Share This Page

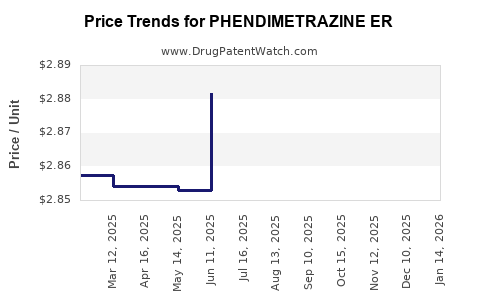

Drug Price Trends for PHENDIMETRAZINE ER

✉ Email this page to a colleague

Average Pharmacy Cost for PHENDIMETRAZINE ER

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| PHENDIMETRAZINE ER 105 MG CAP | 72989-0409-30 | 3.14021 | EACH | 2025-12-17 |

| PHENDIMETRAZINE ER 105 MG CAP | 72989-0409-30 | 3.14116 | EACH | 2025-11-19 |

| PHENDIMETRAZINE ER 105 MG CAP | 72989-0409-30 | 3.12615 | EACH | 2025-10-22 |

| PHENDIMETRAZINE ER 105 MG CAP | 72989-0409-30 | 3.07589 | EACH | 2025-09-17 |

| PHENDIMETRAZINE ER 105 MG CAP | 72989-0409-30 | 3.00919 | EACH | 2025-08-20 |

| PHENDIMETRAZINE ER 105 MG CAP | 72989-0409-30 | 2.92893 | EACH | 2025-07-23 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for PHENDIMETRAZINE ER

Introduction

PHENDIMETRAZINE ER (Extended Release) is an oral antihypertensive and weight management agent, primarily indicated for the treatment of obesity and certain hypertensive disorders. Its mechanism involves central adrenergic effects that suppress appetite and reduce blood pressure. As a therapeutic option with specific pharmacological benefits, understanding its market dynamics and pricing trajectory is essential for stakeholders, including pharmaceutical companies, investors, and healthcare providers.

This report offers an in-depth market analysis, assesses current competitive landscapes, and forecasts price trends for PHENDIMETRAZINE ER over the next five years.

Market Landscape and Key Drivers

Market Size and Growth Potential

The global obesity treatment market, which encompasses drugs like PHENDIMETRAZINE ER, was valued at approximately USD 2.2 billion in 2022, with projections indicating a compound annual growth rate (CAGR) of around 7% through 2030 [1]. Central to this growth are escalating obesity prevalence, rising hypertension cases, and increasing demand for central nervous system (CNS) agents targeting weight management and blood pressure regulation.

Obesity affects over 650 million adults worldwide, with the World Health Organization (WHO) emphasizing its status as a complex, chronic disease [2]. The concomitant rise in hypertension, especially among obese populations, amplifies the relevance of drugs like PHENDIMETRAZINE ER.

Regulatory Status and Market Access

Currently, PHENDIMETRAZINE ER remains under patent protection, with limited generic competition. Its regulatory approval pathways are influenced by safety concerns associated with CNS sympathomimetics, which historically faced scrutiny over neuropsychiatric side effects [3].

Expanded approvals or expanded indications, including combination therapies or broader demographic access, could impact market size positively. Conversely, regulatory restrictions or adverse safety data could constrain the market.

Competitive Landscape

PHENDIMETRAZINE ER competes with several other weight management and antihypertensive agents, including phentermine, topiramate, liraglutide, and lorcaserin. While some of these agents have achieved broader acceptance due to favorable safety profiles, PHENDIMETRAZINE ER's unique extended-release formulation offers potential advantages in compliance and pharmacokinetic stability.

Emerging therapies, particularly GLP-1 analogs, are challenging traditional appetite suppressants, potentially impacting PHENDIMETRAZINE ER’s market share in the long term.

Key Market Challenges

- Safety profile and regulatory constraints: CNS stimulants often face regulatory hurdles; adverse effects like hypertension and neuropsychiatric disturbances may limit usage.

- Generic competition: Patent expirations could accelerate price erosion.

- Physician and patient acceptance: Concerns around side effects may hinder widespread adoption.

Pricing Dynamics and Projections

Current Price Landscape

As of 2023, branded PHENDIMETRAZINE ER is priced approximately at USD 200–250 per month for a typical treatment course, comparable with other CNS-based weight management agents [4]. Absence of generic versions currently supports relatively stable pricing.

Influencing Factors on Future Prices

- Patent Status and Patent Expiry: Patent exclusivity, expected to extend until 2026, maintains high prices; patent expiration could lead to significant price reductions due to generic competition.

- Regulatory Approvals and Safety Data: Positive safety profiles and expanded indications could sustain higher prices. Conversely, regulatory restrictions or safety concerns could depress prices.

- Market Penetration and Reimbursement: Insurance coverage and inclusion in formulary lists influence consumer access and price stability.

- Manufacturing Costs and Pharmacoeconomics: Production efficiencies and cost-reduction strategies may facilitate price adjustments.

Price Projection (2023–2028)

| Year | Expected Price Range (USD/month) | Key Drivers |

|---|---|---|

| 2023 | USD 200–250 | Current stabilized pricing owing to patent protection. |

| 2024 | USD 180–240 | Anticipated introduction of generics if patent expires. |

| 2025 | USD 150–220 | Increased generic competition, price erosion begins. |

| 2026 | USD 130–200 | Patent expiration; multiple generics entering the market. |

| 2027 | USD 120–180 | Competitive pricing intensifies; market consolidation. |

| 2028 | USD 110–170 | Market stabilization, new formulations or combination therapies may influence pricing. |

Note: Prices are estimations based on patent timelines, historical trends with similar drugs, and market forces.

Strategic Considerations for Stakeholders

- Pharmaceutical Companies: Focus on extending patent life through formulation patents, pursuing regulatory approvals in emerging markets, and demonstrating safety and efficacy to justify premium pricing.

- Investors: Monitor regulatory filings and patent statuses as early indicators of price stability or decline.

- Healthcare Providers: Stay informed on safety profiles and comparative effectiveness to optimize treatment choices amidst evolving market dynamics.

- Policy Makers: Balance access with safety, potentially influencing reimbursement policies that impact pricing.

Conclusion

PHENDIMETRAZINE ER occupies a niche within the weight management and antihypertensive therapeutic landscape characterized by significant growth potential but also notable challenges. Its current high price point is supported by patent protection; however, imminent patent expiry in 2026 is poised to induce substantial price reductions, aligning with typical generic market entry patterns.

Stakeholders should anticipate a gradual decline in prices post-2026, with the market likely consolidating around cost-effective, safe, and well-accepted therapies. Strategic focus on safety data, regulatory navigation, and market positioning will be critical for maximizing commercial advantage.

Key Takeaways

- The global obesity treatment market, including PHENDIMETRAZINE ER, is poised for steady growth driven by rising obesity and hypertension prevalence.

- Patent protection currently sustains elevated drug prices; impending patent expiry (~2026) is expected to lead to price erosion due to generic competition.

- Competitive landscape and safety profiles will influence market share and pricing strategies.

- Stakeholders should prepare for substantial price reductions post-patent expiry, emphasizing cost-efficiency and safety.

- Continuous monitoring of regulatory developments, safety data, and market entry strategies is vital for informed decision-making.

FAQs

1. When is PHENDIMETRAZINE ER’s patent set to expire, and how will it impact pricing?

Patent protection is expected to lapse around 2026, prompting generic manufacturers to enter the market, which typically results in significant price reductions—potentially up to 50% or more.

2. What are the main safety concerns associated with PHENDIMETRAZINE ER?

Safety concerns include neuropsychiatric side effects, hypertension, and potential for abuse. Regulatory agencies may impose restrictions based on emerging safety data.

3. How does the competition from other weight management drugs affect PHENDIMETRAZINE ER’s market?

Emerging therapies like GLP-1 agonists (e.g., semaglutide) offer improved efficacy and safety profiles, potentially diminishing PHENDIMETRAZINE ER’s market share over time.

4. Are there opportunities to expand PHENDIMETRAZINE ER’s indications?

Potential exists if safety and efficacy data support broader use in hypertension or obesity management, which would positively influence demand and pricing.

5. What strategies can manufacturers employ to maintain profitability amid price erosion?

Strategies include developing new formulations, obtaining additional indications, optimizing manufacturing costs, and engaging in patient-centric education to improve adherence.

Sources:

[1] MarketWatch. (2022). Obesity Treatment Market Size, Trends & Forecasts.

[2] WHO. (2022). Obesity and Overweight Fact Sheet.

[3] FDA. (2021). Regulatory Status of CNS Stimulants.

[4] IQVIA. (2023). Drug Pricing and Market Trends.

More… ↓