improve adherence could mitigate some pricing pressures.

FAQs

1. When is the patent for PREZISTA set to expire?

Johnson & Johnson's patent protections for PREZISTA are expected to expire around 2026-2027 in major markets, opening the pathway for generic competitors.

2. How does PREZISTA's price compare to alternative treatments?

Currently, PREZISTA costs approximately $3,300–$3,600 per month in the U.S., which is higher than many integrase inhibitor-based regimens that can cost between $2,000–$3,000, reflecting differences in formulation, patent status, and market positioning.

3. What factors could prolong PREZISTA’s market relevance?

Its efficacy in resistant HIV strains, high genetic barrier, and use in salvage therapy sustain its market share even as first-line preferences shift toward newer agents.

4. How will the entry of generics impact PREZISTA’s pricing?

Generic entry typically precipitates substantial price reductions, potentially between 50–70%, reducing profitability but expanding access.

5. Are there ongoing innovations to extend PREZISTA’s lifecycle?

Yes, efforts include developing fixed-dose combination therapies and formulations aimed at improving adherence, which could preserve some market value even amid generic competition.

References

[1] UNAIDS. Global HIV & AIDS statistics — 2022 fact sheet. Available at: https://www.unaids.org/en/resources/fact-sheet

More… ↓