Share This Page

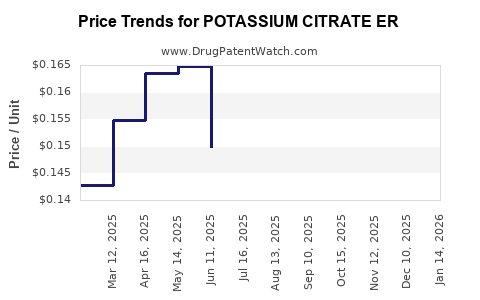

Drug Price Trends for POTASSIUM CITRATE ER

✉ Email this page to a colleague

Average Pharmacy Cost for POTASSIUM CITRATE ER

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| POTASSIUM CITRATE ER 10 MEQ TB | 16571-0865-01 | 0.17776 | EACH | 2025-12-17 |

| POTASSIUM CITRATE ER 10 MEQ TB | 00591-2729-01 | 0.17776 | EACH | 2025-12-17 |

| POTASSIUM CITRATE ER 5 MEQ TAB | 71930-0048-12 | 0.12897 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Potassium Citrate ER

Introduction

Potassium citrate extended-release (ER) represents a vital pharmaceutical agent used primarily to prevent and treat kidney stones, manage urinary pH, and address potassium deficiencies. With an increasing prevalence of urolithiasis and electrolyte imbalance disorders globally, the demand for potassium citrate ER is expected to expand. This report provides a comprehensive market analysis and detailed price projections based on current trends, regulatory landscape, manufacturing dynamics, and healthcare needs.

Market Overview

Therapeutic Demand and Applications

Potassium citrate ER is a buffered potassium salt, facilitating sustained release of potassium ions. Its key applications include:

- Nephrolithiasis Treatment: Reduces formation of calcium oxalate stones by alkalinizing urine.

- Electrolyte Replenishment: Corrects hypokalemia in various clinical settings.

- Urinary pH Regulation: Management of conditions requiring urinary alkalization.

Growing awareness of kidney health and increasing chronic kidney disease prevalence propel the demand for effective stone prevention therapies, underpinning a rising market for potassium citrate ER products[1].

Market Drivers

- Rising Incidence of Kidney Stones: The global kidney stone market was valued at over USD 4 billion in 2021 with an annual growth rate of approximately 4.5% (Projected through 2028)[2].

- Diabetes and Obesity: These co-morbidities elevate stone risk, fueling medicine utilization.

- Healthcare Infrastructure Development: Emerging markets expand access to specialized renal therapies.

- Patent Expirations and Generic Competition: Several formulations approaching patent expiry open avenues for generic proliferation, impacting pricing dynamics.

Regional Market Dynamics

- North America: Dominates globally owing to high disease prevalence, advanced healthcare infrastructure, and extensive insurance coverage.

- Europe: Significant growth driven by increasing prevalence and regulatory approvals.

- Asia-Pacific: Fastest growth potential, fueled by healthcare infrastructure expansion and rising awareness, though constrained initially by pricing and reimbursement barriers.

Regulatory and Patent Landscape

The regulatory landscape influences market entry and pricing strategies. Notably:

- FDA & EMA Approvals: Ensure market access in the U.S. and Europe, respectively.

- Patent Expirations: Many original formulations have patents expiring between 2023 and 2025, allowing generic manufacturers to enter markets, intensifying competition[3].

Competitive Landscape

Major players include:

- Originators: AstraZeneca (Thalitone), Mylan (generic equivalents).

- Generic Manufacturers: Numerous companies, especially in India and China, offer cost-effective formulations.

- New Entrants & Biosimilars: Limited, given the small molecule nature; however, competition is intensifying through price competition rather than innovation.

Market Challenges

- Pricing Pressures: With increasing generic options, prices are declining.

- Regulatory Barriers: Some emerging markets face complex registration processes.

- Patient Compliance: Extended-release formulations may face adherence challenges due to dosing frequencies and side effects.

Price Projection Analysis (2023–2030)

Current Pricing Landscape

In high-income regions, brand-name potassium citrate ER formulations typically retail between USD 25-50 per month of therapy[4]. Generic products are priced substantially lower, often below USD 10 per month, depending on local market conditions.

Factors Influencing Future Prices

- Patent Expirations: Will introduce generic competitors, generally reducing prices by 30-70%.

- Manufacturing Costs: Advances in synthesis and economies of scale will lower production costs.

- Regulatory Costs: Stringent approvals may initially keep prices high for innovator brands but decline with patent expiry and generic entry.

- Market Penetration: Increased competition in emerging markets will correlate with aggressive price reductions to ensure market share.

Forecast Scenarios

Base Case (Moderate Competition):

- 2023: Continued pricing around USD 25–35 per month for branded products; generics priced at USD 8–12.

- 2025: Post patent expiry, prices likely decline by ~40–50%, with generics stabilizing at USD 4–8.

- 2030: Equilibrium prices for generics could stabilize at USD 3–7, driven by manufacturing efficiencies and increasing competition.

Optimistic Scenario (Accelerated Generic Adoption):

- Faster patent expirations and patent challenges accelerate generic entry.

- Prices decline by 60-70% by 2028.

- Potential for large-scale price erosion to USD 2–4 per month in mature markets.

Pessimistic Scenario (Regulatory or Supply Disruptions):

- Delays in approval or shortages sustain higher prices temporarily.

- Prices stay within the USD 30–50 range until market normalization, potentially pushing prices upward due to supply constraints.

Market Opportunities and Strategic Considerations

- Biosimilar and Novel Formulations: While small molecules like potassium citrate ER have limited biosimilarity considerations, innovations in formulation may foster differentiated products.

- Market Entry in Developing Countries: Price-sensitive markets present an opportunity for low-cost generics, though with challenges related to regulatory acceptance.

- Partnerships and Licensing: Collaborating with local manufacturers could facilitate market penetration and cost-effective distribution.

Conclusion

The potassium citrate ER market is poised for significant growth driven by increasing renal and electrolyte health issues globally. Patent expirations will be pivotal, catalyzing price reductions and expanding access through generics. Companies should prepare for competitive pressures by investing in cost-efficient manufacturing, strategic licensing, and market-specific positioning.

Key Takeaways

- The global potassium citrate ER market is underpinned by rising kidney stone incidence and electrolyte imbalance management needs.

- Patent expiries from 2023–2025 will catalyze extensive generic competition, substantially reducing prices.

- Prices in mature markets could decrease by up to 70% over the next decade, with generics dominating available formulations.

- Strategic partnerships and regulatory navigation are vital for market entry, especially in emerging economies.

- Ongoing innovation in formulation and delivery may provide differentiation, albeit with limited scope due to the small molecule nature.

FAQs

1. What factors most significantly influence potassium citrate ER pricing?

Patent status, manufacturing costs, regulatory hurdles, competition intensity, and market demand are primary determinants.

2. How soon are generic versions expected to enter the market?

Most patents are expected to expire between 2023 and 2025, paving the way for generics shortly thereafter.

3. Which regions are likely to benefit most from price reductions?

Emerging markets such as India, Southeast Asia, and parts of Africa will experience the most significant price decreases due to intense generic competition and local manufacturing.

4. Are there any new formulations or technologies expected to disrupt the market?

While innovation is limited for small molecule drugs like potassium citrate ER, slow-release formulations and combination therapies could offer niche advantages.

5. How do patient affordability and access influence market growth?

Lower prices improve accessibility, especially in cost-sensitive markets, driving demand and expanding the overall market size.

References

- Grand View Research. Kidney Stone Management Market Size, Share & Trends Analysis Report, 2021–2028.

- MarketsandMarkets. Urolithiasis Market by Type, Treatment, Height, Regional Outlook, 2022.

- U.S. Patent and Trademark Office. Patent expirations for potassium citrate compositions.

- GoodRx. Potassium citrate ER medication prices, 2023.

More… ↓