Share This Page

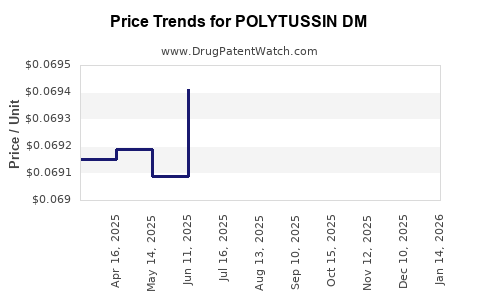

Drug Price Trends for POLYTUSSIN DM

✉ Email this page to a colleague

Average Pharmacy Cost for POLYTUSSIN DM

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| POLYTUSSIN DM 7.5-5-12.5 MG/5 ML | 50991-0132-16 | 0.06229 | ML | 2025-12-17 |

| POLYTUSSIN DM 7.5-5-12.5 MG/5 ML | 50991-0132-16 | 0.06229 | ML | 2025-11-19 |

| POLYTUSSIN DM 7.5-5-12.5 MG/5 ML | 50991-0132-16 | 0.06961 | ML | 2025-10-22 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for POLYTUSSIN DM

Introduction

POLYTUSSIN DM is a widely used over-the-counter and prescription medication combining dextromethorphan, a cough suppressant, with guaifenesin, an expectorant designed to relieve cough and chest congestion. Market dynamics for POLYTUSSIN DM are influenced by its therapeutic efficacy, regulatory landscape, consumer demand for cough and cold remedies, and competitive positioning within the broader respiratory drug market. This analysis evaluates current market trends, compares pricing strategies, and projects future pricing patterns based on industry data, regulatory factors, and consumer behavior.

Market Overview

The respiratory drugs market, encompassing cough suppressants and expectorants, maintains steady growth driven by seasonal variations, aging populations, and increased awareness of respiratory health. According to Global Market Insights, the global cough and cold remedy market was valued at approximately USD 8 billion in 2022, with a compound annual growth rate (CAGR) of around 3.5% projected until 2030[1].

POLYTUSSIN DM particularly appeals to a broad demographic, including pediatric and adult patients, due to its dual-action formulation. Its OTC availability in numerous regions enhances accessibility, fostering high sales volumes. The drug competes with both branded formulations and generic equivalents, impacting both market share and pricing strategies.

Regulatory Environment

Regulatory policies significantly influence market accessibility and pricing. In the U.S., the Food and Drug Administration (FDA) regulates cough suppressants, with dextromethorphan classified as a monographed drug permitted for OTC sales, albeit with federal advisory warnings regarding misuse potential. In recent years, regulatory agencies have imposed stricter controls over dextromethorphan sales due to abuse concerns, affecting market dynamics[2].

In other regions, regulatory approvals and marketing authorizations vary, impacting availability and pricing. Post-pandemic, increased scrutiny on respiratory medications and evolving regulations could influence the deployment and valuation of products like POLYTUSSIN DM.

Competitive Landscape

Key competitors include major pharmaceutical firms such as Johnson & Johnson (Robitussin), GlaxoSmithKline (Benylin), and private-label brands. Over the last decade, the market has seen an influx of generic formulations, exerting downward pressure on prices. Consumer preference shifts towards natural or herbal remedies also influence demand patterns.

Market share distribution reflects brand loyalty, price sensitivity, and trust in efficacy. The presence of private labels and store brands has introduced price competition, emphasizing the importance of cost-effective manufacturing and marketing strategies.

Current Price Landscape

Retail Pricing Structure

Pricing for POLYTUSSIN DM varies notably by region, outlet, and formulation (liquid, capsules, tablets). In the United States:

- Brand Name (e.g., POLYTUSSIN DM): Retail prices typically range from USD 8.99 to USD 13.99 for a 4 oz bottle of liquid, with variations based on retailer and package size.

- Generic Equivalents: Often priced between USD 4.99 and USD 9.99 for comparable quantities, highlighting significant price erosion driven by generics.

- Private Label/Store Brands: Priced as low as USD 4.50, appealing to cost-conscious consumers.

In European markets, prices are relatively higher, often due to differing regulatory stipulations, taxes, and distribution costs, with prices ranging from EUR 7 to EUR 15 per product (equivalent to USD 8–USD 16).

Pricing Drivers

- Formulation and Packaging: Larger quantities and child-specific formulations command premium prices.

- Distribution Channels: Pharmacy, supermarket, online retailing, and discounts influence final consumer prices.

- Regulatory and Taxation Factors: Taxes and import duties can inflate prices, especially in markets with stringent regulations.

- Brand Recognition: Established brands maintain premium pricing owing to perceived efficacy and trustworthiness.

Market Trends and Demand Drivers

Seasonality and Disease Trends

Cough and cold remedies, including POLYTUSSIN DM, exhibit seasonal spikes during colder months, resulting in increased sales. Additionally, heightened awareness of respiratory illnesses like influenza and COVID-19 boosts demand for symptomatic relief medications. The pandemic has also fostered increased consumer engagement with OTC products, influencing sales volumes.

Consumer Preferences

A shift towards natural remedies impacts market shares of traditional formulations. Nonetheless, the convenience, familiarity, and perceived safety of POLYTUSSIN DM sustain its popularity. Online sales channels have expanded access, especially in urban areas and during pandemic-related restrictions.

Regulatory Impact

Tighter regulations on dextromethorphan sales, particularly concerning misuse, have led to age restrictions and purchase limits in some regions, possibly affecting overall volume but not significantly decreasing overall market size.

Innovation and Product Diversification

Limited innovations have emerged specifically for POLYTUSSIN DM; however, companies are developing combination products and reformulations targeting specific patient populations, potentially influencing market share and pricing over time.

Price Projections (2023-2030)

Based on current market dynamics, regulatory factors, and industry forecasts, the following projections are made:

-

Short-term (2023-2025): Prices are expected to stabilize with minor fluctuations, primarily driven by inflation, manufacturing costs, and regional regulatory compliance. Brand-name POLYTUSSIN DM may see retail prices holding at approximately USD 9–USD 15 per bottle in the U.S., with generic versions declining slightly to USD 4–USD 10 due to increased competition.

-

Mid-term (2026-2028): Growing competition from generics, along with potential reformulation trends or new combination therapies, could result in a gradual price decline for branded products, aligning closer to USD 8–USD 12 in the U.S. market.

-

Long-term (2029-2030): Market saturation, technological shifts in drug formulation, and increased regulation may further compress prices. Anticipate a price range of USD 7–USD 10 for brand-name POLYTUSSIN DM, with generics potentially falling below USD 5 per unit, especially as manufacturing efficiencies improve and online retail channels expand.

Factors Influencing Price Trends

- Regulatory Policies: Enhanced focus on controlling abuse of dextromethorphan could restrict OTC sales, affecting volume and pricing.

- Market Penetration of Generics: Greater adoption of low-cost generics reduces average prices.

- Consumer Behavior: Preference for natural or herbal alternatives may dampen demand for traditional formulations, prompting companies to adjust pricing strategies.

- Manufacturing and Supply Chain Costs: Fluctuations influence retail pricing, with potential cost savings driving downward pressure.

Conclusion

POLYTUSSIN DM operates within a mature, competitive segment of the respiratory drug market. Current prices reflect a balance of brand strength, competitive pressures, and regulatory constraints. Market projections indicate a gradual decrease in prices over the next decade, driven by increased generic penetration, regulatory restrictions, and evolving consumer preferences.

Pharmaceutical companies seeking to sustain profitability should focus on cost-efficient manufacturing, strategic brand positioning, and adherence to regulatory standards. Additionally, leveraging digital channels for broader market reach and product diversification can mitigate competitive pressures and sustain growth.

Key Takeaways

- The global cough and cold remedy market, valued at USD 8 billion in 2022, expects steady growth through 2030, with POLYTUSSIN DM maintaining significant market share.

- Current retail prices in the U.S. range from USD 4.99 to USD 13.99, with generics offering substantial price advantages.

- Regulatory concerns regarding dextromethorphan abuse may impact future sales volume and pricing.

- Price projections suggest a downward trend, with branded POLYTUSSIN DM averaging USD 8–USD 12 by 2028, and generics potentially falling below USD 5.

- Market strategies should incorporate regulatory compliance, cost efficiencies, and digital sales channel expansion to optimize profitability.

FAQs

1. How does regulatory regulation influence POLYTUSSIN DM pricing?

Regulations controlling dextromethorphan sales, including age restrictions and purchase limits, potentially reduce sales volume and put downward pressure on prices. Stricter regulations in certain jurisdictions may also increase compliance costs, influencing retail pricing.

2. What competitive factors impact POLYTUSSIN DM’s market positioning?

The presence of multiple generic alternatives, store-brand equivalents, and consumer preferences towards natural remedies affect market share and pricing. Brand loyalty, efficacy perception, and promotional strategies also play crucial roles.

3. Are there upcoming innovations expected to alter POLYTUSSIN DM’s market?

While specific innovations are limited, industry trends point towards combination therapies, reformulations, and digital engagement strategies, possibly influencing future demand and pricing structures.

4. How do seasonal variations impact POLYTUSSIN DM sales?

Cough and cold remedies experience higher sales during cold seasons, typically from fall to early spring, leading to seasonal price fluctuations and stock adjustments.

5. What are the implications of increased online retailing for POLYTUSSIN DM?

Online channels offer broader access, often at lower prices due to reduced overheads, intensifying price competition and enabling manufacturers and retailers to implement dynamic pricing strategies.

Sources

[1] Global Market Insights, “Cough and Cold Remedy Market Size,” 2022.

[2] U.S. Food and Drug Administration, “Regulation of Dextromethorphan,” 2021.

More… ↓