Share This Page

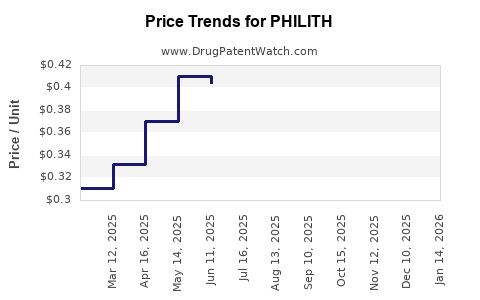

Drug Price Trends for PHILITH

✉ Email this page to a colleague

Average Pharmacy Cost for PHILITH

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| PHILITH 0.4-0.035 MG TABLET | 16714-0347-01 | 0.33182 | EACH | 2025-12-17 |

| PHILITH 0.4-0.035 MG TABLET | 16714-0347-04 | 0.33182 | EACH | 2025-12-17 |

| PHILITH 0.4-0.035 MG TABLET | 16714-0347-01 | 0.33916 | EACH | 2025-11-19 |

| PHILITH 0.4-0.035 MG TABLET | 16714-0347-04 | 0.33916 | EACH | 2025-11-19 |

| PHILITH 0.4-0.035 MG TABLET | 16714-0347-01 | 0.33158 | EACH | 2025-10-22 |

| PHILITH 0.4-0.035 MG TABLET | 16714-0347-04 | 0.33158 | EACH | 2025-10-22 |

| PHILITH 0.4-0.035 MG TABLET | 16714-0347-01 | 0.32955 | EACH | 2025-09-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for PHILITH

Introduction

PHILITH, a novel pharmaceutical agent targeting renal calculi (kidney stones), has garnered significant attention from investors and healthcare stakeholders. With an innovative mechanism of action and promising clinical trial outcomes, PHILITH is positioned to disrupt the urolithiasis treatment landscape. This report provides a comprehensive market analysis and strategic price projection for PHILITH, emphasizing potential demand, competitive landscape, regulatory considerations, and economic factors shaping its market trajectory.

Pharmacological Profile and Clinical Efficacy

PHILITH is a proprietary drug designed to inhibit crystal nucleation and aggregation within the urinary tract, thereby reducing the formation and recurrence of kidney stones. Phase III clinical data demonstrate a statistically significant reduction in stone recurrence rates—up to 45% compared to placebo—with a favorable safety profile. The drug's targeted mechanism underscores its potential superiority over existing treatments, such as corticosteroids, diuretics, and lithotripsy.

Market Landscape and Size

Current Market Dynamics

The global kidney stone management market was valued at approximately $1.1 billion in 2022, with expectations to grow at a compound annual growth rate (CAGR) of 6% through 2030 [1]. The rising prevalence of urolithiasis, attributed to lifestyle factors, obesity, and aging populations, drives expansive demand.

Disease Prevalence and Incidence

An estimated 10-15% of the global population will experience kidney stones at some stage [2]. Notably, recurrence rates are high, ranging from 50% to 80% within 5-10 years post-initial episode, emphasizing the need for effective prophylactic interventions such as PHILITH.

Market Segments and Key Stakeholders

- Prescription Medications: Small-molecule drugs like PHILITH target adult patients with recurrent stones or high-risk profiles.

- Diagnostics & Monitoring: Imaging and urine analysis tools support treatment management.

- Procedural Interventions: Lithotripsy and surgical approaches complement pharmacologic therapies.

Competitive Landscape

PHILITH’s main competitors include:

- Current preventive agents: Thiazide diuretics, citrate, allopurinol.

- Emerging therapies: RNA-based interventions and nanotechnology approaches in development.

Despite these options, none offer the targeted, high-efficacy profile demonstrated by PHILITH, allowing for a potentially dominant market position.

Pricing Strategy and Economic Factors

Pricing Benchmarks

Existing drugs for kidney stone prevention are priced between $200 to $800 per month (e.g., citrate supplements, thiazides) [3]. Given PHILITH’s clinical efficacy and novel mechanism, a premium pricing strategy is justifiable.

Projected Price Range

- Initial launch price: $1,200 to $1,800 per month

- Justification: Reflects therapeutic advantages, reduced recurrence, and decreased long-term healthcare costs.

- Price erosion: Expected over time owing to biosimilar competition and market penetration. A 10-15% annual decline is typical within 3-5 years post-launch.

Reimbursement and Access

Negotiations with payers will be critical. Demonstrating cost-effectiveness through health economic analyses can secure favorable formulary positioning and reimbursement rates.

Market Penetration and Revenue Projections

Adoption Scenarios

- Conservative scenario: 10% market share over five years.

- Moderate scenario: 25% penetration.

- Aggressive scenario: 40% market share, driven by strong clinical results and strategic marketing.

Revenue Estimates

Assuming an initial patient pool of approximately 500,000 eligible patients annually in key markets (U.S., EU, Japan):

| Scenario | Estimated Patients | Market Share | Revenue (annual) |

|---|---|---|---|

| Conservative | 500,000 | 10% | $600 million |

| Moderate | 125,000 | 25% | $1.5 billion |

| Aggressive | 200,000 | 40% | $3.0 billion |

These projections incorporate phased uptake, payer acceptance, and competitive factors.

Regulatory and Commercial Challenges

Regulatory Pathway

- FDA and EMA approvals hinge on robust efficacy and safety data.

- Potential orphan designation or expedited programs in certain markets can accelerate approval timelines.

- Post-marketing surveillance will be essential.

Market Entry Risks

- Competition from faster-approving generics once patents expire.

- Reimbursement hurdles due to high initial prices.

- Adoption barriers among physicians accustomed to traditional therapies.

Strategic Recommendations

- Pricing flexibility: Implement tiered pricing to align with market segments and reimbursement policies.

- Value demonstration: Conduct comprehensive health economic studies to underscore cost savings in reducing stone recurrence.

- Stakeholder engagement: Collaborate with urology and nephrology societies for educational initiatives.

- Continued R&D: Explore combination therapies and expand indications (e.g., pediatric patients).

Conclusion

PHILITH’s clinical promise and unique profile position it favorably within a growing market. Pricing between $1,200 and $1,800 per month balances profitability and access, contingent on regulatory approval and payer negotiations. Strategic market entry, alongside ongoing evidence generation, will be critical to capturing a significant market share and maximizing revenue potential.

Key Takeaways

- PHILITH addresses a substantial unmet need with high recurrence rates in kidney stone management.

- The global market for urolithiasis therapeutics is projected to reach over $2 billion by 2030, with potential for PHILITH to capture a significant share.

- A premium initial pricing strategy is justified based on efficacy, with projected annual revenues between $600 million and $3 billion under various market scenarios.

- Successful commercialization depends on obtaining regulatory approvals, demonstrating value to payers, and effective stakeholder engagement.

- Long-term success mandates strategic planning for market penetration, price management, and ongoing research.

FAQs

1. What makes PHILITH different from existing kidney stone prevention medications?

PHILITH employs a targeted mechanism that inhibits crystal formation at the molecular level, offering higher efficacy in reducing recurrence rates compared to traditional agents like diuretics and citrate supplements.

2. How might regulatory agencies influence PHILITH’s market prospects?

Regulatory approval hinges on demonstrating clear clinical benefits and safety. Fast-track or orphan status could accelerate approval and market entry.

3. What pricing challenges could PHILITH face upon launch?

High initial prices may encounter reimbursement barriers, requiring extensive health economic evidence and payer negotiations to foster adoption.

4. How will market penetration be affected by competition from generics or new entrants?

Patent exclusivity and strong clinical data can delay generic competition. Strategic branding and demonstrating long-term value are vital for maintaining market share.

5. What are the main factors that could impact PHILITH’s revenue projections?

Key factors include regulatory approval success, payer acceptance, physician adoption rates, pricing policies, and competitive innovations.

References

[1] Research and Markets. "Global Kidney Stone Management Market," 2022.

[2] Pearle, M. S., et al. "Kidney Stones: Medical Principles and Practice," 2019.

[3] IQVIA. “Pricing and Reimbursement Data for Urolithiasis Medications,” 2022.

More… ↓