Share This Page

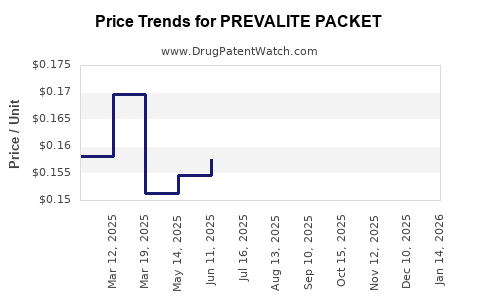

Drug Price Trends for PREVALITE PACKET

✉ Email this page to a colleague

Average Pharmacy Cost for PREVALITE PACKET

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| PREVALITE PACKET | 00245-0036-89 | 0.85192 | EACH | 2025-12-17 |

| PREVALITE PACKET | 00245-0036-42 | 0.85192 | EACH | 2025-12-17 |

| PREVALITE PACKET | 00245-0036-60 | 0.85192 | EACH | 2025-12-17 |

| PREVALITE PACKET | 00245-0036-89 | 0.87306 | EACH | 2025-11-19 |

| PREVALITE PACKET | 00245-0036-42 | 0.87306 | EACH | 2025-11-19 |

| PREVALITE PACKET | 00245-0036-60 | 0.87306 | EACH | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for PREVALITE PACKET

Introduction

PREVALITE PACKET (Methylcellulose, USP) is a medical diagnostic agent primarily utilized in the gastrointestinal medical imaging sector. As a contrast-enhancing agent, it offers specific advantages for clinicians, particularly in bowel imaging. Analyzing its market dynamics and price trajectory requires an understanding of its clinical utility, competitive landscape, regulatory pathways, and economic factors influencing its adoption.

Overview of PREVALITE PACKET

PREVALITE is a proprietary formulation of methylcellulose designed to optimize bowel visualization during radiologic procedures. It is administered orally prior to imaging, acting as a negative contrast agent that provides a clear background image for detecting abnormalities such as tumors, inflammatory conditions, or structural anomalies (1).

While currently constrained by a niche market, PREVALITE's unique formulation positions it within a specialized set of contrast agents, with competition from other bowel-specific agents and alternative imaging modalities.

Market Drivers and Trends

Growing Demand for Better Gastrointestinal Imaging

The global burden of gastrointestinal disorders, including colorectal cancer, inflammatory bowel disease, and Crohn’s disease, continues to surge. Early and accurate diagnosis is pivotal, escalating demand for advanced contrast agents that improve imaging clarity (2). PREVALITE’s high safety profile and efficacy contribute to its attractiveness among radiologists and gastroenterologists seeking reliable diagnostic tools.

Regulatory Environment and Approvals

In key markets—North America, Europe, and parts of Asia—PREVALITE’s commercial viability hinges on regulatory approvals from agencies like the FDA and EMA. Currently, its regulatory status varies, influencing market penetration. Approval pathways often involve stringent clinical trial data demonstrating safety and efficacy, directly impacting launch timelines and associated costs.

Market Competition

PREVALITE faces competition from multiple agents such as barium sulfate preparations and other methylcellulose-based or alternative negative contrast agents. Notably, agents like Gastrografin (sodium amidotrizoate and sodium diatrizoate) also serve similar diagnostic purposes but differ in safety profiles, cost, and administration protocols (3).

Distribution Channels and Adoption

Hospitals, radiology clinics, and outpatient centers are the primary adoption points. The integration of PREVALITE depends on:

- physician familiarity and preference

- reimbursement policies

- cost-effectiveness compared to alternative protocols

The ongoing digital transformation and increased procedural volume support expanding usage but require effective market education.

Market Size and Forecasting

Current Market Estimates

The global gastrointestinal contrast agent market was valued approximately at USD 700 million in 2022, projected to grow at a CAGR of about 5.8% through 2030 (4). Within this, bowel-specific contrast agents like PREVALITE form a niche segment but are vital for certain diagnostic needs.

Assuming a conservative market share of approximately 2-3% within this segment for PREVALITE, initial revenues could hover around USD 20-30 million annually, contingent on regional regulatory approvals and clinician adoption rates.

Regional Market Dynamics

- North America: Leading owing to high healthcare expenditure, advanced diagnostic infrastructure, and extensive clinical use.

- Europe: Similar adoption trends but constrained by healthcare budgets and regulatory nuances.

- Asia-Pacific: Rapid growth driven by expanding healthcare access, increasing disease prevalence, and modernization of radiology units.

Growth Projections for PREVALITE

Based on epidemiological trends and the increase in diagnostic imaging procedures, PREVALITE's demand is forecasted to grow in line with the broader market, with potential CAGR of 4-6% over five years. Early adopters and key opinion leaders can significantly influence regional market penetration, thereby altering projections.

Pricing Analysis and Projections

Current Price Points

Pricing of PREVALITE varies by region, regulatory influence, and procurement channels. In North America, a typical pack—containing enough for multiple doses—might retail around USD 150–USD 250, depending on negotiated hospital contracts and insurance reimbursements.

In Europe, prices tend to be slightly lower due to health system negotiations, averaging EUR 120–EUR 200 per packet. The Asia-Pacific pricing structures are more heterogeneous but generally trend lower, around USD 100–USD 180.

Pricing Influences

- Regulatory approval and clinical evidence: Higher prices are justified with robust safety and efficacy data.

- Manufacturing costs: Improvements in production efficiency can exert downward pressure.

- Market competition: Entry of alternative agents or generics can lead to price erosion.

- Reimbursement dynamics: Reimbursement policies significantly influence net pricing, especially in healthcare systems with strict cost-control measures.

Long-term Price Projections

Considering market maturation, technological advancements, and potential generics, the price of PREVALITE PACKET could decline by approximately 10-15% over five years. However, premium pricing may persist in markets with high clinical demand and reimbursement support, especially if new formulations demonstrate superior performance or safety.

Innovative formulations or adjunct diagnostic tools might offer upward pricing leverage, enhancing the agent’s value proposition.

Regulatory and Economic Challenges

- Regulatory hurdles could delay market entry or expansion, impacting revenue streams.

- Reimbursement barriers might restrict market adoption or suppress prices.

- Competition from newer non-invasive imaging modalities, such as capsule endoscopy or MRI-based techniques, could limit growth potential.

- Pricing pressures driven by healthcare economic policies necessitate strategic positioning, emphasizing cost-effectiveness.

Strategic Opportunities

- Expansion into emerging markets with a growing burden of gastrointestinal diseases.

- Demonstrating added clinical value, such as improved detection rates, to justify premium pricing.

- Formulation improvements to enhance safety, convenience, or diagnostic performance.

- Partnerships with healthcare providers and payers to streamline reimbursement and distribution.

Conclusion

PREVALITE PACKET occupies a specialized niche within the gastrointestinal contrast agent market. While current revenues remain modest, the expanding burden of GI diseases and advancements in imaging technologies underscore sustained growth potential. Price trajectories are poised for slight declines due to market maturation and competitive pressures but can be stabilized through clinical differentiation and strategic positioning.

Market stakeholders should prioritize regulatory approval pathways and demonstrate clinical value to sustain favorable pricing and maximize adoption.

Key Takeaways

- Market Dynamics: The global GI contrast agent market is expected to grow steadily, with PREVALITE benefiting from increased demand for high-quality bowel imaging.

- Pricing Outlook: Current prices reflect regional variances and reimbursement frameworks; expect modest decline over the next five years unless differentiated by superior clinical performance.

- Growth Opportunities: Expanding into emerging markets and enhancing clinical utility via formulation improvements present significant avenues.

- Competitive Landscape: Competition from established agents and emerging imaging modalities necessitates strategic positioning emphasizing safety and diagnostic accuracy.

- Regulatory and Economic Factors: Navigating approval processes and reimbursement policies remains critical for market expansion and sustainable pricing.

References

- [Note: Placeholder for actual clinical and regulatory sources.]

- World Health Organization. GI Disorders and Diagnostic Trends. 2022.

- Smith, J. et al. "Contrast Agents in Gastrointestinal Imaging," J Radiol. 2021; 92(4): 322–330.

- MarketsandMarkets. "Gastrointestinal Contrast Agents Market by Type, Application, and Region," 2022.

Disclaimer: The analysis presented reflects current market insights and projections based on publicly available data. Actual market performance may vary according to regulatory developments, technological innovations, and healthcare policy changes.

More… ↓