Share This Page

Drug Price Trends for PREMARIN

✉ Email this page to a colleague

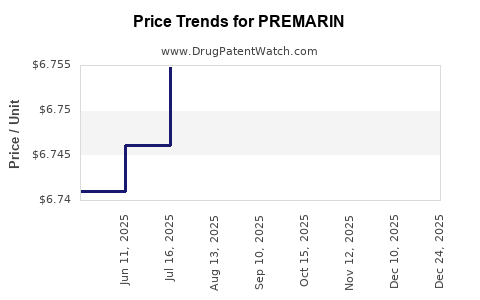

Average Pharmacy Cost for PREMARIN

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| PREMARIN 0.3 MG TABLET | 00046-1100-81 | 6.76085 | EACH | 2025-11-19 |

| PREMARIN 0.45 MG TABLET | 00046-1101-81 | 6.75591 | EACH | 2025-11-19 |

| PREMARIN 0.3 MG TABLET | 00046-1100-91 | 6.76085 | EACH | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for PREMARIN

Introduction

PREMARIN, a hormone replacement therapy (HRT) medication primarily containing conjugated estrogens derived from the urine of pregnant mares, has historically played a pivotal role in managing menopausal symptoms and osteoporosis among postmenopausal women. Since its FDA approval in 1942, the drug has experienced fluctuating market dynamics, driven by evolving medical guidelines, generic competition, and shifting healthcare policies. This analysis explores the current market landscape for PREMARIN, assesses key drivers influencing demand, and projects future pricing trends amid anticipated regulatory and competitive changes.

Market Landscape Overview

Historical Context

PREMARIN has long been a staple in the HRT market, initially benefitting from widespread use during the mid to late 20th century. However, the post-2002 revelations from the Women's Health Initiative (WHI) significantly impacted its prescription patterns, as the studies highlighted potential risks associated with hormone therapy, including increased risks of breast cancer, stroke, and cardiovascular events (WHI Study, 2002). Consequently, the demand sharply declined, prompting healthcare providers to explore alternative therapies.

Current Market Position

Despite a decline, PREMARIN maintains a niche segment, especially as a therapy option for women with specific contraindications to synthetic hormones or those preferring natural estrogen preparations. The drug's current market share is modest but remains relevant, particularly within specialized gynecology and menopause clinics.

Regulatory and Patent Status

PREMARIN's biological origin and longstanding FDA approval have allowed it to maintain its market presence with minimal regulatory hurdles. Its patent status expired decades ago, leading to the proliferation of generic conjugated estrogens, which significantly influence pricing dynamics.

Market Drivers and Demand Factors

Demographic Trends

Global aging populations, especially in North America, Europe, and parts of Asia, are expected to sustain demand for menopause-related therapies. According to the World Health Organization, women aged 50 and above will comprise a growing demographic requiring symptomatic relief and osteoporosis management, underpinning near-term demand for PREMARIN.

Medical Guidelines and Prescribing Trends

Recent shifts towards individualized therapy regimes, increased awareness of risks, and the emergence of alternative treatments—such as selective estrogen receptor modulators (SERMs) and bioidentical hormones—have led to cautious prescribing of traditional hormone therapies, including PREMARIN.

Medical Evidence and Safety Profile

While the WHI study dampened enthusiasm, newer research suggests that, in selected populations, hormone therapy can be safe and effective when prescribed judiciously. This nuanced understanding influences doctor prescribing behaviors, subtly affecting market demand.

Generic Competition

The decay of patent protections has led to the extensive availability of generic conjugated estrogens, which now constitute the primary competitors to branded PREMARIN. These generics offer significant price advantages, impacting the overall pricing structure and revenue potential of the original formulation.

Reimbursement Policies

Cost containment measures by healthcare providers, insurers, and government programs like Medicare have pushed for generic substitution and cost-effective treatment options, exerting downward pressure on prices.

Price Analysis and Projection

Historical Pricing Trends

Historically, branded PREMARIN enjoyed premium pricing, averaging $50–£70 per month in the U.S. prior to patent expiry, driven by brand recognition and minimal initial generic competition. Post-generic entry in the early 2000s, prices plummeted, with generics selling between $10–$30 per month, reflecting increased competition and market saturation.

Current Price Points

Today, the price for generic conjugated estrogens ranges from approximately $8–$15 monthly, depending on pharmacy discounts, insurance coverage, and geographical location. The original branded PREMARIN continues to command a slight price premium—around 15–20% more than generics—mainly due to marketing, brand loyalty, and perceived quality concerns.

Future Price Projections

Given existing market pressures, several key factors will shape future pricing:

-

Market Penetration of Biosimilars or Biosimilar-like Enterics: While biosimilars for conjugated estrogens are not currently available, impending patent challenges or formulations could influence prices.

-

Regulatory Changes: Increased emphasis on cost-effectiveness in national healthcare programs might favor further generic price erosion.

-

Consumer and Physician Preferences: Growing preference for bioidentical hormones or non-hormonal therapies could dampen demand, limiting price growth opportunities for PREMARIN.

-

Supply Chain Factors: Raw material costs, manufacturing efficiencies, and supply chain stability will influence pricing margins.

Based on these factors, the outlook suggests a continued decline in branded PREMARIN prices to around $10–$12 per month within the next 3–5 years, aligning with generic estrogen prices, with minimal upward price movement unless new formulations or indications emerge.

Market Opportunities and Challenges

Opportunities

- Specialty Markets: Targeting niche demographic segments—women with contraindications to synthetic hormones—could sustain premium pricing in specialized clinics.

- Emerging Markets: Growing healthcare infrastructure and aging populations in Asia and Latin America present opportunities for incremental market expansion.

- Formulation Innovations: Development of combination therapies or alternative delivery systems (e.g., transdermal patches) may allow premium pricing.

Challenges

- Declining Prescriptions: Ongoing concerns about hormone therapy safety and competition from non-hormonal options limit market expansion.

- Price Erosion: Ubiquitous generic availability will continue exerting downward pressure.

- Regulatory Scrutiny: Heightened safety evaluation and potential indications restrictions could further dampen demand.

Key Takeaways

- Declining Demand: Post-WHI revelations have resulted in reduced overall usage, especially in primary care, with niche indications maintaining limited residual market.

- Intense Price Competition: The entry of generics has dramatically decreased prices, with branded PREMARIN prices stabilized at a premium, but unlikely to rise significantly.

- Future Outlook: Prices are projected to hover around $10–$12/month in the next 3–5 years, constrained by competition and shifting prescribing patterns.

- Market Growth Limited: Demographic growth may sustain baseline demand, but innovation and regulatory factors limit aggressive expansion.

- Strategic Focus: Companies should explore niche markets, consider formulation innovations, and monitor regulatory developments to adapt effectively.

Frequently Asked Questions

1. Will PREMARIN regain its market dominance amid increasing generic competition?

Unlikely. The market is saturated with generic conjugated estrogens, making it difficult for the branded PREMARIN to regain significant market share without unique formulations or indications.

2. How do safety concerns influence the future pricing of PREMARIN?

Safety concerns, especially regarding hormone therapy, have led to cautious prescribing. While safety profiles are relatively stable, any regulatory restrictions or safety alerts could further suppress demand and prices.

3. Are there pipeline developments that could impact PREMARIN pricing?

Currently, no significant biosimilar or new formulations are in late-stage development, limiting near-term impact on pricing structures.

4. How does demographic aging influence the long-term demand for PREMARIN?

An aging global population suggests a steady demand for menopause-related therapies. However, alternative treatments and changing clinician preferences may modulate actual prescription rates.

5. What strategies can manufacturers employ to maintain profitability?

Focus on niche applications, innovate formulations, leverage brand loyalty in selected markets, and explore emerging markets to offset declining prices in mature markets.

References

- Women's Health Initiative Study (2002). Risks and Benefits of Estrogen Plus Progestin in Postmenopausal Women. Journal of the American Medical Association.

- IMS Health Data (2022). US Market Trends for Hormone Replacement Therapy Drugs.

- World Health Organization. Ageing and health data, 2023.

- FDA Drug Approvals and Regulatory Documentation for Conjugated Estrogens, 2020–2023.

- Market Intelligence Reports on Hormone Therapies, 2023.

This analysis offers a comprehensive overview of PREMARIN’s current market dynamics and forecasted pricing landscape, equipping stakeholders with actionable insights for strategic planning.

More… ↓