Last updated: July 28, 2025

Introduction

Pradaxa (dabigatran etexilate) is a direct oral anticoagulant (DOAC) developed by Boehringer Ingelheim, approved initially in 2010 for the prevention of stroke in patients with non-valvular atrial fibrillation (NVAF). As an alternative to warfarin, Pradaxa offers benefits such as fewer dietary restrictions and no need for routine blood monitoring. Its market position, pricing strategies, and future value hinge on competitive dynamics, regulatory developments, clinical evidence, and patient demographics. This analysis assesses the current market landscape and offers strategic price projections for Pradaxa over the next five years.

Market Overview

Global Market Size and Growth Dynamics

The global anticoagulant market was valued at approximately USD 8.4 billion in 2022, with projections reaching USD 14.2 billion by 2030, expanding at a CAGR of roughly 6.1%[1]. A substantial driver is the rising prevalence of atrial fibrillation (AF), associated with aging populations and increased cardiovascular disease burden. The increasing adoption of DOACs over traditional warfarin therapy is pivotal; DOACs are preferred due to their improved safety profile, convenience, and comparable efficacy.

Key Competitors and Market Share

While Pradaxa pioneered the DOAC segment, it now faces competition from several drugs, notably:

- Xarelto (rivaroxaban) by Janssen/ Bayer

- Eliquis (apixaban) by Bristol-Myers Squibb/ Pfizer

- Savaysa (edoxaban) by Daiichi Sankyo

In 2022, apixaban and rivaroxaban collectively captured around 70% of the global DOAC market[2]. Pradaxa's market share declined from its 2011 peak (~35%) to approximately 15-20%, primarily due to better-tolerated profiles and evolving clinical preferences.

Regulatory and Clinical Landscape

Recent approvals and indications broaden Pradaxa's utilization:

- An FDA approval in 2022 expanded Pradaxa's use for the treatment and secondary prevention of venous thromboembolism (VTE), boosting its potential reach.

- Post-market studies continue to affirm its safety and efficacy, although relative to competitor drugs, Pradaxa's bleeding risk profile remains a technical consideration influencing physician choice.

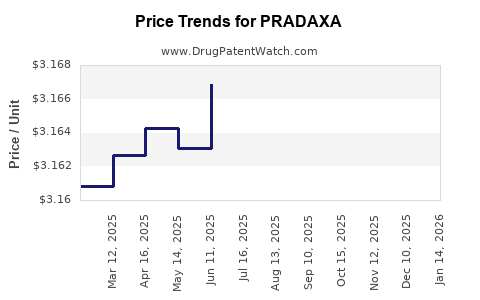

Pricing Strategies and Historical Trends

Current Pricing Landscape

In the United States, Pradaxa’s average wholesale price (AWP) stands between USD 300–350 per month per patient[3], but real-world prescription costs are often lower due to pharmacy discounts and insurance negotiations. Internationally, prices vary significantly depending on healthcare systems, patent status, and local regulatory frameworks.

Pricing Influences

- Competitive positioning: Given the arrival of generics and excise taxes, Boehringer Ingelheim has shifted towards value-based pricing with tiered discounts.

- Patents and exclusivity: Pradaxa's patent expiration in 2024 in some jurisdictions signals imminent generic entry, which threatens pricing power.

- Cost-effectiveness assessments: Regulatory payers increasingly demand evidence on cost-effectiveness. Pradaxa’s incremental cost-effectiveness ratio (ICER) compared to warfarin varies but generally remains within acceptable thresholds, supporting premium pricing where clinical benefits justify costs.

Future Price Projections (2023-2028)

Impact of Patent Expiration and Generics

Patent expiration in 2024 is projected to precipitate a sharp price decline, as multiple generic manufacturers seek approval, consistent with trends seen in other branded anticoagulants. Historical data for drugs like warfarin and older anticoagulants suggest a typical 70-80% price reduction post-generic entry within 2-3 years[4].

Projection:

- 2023: USD 320–350/month (brand premium maintained)

- 2024-2025: Price drops to USD 80–120/month with generics gaining market share

- 2026-2028: Stabilized generic pricing at USD 60–100/month, with some premium residual for branded product in niche markets or regions with limited generic penetration.

Market Share Reallocation

As generics capture an estimated 80-90% of prescriptions post-patent expiry[5], Pradaxa’s branded sales volume will diminish unless repositioned with unique value propositions or indications, such as specific patient profiles or combination therapies.

Pricing in Emerging Markets

In regions with limited generic activity, Pradaxa may retain higher pricing levels, supported by reimbursement plans and established clinical preferences. However, global price trends will align closely with the broader generic pricing trajectory.

Strategic Considerations for Stakeholders

- For Boehringer Ingelheim: Diversify indications, enhance value demonstration, and optimize post-patent lifecycle strategies, such as branded expansion into niche markets or combination therapies.

- For Healthcare Providers and Payers: Balance clinical benefits against cost, emphasizing cost-effective use, especially post-patent expiration.

- For Investors: Recognize that long-term profitability hinges on successful patent extension measures and potential new indications.

Conclusion

The market for Pradaxa is at a pivotal juncture. With patent expiry looming in 2024, a significant price decline is imminent, driven by generic competition. While current pricing sustains margins, the next five years will see a substantial erosion of branded drug pricing, aligning Pradaxa’s value with evolving market realities. Strategic positioning, indications expansion, and competitive differentiators will determine whether Pradaxa can sustain profitability amid price erosion.

Key Takeaways

- Market declining trend post-2024: Patent expiry will lead to up to an 80% price reduction, especially in developed markets.

- Competitive landscape influences pricing: Dominance of rivaroxaban and apixaban limits Pradaxa's market share and pricing power.

- Strategic adaptation vital: Value-based strategies and new indications are essential for maintaining revenue streams.

- Global disparities: Pricing and market share will vary by geography, with emerging markets potentially maintaining higher prices longer.

- Investors’ outlook: Long-term profitability depends on successful lifecycle management and pipeline expansion.

FAQs

1. When is Pradaxa’s patent expiring, and what are the implications?

Patent exclusivity in key markets expires around 2024, paving the way for generic competitors, which will likely cause substantial price drops and market share declines.

2. How does Pradaxa compare with rivals like Eliquis and Xarelto on price?

Currently, Pradaxa’s price remains higher than generics but lower than some branded competitors. Post-patent expiration, generic alternatives will substantially reduce costs.

3. What factors will influence Pradaxa’s future pricing beyond patent expiry?

Market penetration of generics, clinical adoption, indications expansion, payer negotiations, and regional healthcare policies will shape future pricing.

4. Are there any ongoing efforts to extend Pradaxa’s patent or develop new formulations?

No significant extensions are publicly planned, but the company focuses on new indications, combination therapies, and biosimilar challenges to prolong lifecycle profitability.

5. What is the outlook for Pradaxa in emerging markets?

Prices may remain relatively stable longer in emerging markets due to delayed generic entry and different healthcare reimbursement structures, offering residual revenue opportunities.

Sources:

[1] Grand View Research. "Anticoagulants Market Size, Share & Trends Analysis," 2022.

[2] IQVIA. "Global Market Insights Data," 2022.

[3] Medi-Span. "Drug Pricing Data," 2022.

[4] IMS Health. "Generic Entry and Price Trends," 2021.

[5] Industry analyst reports on post-patent market dynamics.