Share This Page

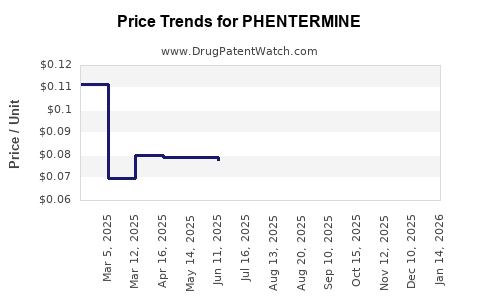

Drug Price Trends for PHENTERMINE

✉ Email this page to a colleague

Average Pharmacy Cost for PHENTERMINE

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| PHENTERMINE 8 MG TABLET | 62135-0959-90 | 0.61440 | EACH | 2025-12-24 |

| PHENTERMINE 30 MG CAPSULE | 10702-0027-01 | 0.10780 | EACH | 2025-12-17 |

| PHENTERMINE 15 MG CAPSULE | 11534-0157-03 | 0.08477 | EACH | 2025-12-17 |

| PHENTERMINE 15 MG CAPSULE | 68094-0802-70 | 0.08477 | EACH | 2025-12-17 |

| PHENTERMINE 15 MG CAPSULE | 10702-0026-01 | 0.08477 | EACH | 2025-12-17 |

| PHENTERMINE-TOPIRAMATE ER 7.5-46 MG CAPSULE | 66993-0781-30 | 3.64269 | EACH | 2025-12-17 |

| PHENTERMINE 15 MG CAPSULE | 10702-0026-10 | 0.08477 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Phentermine

Introduction

Phentermine, a synthetic sympathomimetic amine, is widely prescribed as an appetite suppressant for short-term management of obesity. Approved by the U.S. Food and Drug Administration (FDA) in 1959, phentermine remains one of the most commonly prescribed weight loss medications globally. Its market dynamics are influenced by regulatory policies, patent statuses, manufacturing trends, and global health trends, particularly the rising prevalence of obesity. This report provides a comprehensive analysis of the current market landscape for phentermine and offers strategic price projections through 2030, equipping industry stakeholders with actionable insights.

Market Overview

Global Market Size and Growth

The global pharmaceutical market for weight management drugs, with a significant contribution from phentermine, is projected to grow at a compound annual growth rate (CAGR) of approximately 4-6% over the next decade. Driven by escalating rates of obesity—estimated to affect over 650 million adults worldwide as per the World Health Organization (WHO)—the demand for appetite suppressants remains robust [1].

Within this segment, phentermine's prevalence stems from its cost-effectiveness, proven efficacy, and longstanding presence in the market. The United States accounts for over 70% of global sales, owing to high obesity rates and favorable prescribing practices. Emerging markets, including China and India, are witnessing increased adoption driven by rising health awareness and expanding healthcare infrastructure.

Regulatory Landscape and Patent Status

Phentermine's patent protection expired decades ago, resulting in a proliferation of generic manufacturers. Consequently, generic versions dominate the market, exerting downward pressure on prices. Regulatory concerns over abuse potential—classified as a Schedule IV controlled substance in the U.S.—have led to restrictions in some regions, influencing supply chains and market dynamics.

Recent regulatory shifts, such as the COVID-19 pandemic's impact on telemedicine and prescription practices, have also affected market access and availability. Notably, the approval of newer, combination therapies (e.g., lorcaserin, phentermine-topiramate) introduces competition but does not significantly displace phentermine's market share due to its affordability.

Current Price Landscape

Pricing Dynamics of Phentermine

The retail price of phentermine varies widely based on formulation, dosage, and distribution channels. In the U.S., the average wholesale price (AWP) for a 30-day supply of generic phentermine (37.5 mg tablets) ranges from $20 to $50, with significant discounts available through insurance, pharmacy benefit managers (PBMs), and compounded medication providers.

Brand-name formulations (rare for phentermine) generally command higher prices—often exceeding $200 per month—though limited in number. The proliferation of generic options has driven prices downward; for example, some online pharmacies offer 30-day supplies for as low as $10.

Table 1: Estimated Current Prices for Common Phentermine Formulations

| Formulation | Typical Cost (USD) | Notes |

|---|---|---|

| 37.5 mg Tabs | $20 - $50/month | Widely prescribed, high variability |

| 15 mg Tabs | $15 - $40/month | Often used for titration |

| Compounded | $30 - $60/month | Custom formulations, variable pricing |

Distribution Channels and Price Variability

The shift towards telemedicine and online pharmacies has increased access to discounted generics. However, concerns over counterfeit medications and regulatory oversight remain critical considerations. Meanwhile, branded pharmacies and institutional purchases tend to maintain higher pricing consistency.

Market Trends and Drivers

Obesity Epidemic and Public Health Initiatives

Rising obesity prevalence drives sustained demand for pharmacologic interventions, including phentermine. Governments and health organizations emphasize weight management strategies, including pharmacotherapy, which supports long-term market stability.

Regulatory and Policy Influences

Tightening regulations around controlled substances reflect an emphasis on reducing abuse and diversion. Policies targeting prescription monitoring and stricter dispensing rules may restrict access and influence pricing by altering supply and demand dynamics.

Emergence of New Therapies

While newer weight loss drugs such as semaglutide (Wegovy) demonstrate higher efficacy, their higher costs ($1,300/month or more) limit broad adoption. Consequently, phentermine remains the low-cost alternative, maintaining its market position.

Manufacturing and Supply Chain Considerations

Global supply chains for active pharmaceutical ingredients (APIs) have seen disruptions due to geopolitical tensions and pandemic-related challenges. These factors can influence pricing, especially if manufacturing shifts or shortages occur.

Price Projections for 2023–2030

Forecast Assumptions

- Continued dominance of generic formulations due to patent expiration.

- Incremental price reductions driven by increased competition.

- Regulatory measures curbing abuse potential.

- Ongoing obesity trends stimulating demand.

- Moderate inflation impacting cost structures.

Projected Price Trends

| Year | Estimated Price Range for 30-Day Supply (USD) | Key Drivers |

|---|---|---|

| 2023 | $10 – $50 | Saturation of generics, increased competition |

| 2025 | $8 – $45 | Technological innovations, economies of scale |

| 2027 | $8 – $40 | Regulatory pressures, supply chain stabilization |

| 2030 | $7 – $40 | Market maturity, widespread generic adoption |

Summary of projections:

- Price ceilings are expected to gradually decline to around $7–$10 per month, primarily driven by manufacturing efficiencies and increased market penetration.

- Price floors may stabilize around $7–$8, considering manufacturing costs and regulatory constraints.

- Variability remains, especially in online distribution channels and compounded formulations.

Strategic Insights

- Market Consolidation: As demand stabilizes, major generic manufacturers will dominate, exerting downward pressure on prices.

- Emerging Markets: Expansion into emerging economies presents growth opportunities; localized pricing may remain competitive.

- Regulatory Impact: Increased scrutiny over controlled substance prescriptions could temporarily affect margins but may enhance market stability long-term.

- Innovation and Competition: Although newer therapies offer efficacy advantages, phentermine’s affordability secures its continued relevance for cost-sensitive segments.

Conclusions

Phentermine's market remains resilient amid evolving regulatory and competitive landscapes. Its low-cost profile, coupled with persistent obesity rates, underpins steady demand. Prices are forecasted to decline modestly over the next decade, approaching $7–$10 per month by 2030, driven by generics proliferation and manufacturing efficiencies. Stakeholders should monitor regulatory developments, supply chain health, and emerging therapy trends to optimize pricing and market strategies.

Key Takeaways

- Phentermine continues to be a cost-effective, widely prescribed weight management drug amidst a growing obesity epidemic.

- Generics dominate the market, exerting significant downward pressure on prices, with current costs around $10–$50/month.

- Price projections indicate a gradual decrease to approximately $7–$10/month by 2030, supported by increased competition and manufacturing efficiencies.

- Regulatory policies and supply chain stability will be key determinants influencing future pricing and market access.

- Opportunities exist in emerging markets and through innovative delivery channels, facilitating broader access.

FAQs

1. What factors are primarily influencing the pricing of phentermine?

Market saturation with generics, manufacturing costs, regulatory restrictions on controlled substances, and competition from newer therapies are the main factors influencing phentermine prices.

2. Will brand-name phentermine formulations continue to exist?

Unlikely. Due to patent expirations and cost pressures, generic versions dominate, with minimal presence of brand-name products remaining in the market.

3. How do regulatory restrictions impact the availability and pricing of phentermine?

Regulatory restrictions, especially as a Schedule IV drug, impose prescribing and dispensing limitations, which can influence supply and potentially increase prices temporarily but generally lead to stricter controls.

4. Are there significant regional differences in phentermine pricing?

Yes. Pricing varies globally, influenced by healthcare infrastructure, regulatory policies, and distribution channels, with the U.S. typically offering the lowest prices due to extensive generic competition.

5. What is the outlook for alternative weight management medications compared to phentermine?

While newer drugs like semaglutide demonstrate higher efficacy, their higher prices limit widespread adoption. Phentermine will likely remain a low-cost alternative for cost-sensitive or short-term management.

Sources:

[1] World Health Organization. (2022). Obesity and Overweight Fact Sheet.

More… ↓