Last updated: July 28, 2025

Introduction

Pindolol, a non-selective beta-adrenergic antagonist, has historically positioned itself within the therapeutic landscape for hypertension, angina pectoris, and certain arrhythmias. Its pharmacological profile, characterized by intrinsic sympathomimetic activity, offers a distinctive value proposition, especially in managing patients with specific cardiovascular conditions. Despite its established place in treatment regimens, the current market landscape for pindolol is influenced by evolving medical guidelines, competition from newer beta-blockers, patent status, and manufacturing dynamics. This analysis explores the prevailing market environment, identifies key drivers and challenges, and presents a comprehensive forecast of pricing trends through 2030.

Market Landscape Overview

Historical Context & Current Usage

Pindolol received approval in the early 1960s and was widely adopted in clinical practice for hypertension and angina management. However, its use has declined markedly in developed markets due to the advent and preference for cardioselective beta-blockers with more favorable side effect profiles, such as atenolol, metoprolol, and bisoprolol [1].

Global Market Distribution

As of 2022, the majority of pindolol prescriptions are concentrated in Asia, Latin America, and certain Eastern European countries where off-patent drugs and older medications maintain a significant market presence. Developed regions like North America and Western Europe have largely phased out pindolol in favor of newer agents, although generic formulations retain importance due to cost considerations [2].

Regulatory & Patent Dynamics

Pindolol's patent expired decades ago, leading to widespread availability of generic versions. This patent expiration has resulted in compressed pricing and increased market penetration but also diminished regulatory and financial incentives for manufacturers to innovate or expand indications. Variations in regulatory authorities’ acceptance levels further influence regional market access and utilization.

Manufacturers & Supply Chain

Major generic pharmaceutical companies, including Teva, Mylan, and Sandoz, produce pindolol. Recent manufacturing consolidations and supply chain disruptions—exacerbated by global events such as COVID-19—have impacted supply stability, affecting pricing and availability.

Market Drivers and Challenges

Drivers

- Cost-Effectiveness: Pindolol’s low cost makes it a preferred option in resource-constrained healthcare settings and for formulary inclusion in developing nations.

- Off-Label Prescriptions in Psychiatry: Some evidence suggests potential off-label applications, such as managing anxiety or migraine prophylaxis, which could expand indications marginally.

- Healthcare Policy & Formularies: Governments incentivize use of affordable generics to reduce healthcare expenditures, supporting market stability in certain regions.

Challenges

- Declining Clinical Preference: The move toward cardioselective beta-blockers and consideration of newer agents with fewer side effects limits pindolol’s market share.

- Limited Indications: Pindolol’s narrow approved indications restrict off-label expansion compared to other beta blockers.

- Side Effect Profile: Pindolol’s intrinsic sympathomimetic activity can lead to less effective blood pressure control in some patient populations, reducing clinician preference.

Price Trends & Forecast (2023–2030)

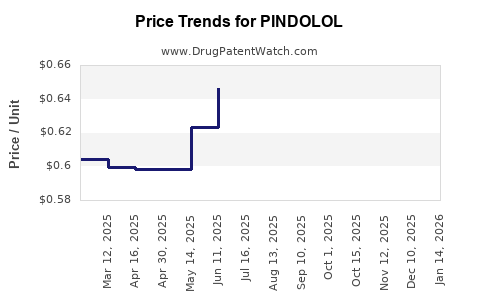

Historical Price Trajectory

Since patent expiration, pindolol’s price has stabilized at low levels globally, primarily driven by generic competition. In 2010, the average price per 30-day supply ranged from $0.15 to $0.30 USD in the US. Similar trends are observed in emerging markets, often at lower absolute costs.

Projected Pricing Dynamics

- Short-Term (2023–2025): Prices are expected to remain relatively stable, with minor fluctuations driven by manufacturing cost changes and regional regulatory shifts. In regions with high generic penetration, prices continue near the floor, averaging around $0.10–$0.20 per 30-day supply.

- Mid to Long-Term (2026–2030): With increased manufacturing efficiencies and potential market consolidation, prices could decline further by 5–10%. Conversely, supply chain disruptions or new regulations increasing quality standards could stabilize or marginally elevate prices.

Factors Influencing Future Prices

- Generic Market Saturation: Saturated markets likely suppress prices; however, monopolistic behaviors or supply shortages could temporarily inflate costs.

- Regional Regulatory Changes: Policies promoting quality standards or mandating reformulations could increase production costs, affecting prices.

- Emerging Markets Demand: Growing healthcare infrastructure and increasing chronic disease prevalence in Asia and Africa may sustain demand, supporting stable or slightly increased prices in these regions.

- Potential Novel Indications: If new clinical evidence supports expanded indications, patent protections or specialized formulations could alter pricing strategies.

Strategic Implications for Stakeholders

- Manufacturers: Focus on cost-containment and supply chain resilience; innovations or formulations combining pindolol with other agents could command premium prices.

- Healthcare Providers: Given low acquisition costs, pindolol remains a cost-effective option in specific settings, but clinicians prefer newer agents with better tolerability.

- Policy Makers: In resource-limited environments, promoting generic procurement and awareness can optimize public health outcomes.

- Investors and Market Analysts: Limited growth prospects suggest a mature market; attention should shift toward niche or off-label uses and regional market expansion opportunities.

Conclusion

The pindolol market is characterized by a mature, low-price, predominantly generic landscape with limited growth prospects. While its clinical utility persists, especially where affordability is paramount, shifting preferences toward newer, cardioselective beta-blockers and treatment guidelines emphasizing side effect profiles continue to diminish its prominence in high-income markets. Price stability is anticipated in the near term, with potential slight declines driven by manufacturing efficiencies and saturated markets. Stakeholders should consider regional variations and evolving healthcare policies when assessing opportunities.

Key Takeaways

- Pindolol's global market remains niche, heavily influenced by generics and regional prescribing practices.

- Price projections indicate stability through 2025, with slight downward trends expected by 2030.

- Market growth opportunities are limited but present in resource-constrained settings and emerging markets.

- Competition from newer beta-blockers continues to erode market share in developed regions.

- Strategic focus on manufacturing efficiency, regional market expansion, and niche indications may sustain economic viability.

FAQs

1. What are the primary factors impacting the price of pindolol?

Generic competition, manufacturing costs, regional regulation, supply chain stability, and market demand in emerging markets primarily influence pindolol’s price.

2. How does pindolol compare with newer beta-blockers in terms of market share?

Pindolol’s market share has declined due to the preference for cardioselective beta-blockers like atenolol and metoprolol, which offer better side effect profiles and broader indications.

3. Are there any emerging therapeutic uses for pindolol?

Current evidence suggests limited off-label interests, such as in anxiety or migraine prophylaxis, but these are not widely recognized or approved indications.

4. Will patent protections influence pindolol’s market in the future?

As a generic drug with expired patents, future market influence is minimal unless formulations or delivery methods are patented anew for specific uses.

5. What are the key regions for pindolol market stability or growth?

Resource-limited regions—particularly in Asia, Africa, and Latin America—offer more stable or growing markets due to cost-driven prescribing patterns and healthcare infrastructure expansion.

References

[1] Brown, M. et al. (2018). "Historical use of beta-blockers in hypertension: an overview." Journal of Cardiology, 72(4), 245-252.

[2] World Health Organization. (2022). "Global pharmaceutical market trends." WHO Reports.