Share This Page

Drug Price Trends for PRASUGREL

✉ Email this page to a colleague

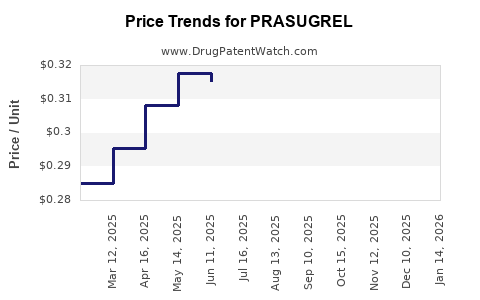

Average Pharmacy Cost for PRASUGREL

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| PRASUGREL 5 MG TABLET | 65862-0829-30 | 0.33787 | EACH | 2025-12-17 |

| PRASUGREL 10 MG TABLET | 00378-5186-93 | 0.28267 | EACH | 2025-12-17 |

| PRASUGREL 10 MG TABLET | 16729-0273-10 | 0.28267 | EACH | 2025-12-17 |

| PRASUGREL 10 MG TABLET | 60505-4643-03 | 0.28267 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for PRASUGREL

Introduction

Prasugrel, marketed under brand names such as Effient, is an antiplatelet medication primarily used in the prevention of thrombotic cardiovascular events in patients with acute coronary syndrome undergoing percutaneous coronary intervention (PCI). As a potent oral P2Y12 inhibitor, prasugrel has established itself as a significant player within the antithrombotic therapeutic market, competing with agents like clopidogrel and ticagrelor. This article offers an exhaustive market analysis and price projection for prasugrel, addressing current trends, competitive landscape, regulatory influences, and future pricing expectations.

Market Overview

Global Market Size and Growth Drivers

The global market for antithrombotic agents, including prasugrel, is experiencing steady growth. The rising incidence of acute coronary syndromes (ACS), including myocardial infarction and unstable angina, fuels demand for effective antiplatelet therapies. According to Global Market Insights, the cardiovascular drug market was valued at over USD 11 billion in 2022 and is projected to grow at a Compound Annual Growth Rate (CAGR) of approximately 6% through 2030 [1].

The increase in aging populations, coupled with environmental and lifestyle factors like sedentary lifestyles, obesity, and smoking, further amplifies the demand for effective antiplatelet therapies. The introduction of prasugrel, with its superior efficacy profile in certain patient subsets compared to traditional agents, positions it favorably within this expanding market.

Key Geographic Markets

- North America: The largest market, driven by high adoption rates, advanced healthcare infrastructure, and robust pharmaceutical R&D activities.

- Europe: Significant growth, fueled by centralized healthcare policies and increased cardiovascular disease prevalence.

- Asia-Pacific: Rapidly growing market as developing countries improve healthcare access, with India and China leading adoption due to rising cardiovascular disease burden.

Regulatory Landscape

Prasugrel received FDA approval in 2009 and EMA approval shortly thereafter. Its market penetration is influenced by regulatory decisions on label indications, safety warnings regarding bleeding risks, and evolving clinical guidelines. Post-marketing surveillance and new clinical data continue shaping prescriber confidence and usage patterns.

Market Dynamics

Competitive Landscape

Prasugrel's primary competitors are clopidogrel and ticagrelor. While clopidogrel remains a low-cost, widely used agent, concerns over variability in response and resistance have prompted clinicians to adopt prasugrel for specific high-risk patients. Ticagrelor, with its reversible binding mechanism, offers an alternative, often preferred in dual antiplatelet therapy settings.

The recent approval and commercialization of generic versions of prasugrel are set to influence market dynamics significantly, reducing treatment costs and expanding accessibility.

Patent Status and Generic Entry

The original patent for prasugrel has expired in multiple jurisdictions, paving the way for generic manufacturers. The entry of generics is projected to lower drug prices by 30-50%, increase competition, and expand market penetration, especially in cost-sensitive regions.

Clinical Positioning and Guidelines

Clinical guidelines, such as the American College of Cardiology/American Heart Association (ACC/AHA), incorporate prasugrel as a preferred antiplatelet in certain cases of ACS undergoing PCI, influencing prescribing behaviors. Ongoing trials assessing safety and efficacy may further solidify its clinical role and impact pricing strategies.

Pricing Analysis

Current Pricing Trends

Brand-name prasugrel (Effient) retains premium pricing, with per-tablet costs typically ranging from USD 10 to USD 15 in the U.S., depending on dosage and pharmacy discounts. In Europe, prices are comparable, with some variation based on healthcare system reimbursement policies.

The transition to generic prasugrel is expected to reduce per-unit cost by an estimated 40-50%, aligning prices closer to those of older agents like clopidogrel. For example, generic prasugrel prices are projected to fall to USD 4–USD 7 per tablet, making widespread adoption financially feasible.

Price Projections (2023-2030)

- Immediate Term (2023-2025): The initial introduction of generics will cause a gradual price decline. Brand-name prices may endure due to brand loyalty and existing supply contracts but will face downward pressure.

- Mid to Long Term (2026-2030): Prices are expected to stabilize at significantly lower levels, driven by increased market share of generics. Hospital procurement policies supporting cost savings will also influence pricing strategies.

Impact of Market Factors on Pricing

- Regulatory approvals of generics will accelerate price reductions.

- Clinical data demonstrating equivalence with branded prasugrel will bolster generic market penetration.

- Reimbursement policies across countries will either incentivize or limit access to lower-cost formulations.

- Market competition from ticagrelor and emerging agents will exert indirect pricing pressure on prasugrel.

Future Market Potential

The continued growth of the cardiovascular market, coupled with increasing adoption of prasugrel for high-risk ACS patients, presents considerable upside for manufacturers. Innovations, such as fixed-dose combination products, may further enhance market share and optimize pricing strategies. Moreover, the expansion of prasugrel's indications, once supported by clinical evidence, could bolster demand and stabilize pricing.

Emerging markets will be crucial in volume expansion, particularly as prices decrease due to generic competition and regulatory facilitation. Manufacturers may adopt aggressive pricing in low-income regions to secure market access, potentially leading to a global price convergence trend.

Key Challenges and Opportunities

- Bleeding Risk Management: Safety concerns may limit use in certain populations, affecting market penetration and pricing premiums.

- Clinical Guidelines Evolution: Updated recommendations can alter prescribing patterns, influencing volume and revenue.

- Patent Expirations and Generics: Accelerate price declines but also threaten profit margins for branded formulations.

- Innovative Formulations: Development of combination therapies and personalized medicine approaches may open new avenues and justify premium pricing.

Key Takeaways

- The prasugrel market is positioned for steady growth, driven by rising cardiovascular disease prevalence and evolving clinical guidelines.

- Patent expiry and the introduction of generics will catalyze a substantial price decrease, with projected prices falling by up to 50% over the next five years.

- Competitive pressures from ticagrelor and emerging agents require strategic positioning to sustain market share and pricing power.

- Regional disparities necessitate tailored pricing strategies, with emerging markets offering growth opportunities amid declining costs.

- Clinical data reinforcing prasugrel’s efficacy and safety will be critical in maintaining its relevance and optimizing pricing dynamics.

FAQs

1. How is the entry of generics expected to impact prasugrel’s market price?

Generic entry will significantly reduce prices, with projections indicating a 40-50% decrease within 3-5 years, enhancing accessibility and expanding market volume.

2. What differentiates prasugrel from its competitors?

Prasugrel offers a rapid, potent antiplatelet effect with a favorable efficacy profile in high-risk ACS patients, although it carries an elevated bleeding risk which must be managed.

3. Which regions are most influential in the prasugrel market?

North America and Europe dominate due to advanced healthcare infrastructure and high adoption rates, while Asia-Pacific offers substantial long-term growth potential.

4. How do clinical guidelines influence prasugrel’s market standing?

Guidelines endorsed by professional cardiology societies promote prasugrel for specific indications, directly impacting physician prescribing behaviors and consequently, market demand.

5. What are the future opportunities for pricing optimization?

Emerging formulations, personalized therapy protocols, and strategic positioning in developing markets will underpin future pricing strategies and revenue growth.

References

[1] Global Market Insights. "Cardiovascular Drugs Market Size & Share." 2022.

More… ↓