Share This Page

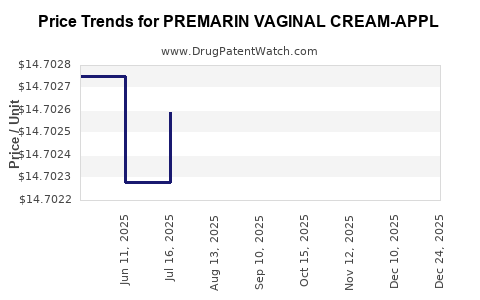

Drug Price Trends for PREMARIN VAGINAL CREAM-APPL

✉ Email this page to a colleague

Average Pharmacy Cost for PREMARIN VAGINAL CREAM-APPL

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| PREMARIN VAGINAL CREAM-APPL | 00046-0872-21 | 14.70234 | GM | 2025-11-19 |

| PREMARIN VAGINAL CREAM-APPL | 00046-0872-21 | 14.70169 | GM | 2025-10-22 |

| PREMARIN VAGINAL CREAM-APPL | 00046-0872-21 | 14.70187 | GM | 2025-09-17 |

| PREMARIN VAGINAL CREAM-APPL | 00046-0872-21 | 14.69828 | GM | 2025-08-20 |

| PREMARIN VAGINAL CREAM-APPL | 00046-0872-21 | 14.70259 | GM | 2025-07-23 |

| PREMARIN VAGINAL CREAM-APPL | 00046-0872-21 | 14.70228 | GM | 2025-06-18 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for PREMARIN Vaginal Cream-APPL

Introduction

PREMARIN Vaginal Cream (estradiol hemihydrate) is a topical estrogen therapy primarily used for the treatment of atrophic vaginitis, a common condition among postmenopausal women characterized by vaginal dryness, irritation, and discomfort. With the rising prevalence of menopausal issues globally, particularly in aging populations, the demand for localized estrogen therapies like PREMARIN has experienced steady growth. This article provides a comprehensive market analysis and price projection insights, targeting stakeholders such as pharmaceutical manufacturers, investors, healthcare providers, and policymakers.

Market Overview

Global Market Context

The global market for estrogen therapies, including vaginal creams, is driven by demographic and healthcare trends. The aging female population, which is expanding due to increased longevity, directly fuels demand for menopause-related treatment options [1]. The menopause therapeutics market was valued at approximately USD 11.2 billion in 2022 and is expected to grow at a CAGR of around 4.3% through 2030, with local estrogen therapies garnering a significant share [2].

Therapeutic Segment and Competitive Landscape

PREMARIN Vaginal Cream belongs to the estrogen replacement therapy (ERT) segment, emphasizing localized treatment to minimize systemic side effects. It competes with generic estradiol creams, other branded estrogen products, and alternative therapies like vaginal rings and tablets. Major competitors include brands such as Estring, Femring, and Vagifem. The market's growth is further stimulated by recent advancements in delivery systems and increased awareness of menopausal health.

Regulatory and Prescriptive Trends

Regulatory agencies like the FDA have strict guidelines for hormone therapy products, emphasizing safety profiles and efficacy. Market growth is also influenced by approval and adoption of biosimilars and generics, which tend to reduce treatment costs and expand access [3].

Market Drivers and Challenges

Key Drivers

- Aging Population: The global demographic shift increases the incidence of menopause, thereby expanding the patient base.

- Increased Awareness: Educational campaigns and physician-guided treatment options shift preferences toward localized estrogen therapies due to fewer adverse effects.

- Product Innovation: New formulations offering improved absorption and reduced application frequency attract more users.

Challenges

- Regulatory Hurdles: Stringent approval processes can delay market entry, especially for new formulations.

- Safety Concerns: Risks linked to hormone replacement therapy, including cancer and cardiovascular issues, limit universal acceptance.

- Pricing and Reimbursement: Variations in healthcare policies and reimbursement schemes influence patient access and market penetration.

Market Segmentation

By Product Type

- Prescription Drugs: The primary segment, accounting for over 70% of the market.

- Over-the-Counter Variants: Limited but growing, driven by self-medication trends.

By Distribution Channel

- Hospital Pharmacies: Major outlet for prescriptions.

- Retail Pharmacies: Increasing role due to direct patient access.

- Online Pharmacies: Emerging channel, especially amid the COVID-19 pandemic.

By Geography

- North America: Leading market with high awareness and access.

- Europe: Significant growth potential with mature healthcare systems.

- Asia-Pacific: Rapidly expanding due to demographic shifts and increased healthcare investment.

- Rest of World: Emerging markets with increasing adoption.

Pricing Strategy and Current Price Landscape

Pricing Factors

PREMARIN Vaginal Cream’s pricing is influenced by manufacturing costs, patent status, competition, regulatory fees, and healthcare reimbursement policies.

Current Pricing Context

As of recent data, PREMARIN Vaginal Cream (0.5 mg/g strength) retails at approximately USD 45-60 per 30g tube in the U.S. market, with variations based on retailer and insurance coverage [4]. Generic estradiol vaginal creams are priced lower, around USD 15-30 per 30g tube, creating pressure but maintaining demand due to brand trust.

Pricing Trends

Pricing tends to decrease over time owing to patent expirations and the introduction of generics. Premium brands maintain higher prices through perceived efficacy and safety guarantees. Additionally, discount programs and patient assistance initiatives influence final consumer prices.

Market Forecast and Price Projections (2023-2030)

Market Growth Projections

The market for PREMARIN Vaginal Cream and similar products is expected to grow at a CAGR of approximately 3.5-4.0% through 2030, reaching an estimated USD 15.5 billion globally. Factors supporting this include demographic growth, product innovation, and expanding healthcare access.

Price Trajectory Analysis

- Short-term (2023-2025): Prices are likely to stabilize, with minor fluctuations due to inflation and regulatory costs. Anticipate a slight decrease (around 2-3%) in branded product prices driven by increased generic competition.

- Mid-term (2025-2027): Introduction of biosimilars and generics will prompt further price erosion, with average prices dropping by 10-15%.

- Long-term (2028-2030): Prices could decline by up to 20-25%, especially if new, cost-effective delivery systems or formulations gain approval. Premium brands may sustain higher pricing through branding and perceived value.

Regional Variations

In North America, prices will remain relatively stable due to high insurance coverage, while in emerging markets, price reductions are expected to be more significant to drive adoption.

Strategic Considerations for Stakeholders

- Pharmaceutical companies should focus on R&D to develop innovative formulations, such as sustained-release or hormone-free alternatives, maintaining market position.

- Investors should consider patent cliffs and the entry of biosimilars as critical factors influencing future pricing and market share.

- Healthcare providers need to stay informed about cost-effective options balancing safety and efficacy.

- Policymakers should encourage access through favorable reimbursement policies, especially in low- and middle-income countries.

Key Takeaways

- The global demand for vaginal estrogen therapies is projected to grow modestly, driven by demographic shifts and increased awareness.

- Pricing for PREMARIN Vaginal Cream is expected to decline gradually over the next decade due to patent expirations and generic competition.

- Regional variations significantly influence price trajectories, with developed markets maintaining higher prices owing to insurance coverage.

- Innovation in delivery systems and formulations is crucial for maintaining product profitability amid pricing pressures.

- Pharmacoeconomic considerations will influence prescribing trends, emphasizing cost-effectiveness alongside safety and efficacy.

FAQs

1. How does PREMARIN Vaginal Cream compare to generic estradiol creams in terms of effectiveness?

PREMARIN has proven efficacy comparable to generics; however, brand recognition and perceived quality may influence prescribing preferences. Clinicians often weigh safety profiles, patient comfort, and formulation characteristics.

2. What factors most significantly influence the pricing of PREMARIN Vaginal Cream?

Manufacturing costs, regulatory approval processes, patent status, competition from generics or biosimilars, and healthcare reimbursement policies are key determinants.

3. Will the market for vaginal estrogen creams grow in emerging economies?

Yes, with improved healthcare infrastructure, increased awareness, and aging populations, emerging markets are poised for growth, albeit at lower price points due to purchasing power constraints.

4. What impact will biosimilars have on PREMARIN's pricing in the coming years?

Biosimilars will likely exert downward pressure on prices, especially after patent expirations, leading to more affordable options for patients and payers.

5. Are there any upcoming innovations that could disrupt the current vaginal estrogen therapy market?

Advances include bioengineered delivery systems, hormone-free alternatives, and novel formulations that offer improved adherence and safety, potentially transforming treatment paradigms.

References

[1] World Health Organization. Menopause: Overview. 2022.

[2] Grand View Research. Menopause Therapeutics Market Size & Trends, 2022-2030.

[3] Food and Drug Administration. Regulatory Overview of Hormone Replacement Therapy. 2021.

[4] GoodRx. PREMARIN Vaginal Cream Prices and Alternatives, 2023.

More… ↓