Last updated: July 27, 2025

Introduction

Phenobarbital, a longstanding barbiturate used primarily as an anticonvulsant and sedative, maintains a significant yet specialized role in global pharmacotherapy. Despite the advent of newer therapies, phenobarbital remains vital in managing epilepsy, especially in low- and middle-income countries due to its affordability and efficacy. This report provides a comprehensive market analysis, key drivers, competitive landscape, and price projections for phenobarbital, aiming to aid stakeholders in strategic decision-making.

Therapeutic and Market Overview

Phenobarbital was first introduced in the 1910s and remains one of the most cost-effective anticonvulsants worldwide. Its mechanisms involve enhancing GABA-mediated inhibitory neurotransmission, which suppresses seizure activity. While newer agents like levetiracetam and lamotrigine have gained popularity, phenobarbital continues to be prescribed, particularly where cost and access are limiting factors.

Globally, the epilepsy treatment market exceeds USD 4 billion, with phenobarbital accounting for roughly 15-20% of this segment (approximate valuation USD 600 million to USD 800 million). Its usage is notably high in Asia, Africa, and Latin America, where healthcare infrastructure and economic factors favor its utilization over more expensive newer drugs.

Market Drivers

Cost-Effectiveness and Accessibility

Phenobarbital's low production cost makes it universally accessible, especially in resource-limited settings. The drug's presence on the World Health Organization’s (WHO) Model List of Essential Medicines consolidates its role as a first-line treatment, reinforcing demand.

Regulatory Status and Patent Expiry

Being over a century old, phenobarbital is off-patent in most jurisdictions, enabling generic manufacturing which sustains low prices and diverse supply sources. This generic landscape creates high market penetration barriers for branded versions but ensures continued affordability and consistent supply.

Global Health Initiatives

International agencies’ focus on managing epilepsy and neurological disorders in developing nations supports phenobarbital distribution. Programs such as WHO’s efforts to improve antiepileptic drug accessibility directly influence market stability and growth potential.

Limitations of Alternatives

In some regions, concerns over phenobarbital’s sedative effects and potential cognitive side effects limit widespread adoption. Nonetheless, a balance between cost and efficacy sustains its role in public health sectors.

Competitive Landscape

Major Manufacturers

- Indian and Chinese generic manufacturers: dominate the phenobarbital market, leveraging low production costs.

- Global pharmaceutical firms: some produce branded versions, although they have limited market share in low-income countries.

- Emerging market players: expanding capacity and distribution channels.

Product Forms and Dosage

Phenobarbital is available as tablets, capsules, and injectable formulations, mainly supplied as generic products. Customization of dosing and formulations (e.g., pediatric syrups) further expands market applicability.

Regulatory Challenges

Strict regulations around barbiturates in some countries, owing to their sedative properties and potential for misuse, may limit availability. However, in public health settings, these barriers are minimal, favoring continued usage.

Market Outlook and Price Projections

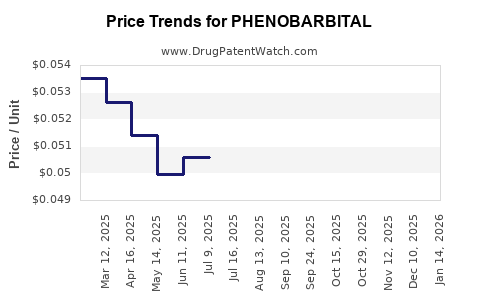

Historical Pricing Trends

Historically, phenobarbital prices have remained stable, primarily due to generic manufacturing and high availability. According to market surveys, the average retail price per 100 mg tablet ranges from USD 0.01 to USD 0.05 in developing countries.

Factors Influencing Future Prices

- Inflation and raw material costs: minor influence due to minimal raw material costs.

- Regulatory changes: stricter controls or bans could impact supply and pricing.

- Supply chain disruptions: geopolitical factors, pandemics (e.g., COVID-19), can temporarily influence prices through manufacturing or distribution bottlenecks.

- Emerging competition: introduction of novel formulations or replacement therapies could pressure prices downward.

Price Projections (2023-2028)

Given its entrenched market position and low-cost manufacturing ecosystem, phenobarbital prices are expected to remain largely stable with marginal fluctuations:

- Short-term (next 1-2 years): Minimal change, with prices staying within USD 0.01–0.05 per 100 mg tablet.

- Mid-term (3-5 years): Slight downward pressure anticipated as manufacturing efficiencies improve and competition intensifies; prices could decline by 10-15%, reaching approximately USD 0.009–0.045 per tablet.

- Long-term (beyond 5 years): Potential for further stabilization or slight reductions; market saturation and public health policies will heavily influence this trajectory.

In regions where procurement is centralized through WHO or government tenders, price stability may be more pronounced, further solidifying phenobarbital’s affordability. Conversely, in markets with fragmented supply chains or stringent regulations, prices may fluctuate more significantly.

Distribution and Market Penetration

The distribution landscape favors established generic manufacturers, especially in Asia and Africa. Growing awareness and international aid programs bolster regional demand. Moreover, demographic trends, including rising epilepsy prevalence in developing nations, underpin sustained demand growth.

Regulatory and Policy Landscape

World health policies prioritize accessible epilepsy treatment, with phenobarbital receiving clear endorsement for primary use. Conversely, some countries restrict its use due to safety concerns. Regulatory shifts affecting scheduling or import regulations could impact supply and prices.

Challenges and Opportunities

Challenges

- Safety and Side Effects: cognitive and sedative effects may limit usage in some patient populations.

- Regulatory Restrictions: tighter controls could reduce supply or increase costs.

- Market Saturation: extensive generic availability may limit profit margins for manufacturers.

Opportunities

- Expanding Access: innovative procurement strategies in developing nations can sustain demand.

- Formulation Development: introducing novel formulations—such as sustained-release—could command premium pricing.

- Public-Private Partnerships: collaborations to improve supply chain resilience and affordability.

Key Takeaways

- Phenobarbital remains a cornerstone treatment for epilepsy in resource-limited settings, driven by its affordability, efficacy, and WHO endorsement.

- The global market is characterized by extensive generic manufacturing with stable, low pricing.

- Price projections indicate minimal fluctuations over the next five years, with potential slight declines owing to manufacturing efficiencies and market competition.

- Regulatory landscapes and safety considerations are pivotal factors influencing future availability and pricing.

- Strategic focus on expanding access and optimizing supply chains can further sustain phenobarbital's market position.

Conclusion

Phenobarbital’s enduring relevance in global epilepsy management ensures steady demand and a stable low-price environment. Stakeholders should monitor regulatory trends and supply chain dynamics closely, as these will influence future pricing and market access. The drug’s affordability and WHO endorsement reinforce its vital role, especially within public health initiatives targeting underserved populations.

FAQs

1. Is phenobarbital still a recommended treatment for epilepsy globally?

Yes. The WHO recommends phenobarbital as a first-line treatment for epilepsy in resource-limited settings due to its efficacy, safety profile, and affordability.

2. How does phenobarbital compare cost-wise to newer anticonvulsants?

Phenobarbital remains significantly cheaper—generally priced at a fraction of newer agents like levetiracetam or lamotrigine—making it suitable for low-income markets.

3. Are there regulatory concerns affecting phenobarbital’s availability?

Certain countries impose restrictions due to its sedative properties, but globally it remains accessible, especially through generic channels and public health programs.

4. What future price trends can industry players anticipate?

Prices are expected to stabilize, with potential minor declines driven by manufacturing efficiencies and increased competition among generic producers.

5. What are the main opportunities for growth in phenomenabital’s market?

Expanding access through procurement initiatives, developing specialized formulations, and strengthening global supply chains represent key avenues for growth.

References

[1] World Health Organization, “WHO Model List of Essential Medicines,” 2021.

[2] MarketResearch.com, “Global Antiepileptic Drugs Market Analysis,” 2022.

[3] IMS Health, “Generic Drug Pricing Trends,” 2022.

[4] Epilepsy Foundation, “Treatment Guidelines,” 2022.

[5] GlobalData, “Pharmaceutical Manufacturing in Asia,” 2021.