Share This Page

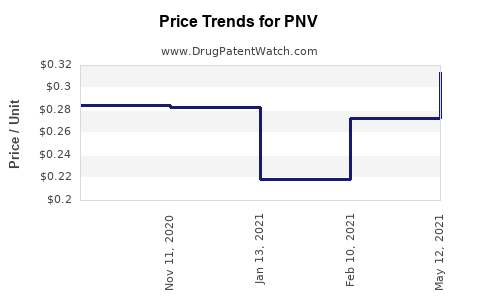

Drug Price Trends for PNV

✉ Email this page to a colleague

Average Pharmacy Cost for PNV

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| PNV-DHA SOFTGEL | 42192-0321-30 | 1.00653 | EACH | 2025-12-17 |

| PNV-DHA SOFTGEL | 42192-0321-30 | 0.97137 | EACH | 2025-11-19 |

| PNV-DHA SOFTGEL | 42192-0321-30 | 0.91381 | EACH | 2025-10-22 |

| PNV-DHA SOFTGEL | 42192-0321-30 | 0.91102 | EACH | 2025-09-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for PNV (Pneumococcal Conjugate Vaccine)

Introduction

The landscape of pneumococcal disease prevention continues to evolve, driven by technological advances, regulatory approvals, and global health initiatives. PNV (Pneumococcal Conjugate Vaccine), which targets Streptococcus pneumoniae—the causative agent of invasive pneumococcal diseases (IPD)—is a significant asset in infectious disease management and immunization programs worldwide. This report provides a comprehensive market analysis and price projection for PNV, factoring in current trends, competitive dynamics, regulatory environments, and projected global demand.

Market Overview

Global Disease Burden and Immunization Policy Shift

Streptococcus pneumoniae remains a leading cause of morbidity and mortality among children under five, causing pneumonia, meningitis, and sepsis. According to the World Health Organization (WHO), pneumococcal disease accounts for approximately 1.5 million deaths annually, with the majority occurring in low- and middle-income countries (LMICs) [1].

The global push for universal immunization, driven by organizations like GAVI (Global Alliance for Vaccines and Immunization) and national health agencies, has increased the deployment of pneumococcal conjugate vaccines (PCVs). The global PCV market has experienced rapid growth, with projections estimating a compound annual growth rate (CAGR) of approximately 7-8% over the next five years, fueled by expanding immunization coverage and the introduction of newer, higher-valency vaccines.

Market Segments

The PNV market encompasses:

- Pediatric markets: The primary segment, accounting for approximately 70% of total volume, driven by infant and toddler vaccination schedules.

- Adult markets: Growing segment, especially in high-income countries, where pneumococcal vaccination is recommended for high-risk adult populations.

- Emerging markets: Rapid adoption due to governmental immunization programs, often supported by GAVI, with a focus on children.

Leading Players and Competition

Major vaccine manufacturers—such as Pfizer, GlaxoSmithKline (GSK), Merck, and Sanofi—hold dominant positions, with their respective PCV formulations (e.g., PCV13, PCV15, PCV20). The entry of new vaccines with broader serotype coverage and improved thermostability intensifies market competition.

Notably, newer high-valency vaccines aiming to cover 15-20 serotypes pose a competitive threat and could potentially shift the market dynamics.

Market Drivers

- Gaining Global Coverage: Growing immunization programs in LMICs, supported by GAVI and WHO, dramatically increase demand.

- Regulatory Approvals and Expanded Indications: Expansion into adult and high-risk groups widens the target market.

- Serotype Replacement and Vaccine Innovation: The evolution of pneumococcal strains necessitates updated vaccines, boosting the market.

- Public Health Policies: Policies advocating for routine pneumococcal vaccination in children and adults sustain steady demand.

Market Challenges

- Pricing pressures: Especially in LMICs where governments and NGOs negotiate for low-cost vaccines.

- Regulatory hurdles: Different pathways for approval across countries can delay market entry.

- Vaccine hesitancy: Misinformation and vaccine fatigue may slow uptake in some regions.

- Serotype coverage and herd immunity: Limited coverage can reduce perceived efficacy, influencing demand.

Price Analysis and Projections

Current Pricing Landscape

Vaccine pricing exhibits significant variability based on market segment, purchaser, and region:

- High-Income Countries (HICs): Prices generally range from $60 to $150 per dose for PCV13, with negotiated discounts often lower but still substantial for public procurement [2].

- LMICs: GAVI-supported prices for PCV13 are approximately $3-$7 per dose, reflecting subsidies and economies of scale.

Pricing Trends

Price decreases are driven by manufacturing efficiencies, increased competition, and negotiations. Additionally, innovations such as thermostability and single-dose presentations could influence pricing strategies.

Projected Price Trends

Over the next five years, the following trends are anticipated:

- Price stabilization: For developed markets, prices are likely to remain relatively steady, with minor reductions due to volume discounts and contract negotiations.

- Decrease in LMIC prices: Continuation of tiered pricing models is expected, potentially stabilizing around $2-$5 per dose as manufacturing costs decrease and competition increases.

- Introduction of higher-valency vaccines: These may initially command higher prices (~$100-$200 per dose in HICs) but could see price reduction as market saturation occurs and manufacturing scales are optimized.

Price Projections (2023-2028)

| Region | 2023 Avg. Price | 2025 Projection | 2028 Projection |

|---|---|---|---|

| High-Income | $70 - $150 | $65 - $140 | $60 - $130 |

| Emerging Markets | $3 - $7 | $2.5 - $6 | $2 - $5 |

These projections assume ongoing market competition, technological innovations, and sustained global immunization efforts.

Market Opportunities and Risks

Opportunities

- Growth in adult immunization segments, with increasing acceptance in HICs.

- Introduction of higher-valency vaccines, offering broader serotype coverage.

- Expansion into new territories, particularly in Africa and Asia.

- Strategic partnerships to reduce costs and increase access.

Risks

- Emergence of new pneumococcal strains not covered by existing vaccines.

- Pricing controls and reimbursement hurdles.

- Political instability affecting healthcare budgets and vaccine procurement.

- Technical challenges related to vaccine shelf life and storage.

Regulatory Environment and Future Outlook

Regulatory pathways continue to evolve, with expedited approvals in many regions to expedite access. The US FDA, EMA, and WHO prequalification standards influence market entry strategies. Further, patent expirations and biosimilar developments may impact pricing and market share.

Given the global emphasis on reducing pneumococcal disease burden, continued investments and innovations are expected, with the future landscape dominated by higher-valency vaccines and tailored immunization programs addressing regional serotype prevalence.

Key Takeaways

- The global PNV market is poised for steady growth, driven by expanding immunization programs and technological advances.

- Pricing will remain highly region-dependent, with significant disparities between high-income and emerging markets.

- Competitive pressures and innovation will likely lead to moderate price reductions, particularly in LMICs.

- High-valency vaccines and adult immunization segments represent significant growth opportunities.

- Strategic alignment with global health initiatives and regulatory agencies will be essential to capitalize on market potential.

FAQs

1. What factors influence pneumococcal vaccine prices globally?

Vaccine prices are influenced by manufacturing costs, competition, regional procurement negotiations, governmental subsidies, and the vaccine's valency and technological features.

2. How will emerging high-valency pneumococcal vaccines impact pricing?

Higher-valency vaccines, initially priced higher due to advanced technology and broader coverage, are expected to become more affordable over time as manufacturing scales up and competition increases.

3. What role does GAVI play in the PNV market?

GAVI facilitates vaccine access in LMICs through subsidized pricing, negotiations, and supporting immunization infrastructure, significantly impacting demand and pricing in these regions.

4. Are there notable regional differences in vaccine adoption?

Yes. High-income countries with established healthcare infrastructure and regulatory pathways have higher vaccination rates and prices, whereas LMICs rely heavily on subsidies, influencing lower prices.

5. What are the key challenges facing PNV market growth?

Challenges include pricing pressures, vaccine hesitancy, regulatory delays, and the emergence of serotypes not covered by existing vaccines.

References

[1] World Health Organization. Pneumococcal disease. WHO; 2022.

[2] Market Research Future. Pneumococcal Conjugate Vaccine Market Analysis. 2022.

More… ↓