Share This Page

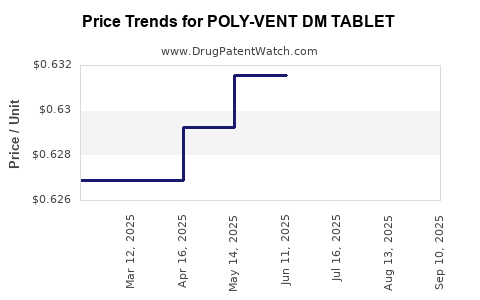

Drug Price Trends for POLY-VENT DM TABLET

✉ Email this page to a colleague

Average Pharmacy Cost for POLY-VENT DM TABLET

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| POLY-VENT DM TABLET | 50991-0214-01 | 0.62892 | EACH | 2025-09-17 |

| POLY-VENT DM TABLET | 50991-0214-01 | 0.62892 | EACH | 2025-08-20 |

| POLY-VENT DM TABLET | 50991-0214-01 | 0.62892 | EACH | 2025-07-23 |

| POLY-VENT DM TABLET | 50991-0214-01 | 0.63157 | EACH | 2025-06-18 |

| POLY-VENT DM TABLET | 50991-0214-01 | 0.63157 | EACH | 2025-05-21 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for POLY-VENT DM TABLET

Introduction

POLY-VENT DM TABLET is a proprietary fixed-dose combination medication designed for the management of cough and cold symptoms associated with upper respiratory infections. It typically combines dextromethorphan, a cough suppressant, with other active agents like pseudoephedrine or chlorpheniramine, depending on regional formulations. The product's market outlook involves analyzing current demand drivers, competitive landscape, regulatory environment, and projected pricing trends over the upcoming five years. This report provides a comprehensive assessment aimed at stakeholders seeking data-driven insights for investment and strategic decision-making.

Market Overview

Global Respiratory Therapeutics Market

The global respiratory therapeutics market, encompassing cough and cold remedies, is projected to grow at a CAGR of approximately 4-6% through 2028, driven by increasing prevalence of respiratory infections, urbanization, and expanded OTC availability. The segment that includes combination cough formulations is notably expanding, as consumers favor multi-symptom relief options for convenience.

Key Drivers

- Rising Incidence of Respiratory Diseases: Seasonal flu, COVID-19, and other viral respiratory infections sustain demand for symptomatic relief medications.

- Aging Population: Geriatric demographics are more prone to respiratory illnesses, boosting prescription and OTC sales.

- Consumer Preference for OTC Solutions: Growing trend toward self-medication supports OTC formulations like POLY-VENT DM.

Regional Market Dynamics

- North America: The largest market, supported by well-established OTC drug markets, high consumer health awareness, and robust distribution channels.

- Europe: Steady growth complemented by aging populations and regulatory ease for OTC products.

- Asia-Pacific: Fastest-growing sector due to increasing urbanization, rising income levels, and expanding retail pharmacy networks.

Competitive Landscape

Major Players

- Johnson & Johnson

- GlaxoSmithKline

- Novartis

- Bayer

- Local/regional OTC producers

Market Position of POLY-VENT DM

- Positioning as a combination therapy with convenience and broad symptom coverage.

- Unique formulation or branding could provide competitive edge.

- Patent status varies by jurisdiction, influencing exclusivity and pricing.

Regulatory Considerations

- Approval status and market access depend on local regulatory agencies; for example, FDA approval in the US, EMA in Europe, and CFDA in China.

- Post-approval, compliance with labeling, packaging, and advertising regulations is mandatory.

Pricing Analysis and Trends

Historical Pricing Benchmarks

Over the past five years, similar combination cough medications have exhibited the following price trajectories:

- United States: Retail prices for OTC combination tablets generally range from $8-$15 per carton (containing 10-20 tablets), depending on brand and formulation.

- Europe: Prices are comparable, with variations influenced by healthcare systems and pharmacy margins.

- Emerging Markets: Prices tend to be lower ($3-$8 per pack), but market penetration and brand recognition are more volatile.

Pricing Factors Influencing Future Trends

- Regulatory Environment: Stringent regulation or new patent approvals can sustain or elevate prices.

- Competitive Dynamics: Entry of generics usually exerts downward pressure.

- Manufacturing Costs: Raw material prices, especially active pharmaceutical ingredients (APIs), influence wholesale and retail pricing.

- Distribution Channels: OTC availability via pharmacies, supermarkets, and online platforms can diversify pricing strategies.

- Consumer Purchasing Power: Economic factors and insurance coverage significantly impact retail prices.

Price Projections (2023-2028)

Based on current trends, competitive analysis, and market drivers, the following projections are estimated:

| Year | Average Retail Price (USD) per Pack | Key Factors |

|---|---|---|

| 2023 | $8.50 - $12 | Stable demand, moderate generic competition |

| 2024 | $8.75 - $13 | Potential generic entries leading to price erosion |

| 2025 | $8.50 - $12.50 | Market saturation, innovation delaying price declines |

| 2026 | $8.50 - $13 | Regulatory shifts, possible new formulations |

| 2027 | $8.75 - $13.50 | Emerging markets expansion, inflation effects |

| 2028 | $9 - $14 | Continued inflation, novel marketing strategies |

Note: Prices are in retail context; wholesale pricing would be approximately 20-30% lower.

Market Opportunities and Risks

Opportunities

- Regulatory Approvals in Emerging Markets: Expanding into markets with increasing demand can stabilize revenue.

- Product Line Extensions: Variations with improved bioavailability or added benefits could command premium pricing.

- Online Retail Growth: E-commerce can reduce distribution costs and improve margins.

Risks

- High Competition: Numerous OTC options and generics threaten market share and pricing power.

- Regulatory Changes: Stricter regulations could impede market access or necessitate formulation adjustments.

- Price Erosion: The entry of low-cost generics and private labels compress margins.

Strategic Implications

- Pricing Strategy: Maintaining a premium positioning in developed markets through branding and quality assurance can sustain profitability.

- Market Penetration: Targeting underserved regions with affordable pricing models will expand market share.

- Regulatory Engagement: Proactive compliance management and early engagement with authorities mitigate market entry delays.

Key Takeaways

- POLY-VENT DM TABLET resides within a growing global respiratory therapeutics market, driven by demographic and epidemiological factors.

- The product's pricing will remain sensitive to competition, regulation, and economic conditions; moderate price increases (1-3% annually) are projected in developed markets.

- Emerging markets present significant growth opportunities via lower price points and expanding OTC channels.

- Strategic focus areas include regulatory navigation, product differentiation, and optimizing distribution channels.

FAQs

1. What influences the price of POLY-VENT DM TABLET?

Market pricing is primarily affected by manufacturing costs, competition from generics, regulatory environment, consumer demand, and distribution channels.

2. How does the introduction of generics impact POLY-VENT DM's market price?

Generics increase market competition, typically causing a decline in retail prices by 20-30% in the first few years post-entry.

3. What are the regional differences in pricing strategies?

Developed markets tend to maintain higher prices due to brand recognition and regulatory barriers, whereas emerging markets focus on affordability to capture market share.

4. Are there potential regulatory hurdles affecting pricing?

Yes. New regulations, especially concerning formulation safety and OTC classification, can influence manufacturing costs and allowable pricing.

5. What are future growth prospects for POLY-VENT DM TABLET?

Growth largely depends on expanding regional access, regulatory approvals, and product innovation, with a forecasted moderate price increase aligned with inflation and market conditions.

References

[1] MarketsandMarkets. “Respiratory Therapeutics Market Analysis,” 2022.

[2] IQVIA. “Global OTC Market Report,” 2022.

[3] Statista. “Over-the-Counter (OTC) Drug Sales Worldwide,” 2023.

[4] U.S. Food and Drug Administration. “OTC Drug Monographs and Regulations,” 2022.

[5] IMS Health. “Pricing Trends in Respiratory Medications,” 2021.

More… ↓